Captio is a leading technological platform in Spain for the travel management and expenses of the company. Through a appemployees can digitise the tickets with a simple photowhich processes this data automatically thanks to the image recognition technology developed by the company, which employs 50 people.

Captio grows through investment rounds

This investment round, led by Sabadell Venture CapitalThis is the third round he has done Captiowhich was founded in 2012. In 2013 they closed a €300,000 investment round, and in February 2015, another €2.3M.

If the other two previous rounds helped them to become strong in the Spanish market, this third round will help them to open offices in London and Paris to replicate abroad the model that has led them to leadership in Spain. Currently, 10% of the firm's turnover (around 1.5 million euros in all markets) comes from other countries, and in the next 12 months it expects to reach 30%.

What are the top 5 Mobility Fintech companies?

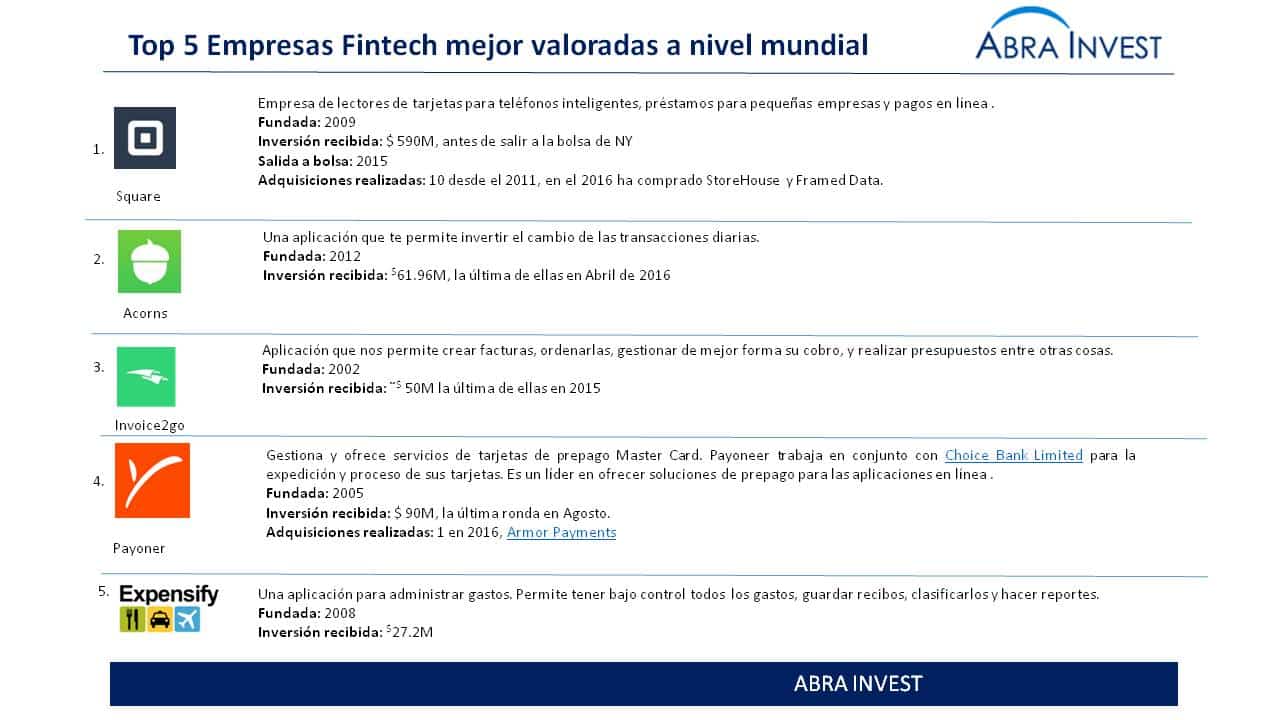

In the global Fintech sector, Captio will have to compete with start-ups that have received a large amount of investment.

As an example in the Top 1 is Square, a smartphone card reader, small business lending and online payments company. This company has received more than $590M, since its inception in 2009, which has allowed it to grow through acquisitions. Square has made 10 acquisitions.

The investment in Captio is the 4th investment by Sabadell Venture Capital

In 2016, Sabadell launched Sabadell Venture Capital, aimed at companies at a more advanced stage than those participating in the BStartup. The companies that have benefited from this fund so far have so far been 3: ForceManager, CornerJob and MyTwinPlace, none of them operating in the field of finance.

ForceManager (@forcemanager): Mobile CRM designed to maximise sales and improve the performance of a company's sales force.

CornerJob (@cornerjob_en): application to find geolocated jobs. Job focus profiles blue collar.

MyTwinPlace (@MyTwinPlace): free home exchange platform between individuals from all over the world.

If you are looking for investorsfor your company in Abra-Invest we can help you, call +34 946424142 or fill in the contact form.

Other posts that may interest you

Spain-based Spocat Fintech receives €31M