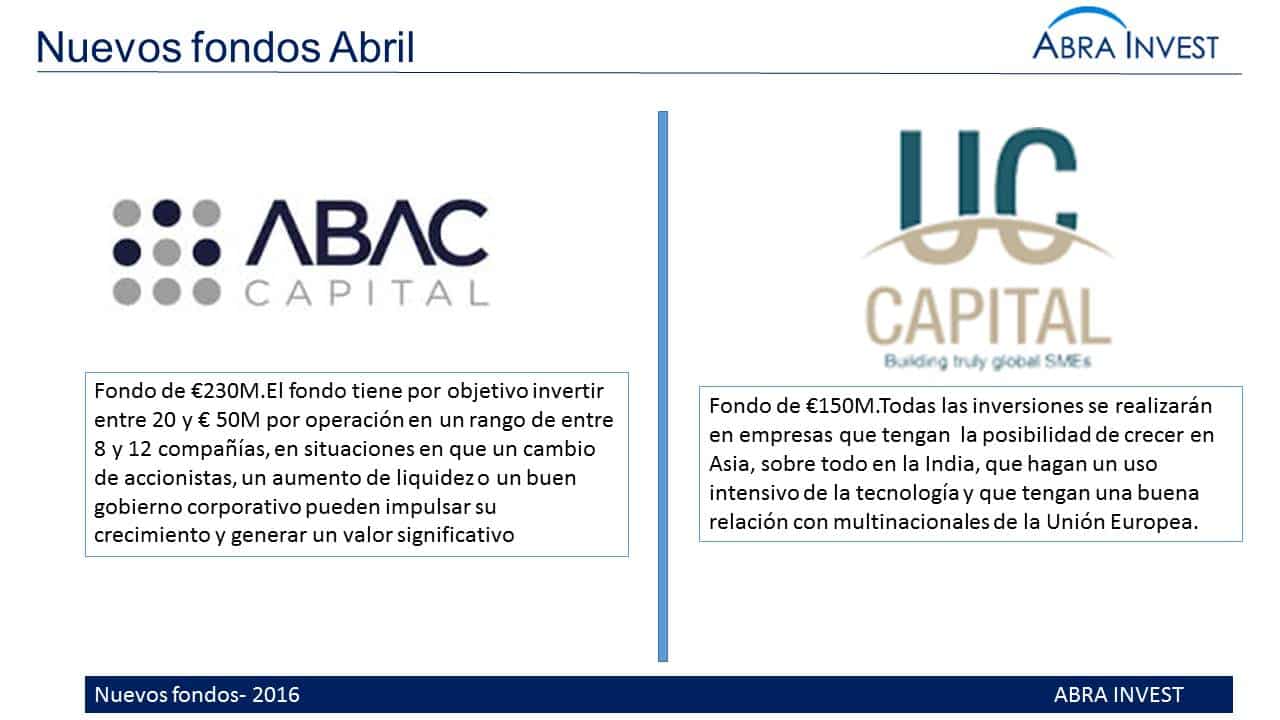

Abac, with €230M, has raised the largest fund in Southern Europe for a start-up fund manager and UC has raised a fund for SMEs that have the potential to grow in Asia, especially in India.

Abac raises €320M fund from foreign investors to invest in medium-sized companies in Spain

In spite of political instability, the private equity Abac has successfully closed its first €320M fund. Approximately 20% was committed by Spanish investors, 40% by Europeans, 30% by North Americans and 10% by Asia-Pacific institutions.

This fund is the largest fund raised in Southern Europe since the beginning of the crisis by a newly created fund manager.

Abac, has already realised two acquisitions in 2015, the acquisition of Metalcuacho, an automotive spare parts company with a turnover of €40m in 2014, and Figueras International Seating, dedicated to the manufacture of seats for auditoriums.

According to Borja Martinez de la Rosa, one of Abac's directors, "the fund aims to invest between €20 and €50M per deal in a range of between 8 and 12 companies, in situations where a change of shareholders, increased liquidity or good corporate governance can drive growth and generate significant value".

UC Capital launches a €150M fund to invest in SMEs

UC Capital, a product of the merger of Urdaneta and Capvent, has created the Lions Growth fund with which it plans to invest a total of €150M over the next four years. The fund will invest in SMEs, which have sales of between €10 and €80M and are experiencing difficulties (e.g. bankruptcy), and all investments will be made in companies that have the potential to grow in Asia, particularly India, are technology intensive and have a good relationship with EU multinationals.

Sectors of focus include energy, construction, manufacturing, engineering, automotive, advanced materials and personal care.

The fund will invest between €4m and €20m in each transaction, including equity and debt assumption. In total, they intend to enter into a dozen companies.

UC Capital aims to take over 50% of a company's equity and become involved in its management for about 5 years, during which time the firm is transformed and eventually sold. In parallel, the previous owners remain within the company and at the time of divestment, a partner is sought in agreement with the historical shareholders.

Other posts that may interest you

Strengzen and Caixa Innvierte Start, new funds March 2016

New venture capital funds for SMEs: Meridia capital and Closa Gordon

New funds for 2016: Sabadell, Caixa Capital risk, Samapaita Ventures and others.