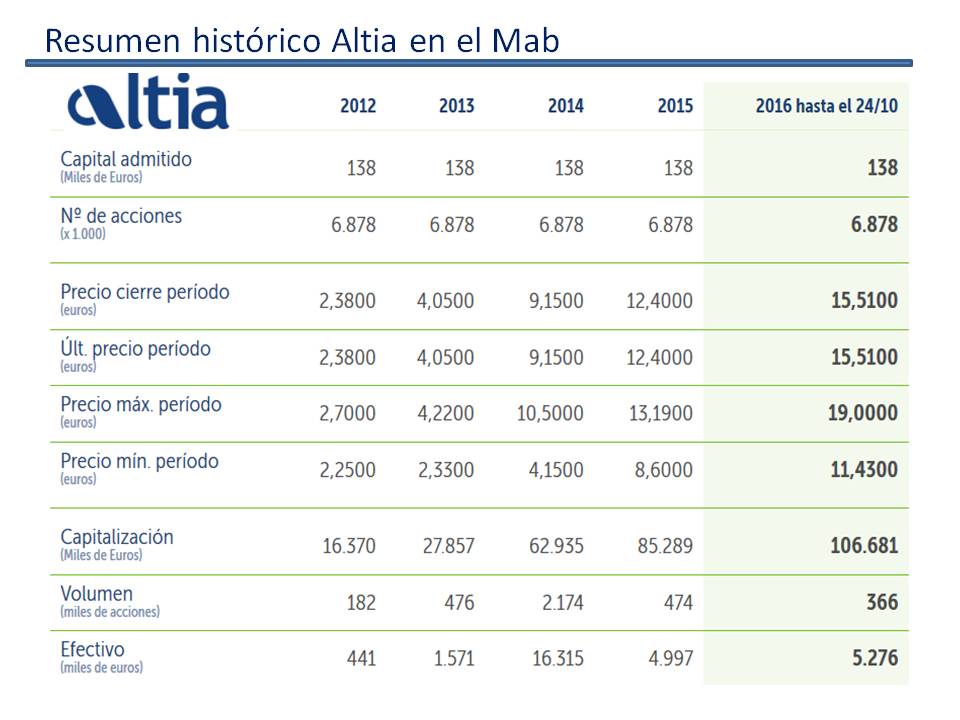

Altia is a technology consultancy based in A Coruña, which in 2010 went public on the Mab and in the first six months of the year has managed to improve its numbers, compared to the same period last year: a net profit of more than €2.9M (+28 % )a 15 % increase in turnover, which translates into €37.7M; and the increase in gross operating profit before tax (ebitda) of €4.3M. Indian tycoon Ram Bhavnani has increased his stake in the company this year to 8.51TTP1T.

Altia's Mab listing, key to its success What were the reasons for Altia's Mab listing?

-The need to increase the company's equity in order to be able to undertake larger projects and carry out inorganic growth operations, which would allow it to expand its portfolio of services and products and a diversified portfolio of clients and sectors to reduce concentration risks. Altia has acquired the Vodafone and Exis data centres and has a policy of investing in small technology companies with high growth potential.

-To enable the financing channel for potential future business development.

-Broaden the shareholder base and provide a new mechanism for liquidity and objective valuation of shares to serve as potential consideration in possible corporate transactions.

-Increased brand awareness, not only with the investment community, but also with customers and stakeholders.

Altia has managed to grow inorganically after the IPO on Mab

ALTIA bought Vodafone Spain's Data Centre business in Vigo in 2011, with the aim of improving its service offering, particularly in outsourcing, a key sector for Altia.

In addition, in 2013 it bought Exis for €3M with the aim of increasing its market share in Madrid and entering some sectors where it did not have a significant market share. Exis has improved its solvency since the acquisition and now the challenge is to get more sales people.

Additionally in 2015 Altia purchased a 1,74% from Centum Research & Technology, a technology company engaged in the design, development and commercialisation of aeronautical mission systems (high-tech electronic systems commonly referred to as payloads and sensors) for both manned and unmanned vehicles. The systems are primarily aimed at missions in the Emergency, Security and Defence markets.

With this acquisition of a small percentage of the capital of Centum Research & Technology, S.L. Altia has implemented a policy of taking minority positions in technology companies in their early stages. The aim of this policy is not only to obtain an interesting financial return, but also to achieve diversification (in this case, in the field of technology applied to innovative products), presence in the most technologically advanced market and participation in new projects with great potential.

Altia's strategy for 2017

Altia plans to invest around €2M by 2017 to continue growing "in an orderly manner and with sustainable margins".

The keys to maintaining the trend are set out in the business plan presented by the company for 2016 and 2017, and mainly involve increasing the customer portfolio and consolidating existing customers; developing business in sectors where it does not currently have a presence or where it has a testimonial presence, such as tourism or ports, and also reducing debt and generating cash flows.

On the other hand, Altia highlights in its report that the growing availability of own liquid assets, added to the reduction of low debt, "could finance inorganic growth operations that may be considered". According to the company's forecasts, equity will increase from 27.3 million in 2015 to 37.9 million in 2017.

If you are seeking funding or you want to buy or selling a company, get in touch with us. Abra-Invest has an experienced team that will help you to make your transaction a success. Call +34 946424142 or fill in the contact form.