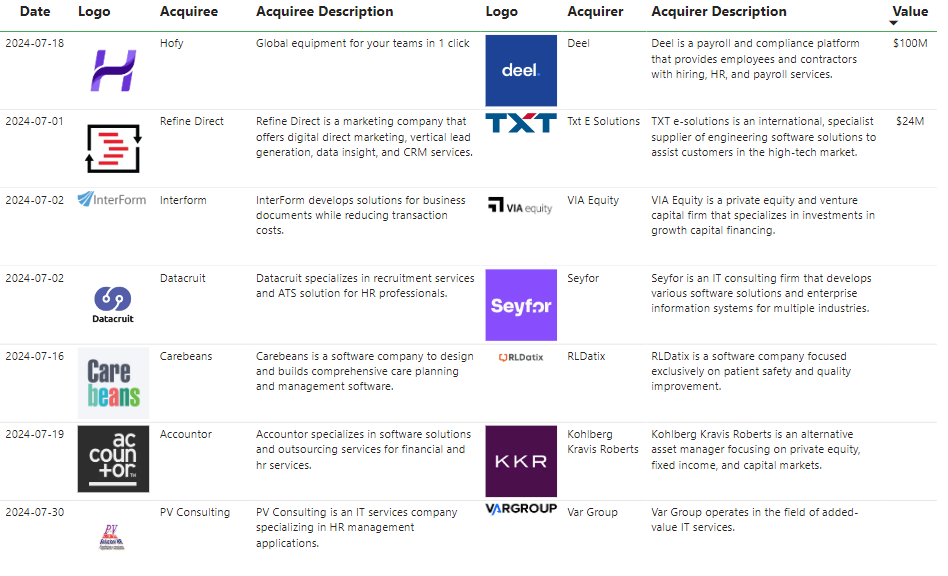

The enterprise software sector continues to show notable M&A activity, underscoring the industry-wide drive to expand, enhance technological capabilities and increase market share. The most notable recent transactions reveal companies strategically acquiring specialized software companies to integrate niche capabilities, strengthen product offerings and increase their competitive advantage. These five recent transactions illustrate the industry's momentum as buyers invest in innovative solutions for business management, recruitment services, patient safety, care planning and data reporting.

Deel acquires Hofy for $100 million to create global equipment solutions team

In July 2024, Deel acquired Hofy, a leading provider of global equipment solutions, for $100 million. The integration of Hofy into Deel enables companies to further streamline their global operations by ensuring that team members have the tools they need to work productively from day one.

Description of Deel

Deel, a global payroll and compliance platform, has grown significantly by streamlining payroll, HR and recruiting for remote and distributed teams. By incorporating Hofy's one-click global team delivery system, Deel will be able to offer a more complete solution for companies looking to onboard and support teams around the world.

Description of Hofy

Hofy's single platform simplifies the process of delivering equipment to employees, ensuring fast and secure delivery to multiple locations. This acquisition strategically enhances Deel's ability to meet the logistical and operational needs of global workforces, facilitating seamless equipment management alongside its core payroll and HR services.

Explanation of the strategic reasons for the acquisition

This acquisition aligns with Deel's mission to become a one-stop solution for all global recruiting, HR and employee support needs, reinforcing its position as a leader in the remote work and global employment ecosystem.

TXT E-Solutions acquires Refine Direct to strengthen digital marketing capabilities

In a major strategic move to expand its digital and marketing capabilities, TXT E-Solutions acquired Refine Direct in July 2024 for $24 million. This acquisition combines TXT's expertise in engineering software for high-tech markets with Refine Direct's strengths in digital direct marketing, lead generation, data insights and CRM services.

About TXT E-Solutions

TXT E-Solutions, an international provider of engineering software for high-tech markets, views this acquisition as a strategic move to enhance its offering by integrating advanced marketing and lead generation capabilities.

About Refine Direct

Refine Direct specializes in vertical lead generation, CRM and data insights, providing comprehensive marketing services to effectively reach target audiences. This acquisition allows TXT to expand its capabilities beyond engineering software, adding valuable customer relationship and digital marketing services.

Strategic Justification of the Acquisition

The goal of the transaction is to enhance TXT's ability to offer tailored marketing solutions alongside its existing software products. By integrating Refine Direct's data-driven marketing tools and customer relationship information, TXT intends to create comprehensive customer-centric solutions for its high-tech clients, further expanding its market reach and service offering in a competitive industry.

Acquisition of InterForm by VIA Equity: advanced document solutions for efficient business operations

VIA Equity has announced the acquisition of InterForm, a key player in enterprise document management solutions, with a mission to improve document efficiency and reduce transaction costs for organizations. This acquisition reflects VIA Equity's commitment to supporting growth-ready companies in technology-driven markets as they continue to invest in high-potential businesses.

The potential of a company can be enhanced by implementing a solid strategy for business growth. Business growth is key to the success of an organization, whether through mergers or acquisitions.

Description of VIA Equity

VIA Equity, a private equity firm known for its strategic growth capital investments, seeks to strengthen companies with innovative solutions and strong market positions. By adding InterForm to its portfolio, VIA Equity intends to leverage InterForm's expertise in streamlined document solutions to optimize the value delivered to its clients.

InterForm Description

InterForm, recognized for its ability to simplify complex document workflows and significantly reduce transaction costs, will benefit from VIA Equity's resources and market expertise. The integration promises to advance InterForm's technology, enabling it to expand its offerings and strengthen its competitive advantage.

Strategic Reasons for the Acquisition

Through this acquisition, which took place in July 2024, VIA Equity plans to drive further innovations in document management, ultimately delivering greater efficiency and value to customers in a competitive, digital marketplace. This partnership underscores VIA Equity's dedication to fostering growth in cutting-edge technology sectors.

Seyfor acquires Datacruit to enhance recruitment technology and HR solutions

In July 2024, Seyfor expanded its technology portfolio through the acquisition of Datacruit, a recruitment services provider specializing in applicant tracking system (ATS) solutions tailored to HR professionals. This acquisition is an important step for Seyfor in strengthening its offering to HR and recruiting teams through the integration of advanced recruiting technology.

Description of Seyfor

Seyfor is a leading IT consultancy that develops software and business information systems across diverse industries, with a focus on supporting digital transformation and efficiency. This acquisition of Datacruit enables Seyfor to offer a specialized set of tools that streamline the hiring process, meeting the evolving needs of HR professionals.

Datacruit Description

Datacruit, known for its ATS solutions, helps HR teams improve candidate management, recruitment automation and decision making. By joining Seyfor, Datacruit gains access to Seyfor's resources and technical expertise, which will support further innovation in recruitment technology.

Explanation of the strategic reasons for the acquisition

The strategic acquisition aligns with Seyfor's goal to expand its influence in the HR technology sector by addressing the growing demand for efficient recruitment solutions. This transaction is intended to provide clients with end-to-end talent acquisition support, simplifying recruitment for a more agile and efficient hiring experience.

RRLDatix acquires Carebeans to create patient care planning software

RLDatix has acquired Carebeans, a software provider known for its robust care planning and management solutions. This acquisition, made in July 2024, underscores RLDatix's commitment to expand its suite of quality improvement and patient safety tools by integrating comprehensive care management capabilities.

About RLDatix

RLDatix is a leader in healthcare software, focused exclusively on improving patient safety and quality. With a worldwide reputation, RLDatix provides technology solutions to help healthcare organizations streamline processes, reduce risk and drive continuous improvement.

About Carebeans

Carebeans, with its focus on care planning software design, supports healthcare providers by simplifying patient care management and workflows. This acquisition provides RLDatix with a foundation to offer comprehensive patient safety and care management solutions.

Strategic Justification of the Acquisition

From a strategic standpoint, this acquisition enables RLDatix to offer a broader set of tools for healthcare professionals, improving both patient safety and quality of care. The combination of RLDatix's expertise with Carebeans' specialized software will enable providers to improve patient outcomes through efficient and integrated care planning.

This partnership marks a significant step towards a more cohesive approach to patient care and safety, positioning RLDatix as a comprehensive leader in healthcare technology.

Trends in the business software market: Innovation and integration

These recent acquisitions highlight a clear trend in the business software market: consolidation driven by the need for more integrated and versatile solutions. As companies strive to enhance operational efficiency and service offerings, acquisitions serve as a powerful tool for rapid innovation. This trend is likely to continue, with companies increasingly prioritizing acquisitions of specialized software companies that enhance their core capabilities and provide comprehensive, value-based solutions.

At Baker Tilly Tech M&A Advisors, we specialize in the purchase and sale of companies in the technology sector. Contact our expert advisors for a valuation of your company or to request information about business transactions.