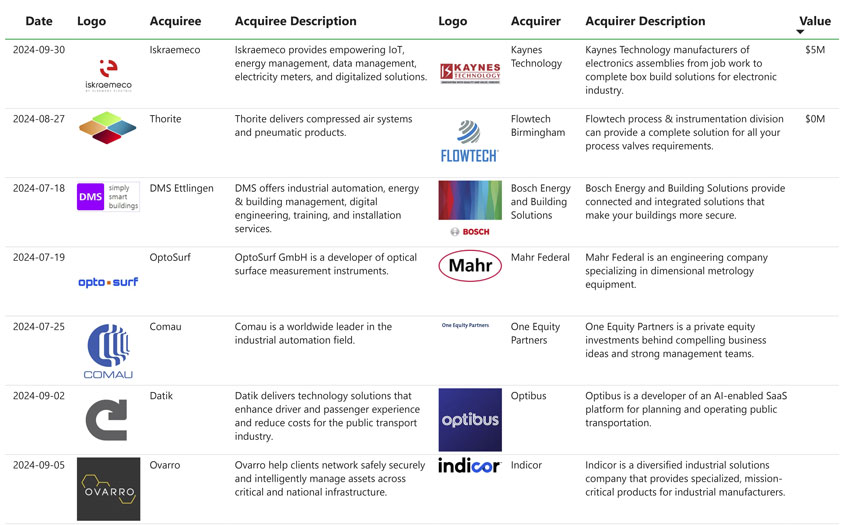

The industrial technology sector has witnessed a wave of strategic transactions in recent months, signalling rapid evolution and expansion. Among the most notable deals, Bosch Energy and Building Solutions acquired DMS Ettlingen to strengthen its presence in energy and building management. Kaynes Technology’s purchase of Iskraemeco highlighted the drive for IoT-based energy solutions, while Mahr Federal’s acquisition of OptoSurf aimed to enhance innovation in metrology. The acquisition of Thorite by Flowtech Birmingham and One Equity Partners’ investment in Comau further underscored the sector’s focus on automation and process optimisation. Collectively, these transactions demonstrate a sector on the rise.

Kaynes Technology acquires Iskraemeco to revolutionise IoT and energy management solutions

In a strategic move to strengthen its position in the IoT and energy management space, Kaynes Technology acquired Iskraemeco for $5 million in September 2024. This acquisition represents a merger of advanced energy solutions with cutting-edge electronics manufacturing, aligning the technology innovation and market expansion goals of both companies.

Kaynes Technology recognised the importance of growth and strategic expansion for achieving organisational success, as mergers and acquisitions can support and accelerate this process. We discuss this in our article on the key aspects of defining an M&A strategy.

About Kaynes Technology

Kaynes Technology specialises in electronic component assembly, from custom work to complete box build solutions, serving industries with state-of-the-art manufacturing capabilities. The company is known for its adaptability and commitment to driving growth through innovation.

About Iskraemeco

Iskraemeco is a leading provider of energy management solutions powered by IoT, electricity metering and digitised technologies. Its expertise lies in optimising energy use through smart devices and data-driven insights.

Strategic Justification of the Acquisition

This acquisition enables Kaynes Technology to integrate Iskraemeco's energy management technologies into its offering, opening new avenues in smart metering and IoT solutions. By leveraging Iskraemeco's advanced capabilities, Kaynes can enhance its value proposition across industries, particularly in energy and utilities.

The acquisition underscores Kaynes Technology's commitment to expanding its technology footprint and embracing sustainable solutions. By aligning with Iskraemeco, the company is poised to capitalise on the growing demand for energy efficiency and IoT-enabled solutions.

Flowtech Birmingham acquires Thorite to expand its pneumatic and compressed air solutions portfolio

In a strategic move to strengthen its market position, Flowtech Birmingham acquired Thorite, a leading supplier of compressed air systems and pneumatic products, for $10m in August 2024. The acquisition is expected to strengthen Flowtech's capabilities and expand its portfolio in the automation and industrial instrumentation sectors.

Description of Flowtech Birmingham

Flowtech Birmingham is a specialist in process valves and instrumentation solutions, offering comprehensive services to industries requiring precision and reliability. Its expertise lies in providing bespoke solutions to meet complex operational demands.

Description of Flowtech Birmingham

Thorite is known for its complete range of compressed air systems and pneumatic technologies. With a solid reputation for quality and service, Thorite has been a trusted partner for companies seeking innovative and efficient industrial solutions.

Explanation of the strategic reasons for the acquisition

This acquisition aligns with Flowtech's strategy to enhance its value proposition by integrating Thorite's advanced pneumatic offering. The synergy will enable Flowtech to offer end-to-end solutions, from process valves to pneumatic systems, serving a broader customer base.

This acquisition highlights the growing demand for integrated industrial solutions, highlighting the importance of efficiency and innovation in manufacturing and automation. Combining their expertise, Flowtech and Thorite are poised to drive growth and deliver greater value to their customers.

Bosch Energy and Building Solutions strengthens portfolio with acquisition of DMS Ettlingen

In a major expansion of its capabilities, Bosch Energy and Building Solutions acquired DMS Ettlingen in July 2024. This acquisition integrates DMS's industrial automation and energy management expertise with Bosch's advanced connected building solutions, delivering unrivalled value to customers.

Description of Bosch Energy and Building Solutions

Bosch Energy and Building Solutions is a leading provider of safe, connected and integrated building systems. Focused on improving safety and operational efficiency, Bosch solutions are tailored to a wide range of sectors and respond to changing energy and building management needs.

Description of DMS Ettlingen

DMS Ettlingen, a specialist in industrial automation, energy management and digital engineering, complements the Bosch portfolio. With its training, installation and advanced technology services, DMS has established itself as a reliable partner for optimising the operational efficiency of companies.

Strategic Reasons for the Acquisition

This strategic acquisition allows Bosch to expand its presence in industrial automation and energy management, integrating DMS' expertise to offer enhanced end-to-end solutions. The combined offering will drive innovation, streamline operations and serve a broader range of industries.

As demand for sustainable and safe building systems grows, this acquisition underscores the industry's interest in integrated, technology-enabled solutions. Bosch's enhanced capabilities position it as a key player in driving the future of energy and building management.

Mahr Federal expands its precision measurement offering with the acquisition of OptoSurf

In July 2024, Mahr Federal, a leader in dimensional metrology equipment, acquired OptoSurf GmbH, a specialist in optical surface measurement instruments. This acquisition aims to strengthen Mahr Federal's capabilities in surface metrology, addressing the growing demand for accurate, non-contact measurement solutions across all industries.

About Mahr Federal

Mahr Federal has a long-standing reputation for engineering excellence and offers advanced metrology solutions for industrial and scientific applications. Its products ensure accuracy and reliability in dimensional measurements and serve industries such as automotive, aerospace and manufacturing.

About OptoSurf

OptoSurf is renowned for its state-of-the-art optical surface measurement instruments. These tools enable high-precision non-contact assessments, especially valuable in industries that require accurate surface quality assessments, such as electronics and medical devices.

Strategic Justification of the Acquisition

The acquisition aligns with Mahr Federal's strategy to enhance its technology offering and market reach. The integration of OptoSurf's optical expertise with Mahr's dimensional metrology solutions will enable the company to offer a broader and more advanced set of measurement tools. This synergy will improve management with customers seeking innovative and integrated solutions for their quality control needs.

By combining its strengths, Mahr Federal reinforces its position as a world leader in metrology, meeting the changing challenges of the industry with a comprehensive and technologically advanced portfolio.

One Equity Partners acquires Comau to reinforce its leadership in industrial automation

In July 2024, the private equity firm (private equity) One Equity Partners announced the acquisition of Comau, a global leader in industrial automation. The goal of the transaction is to leverage Comau’s advanced automation technologies and support its growth in a rapidly evolving sector.

Description of One Equity Partners

One Equity Partners specialises in private equity investments, focusing on companies with attractive growth opportunities and strong management teams. With a portfolio spanning multiple sectors, the firm brings strategic expertise and capital to accelerate business transformation.

Description of Comau

Comau has established itself as a pioneer in industrial automation, offering cutting-edge solutions in robotics, digital manufacturing and intelligent automation systems. Serving diverse industries such as automotive, aerospace and logistics, Comau has a reputation for innovation and operational excellence.

Explanation of the strategic reasons for the acquisition

The acquisition reflects One Equity Partners' commitment to capitalise on the growing demand for automation solutions. By integrating Comau's expertise with One Equity Partners' financial and strategic support, the partnership is poised to expand its reach and enhance its product offering, meeting the growing automation needs of global industries.

This transaction underscores the current trend of private equity investment in high-tech manufacturing, positioning Comau and One Equity Partners to drive future advances in industrial automation.

Trends in the Industrial Tech Sector: Automation and Digital Integration Lay the Path

These transactions reflect a clear trend to align innovation with market demands in the Industrial Tech sector. Companies are investing heavily in automation, digital transformation and energy efficiency to remain competitive. With the increasing adoption of IoT and smart manufacturing solutions, the sector is poised for sustained growth, driven by acquisitions and strategic partnerships. These developments highlight the shift towards integrated solutions that optimise efficiency and reduce costs, positioning the industry for a dynamic, technology-driven future.

At Baker Tilly, as specialists in technology sector mergers and acquisitions, we advise on the transaction processes of company sales and purchases. If you are seeking advice on this matter, feel free to contact us.