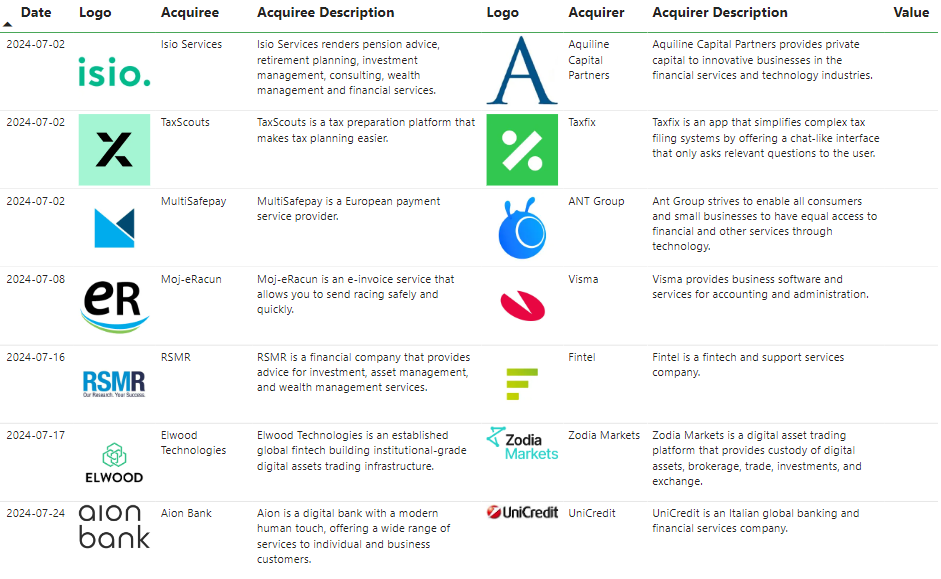

El sector FinTech se ha visto sumergido en una oleada de adquisiciones estratégicas, impulsadas por la creciente demanda de servicios financieros digitales sin fisuras y soluciones tecnológicas avanzadas. Las recientes adquisiciones, como la compra de Aion Bank por UniCredit, la de RSMR por Fintel y la de MultiSafepay por ANT Group, ponen de relieve una tendencia de consolidación entre los actores establecidos que buscan ampliar sus capacidades digitales y mejorar la experiencia del cliente. Además, la compra de Wizard Corporate Training por parte de Lumify muestra un impulso hacia ofertas de servicios más completas y mejoradas tecnológicamente.

Aquiline Capital Partners announces acquisition of Isio Services to enhance its financial advisory capabilities

In July 2024 Aquiline Capital Partners acquired Isio Services in a strategic move to expand its presence in the financial services and wealth management sector. This acquisition underscores a strong alignment between Aquiline's investment expertise and Isio's full range of services, which encompasses pension advice, retirement planning and investment management.

Aquiline Capital Partners Description

Aquiline Capital Partners is a private equity firm specialising in financial services and technology, seeking innovative companies with strong growth potential. With an established track record of nurturing industry leaders, Aquiline's focus on innovation in financial services makes it well positioned to leverage Isio's advisory capabilities.

Isio Services Description

Isio Services, recognised for its expertise in wealth management, consulting and financial advice, brings a strong portfolio designed to meet clients' complex retirement and investment planning needs. Its deep industry knowledge and client-focused approach make it an attractive asset to expand Aquiline's reach.

Strategic Reasons for the Acquisition

The acquisition strategically complements Aquiline's portfolio, enabling it to offer an enhanced range of advisory services. This partnership aims to drive growth and better serve clients in a rapidly evolving financial landscape, reinforcing Aquiline's commitment to fostering leadership within the financial and technology sectors.

Visma expands its digital services with the strategic acquisition of e-invoicing platform Moj-eRacun

In July 2024, Visma, a leading provider of business software and back-office services, acquired Moj-eRacun, a trusted e-invoicing service known for its secure and fast invoicing. This acquisition represents a strategic expansion for Visma, adding e-invoicing capabilities to its suite of business solutions.

About Visma

Visma specialises in software and services to support accounting, administrative and human resources needs, focusing on solutions that streamline business operations for companies of all sizes. The company's expertise in accounting technology fits perfectly with the integration of Moj-eRacun's capabilities.

About Moj-eRacun

Moj-eRacun has earned a solid reputation as a reliable platform for electronic invoice management, improving the efficiency and security of companies sending and receiving payments. Its technology complements Visma's offering by providing a specialised invoicing service that adds value to Visma's accounting and administrative software.

Strategic Justification of the Acquisition

The acquisition allows Visma to expand its digital offering, providing companies with a complete solution that includes both accounting management and electronic invoicing. This move strengthens Visma's position in the digital business solutions market, positioning it to offer end-to-end support for its customers' financial and administrative needs, from invoicing to accounting.

Visma has been acquiring technology companies for some time. In April 2022, Europe's leading software company left the company in April 2022. advising Baker Tilly Tech M&A experts to acquire the company Declarando. Se trata de una empresa de software contable y fiscal y gracias a esta operación, Visma reforzó su presencia en España.

In January 2023, in a further expansion strategy in the Iberian Peninsula, Visma returned to rely on our advisors specialised in the sale and purchase of technology companies. for the acquisition of the company Moloni, a company that provides cloud-based point-of-sale (POS) and billing software solutions.

ANT Group acquires MultiSafepay to strengthen its fintech presence in Europe

ANT Group acquired MultiSafepay, a leading European payment service provider, to expand its reach and improve the accessibility of digital payments in Europe. This acquisition aligns with ANT Group's mission to democratise financial access for individuals and small businesses through advanced technology.

ANT Group Description

ANT Group is known for its commitment to providing equitable financial services through digital innovation, with an extensive presence across Asia. By integrating MultiSafepay's extensive experience in the European payments industry, ANT aims to deepen its presence and streamline cross-border transactions.

MultiSafepay Description

MultiSafepay has a strong foundation in the digital payments industry in Europe and offers merchants tailor-made solutions for secure and efficient payment processing. This makes it a strong partner for the ANT Group, which can leverage MultiSafepay's established networks to expand the service offering and bring innovative financial solutions to new markets.

Explanation of the strategic reasons for the acquisition

This acquisition took place in July 2024 and signifies a strategic move for ANT Group to take advantage of Europe's evolving fintech landscape, positioning it to better serve the growing demand for accessible and seamless digital payments. This collaboration is expected to strengthen ANT's position in the global market and enhance MultiSafepay's capabilities and reach.

Fintel adquiere RSMR para ampliar sus capacidades de asesoramiento financiero

In July 2024 Fintel, a leading fintech and support services company, acquired RSMR, a financial advisory firm specialising in investment, asset management and wealth services. This strategic acquisition aims to strengthen Fintel's value proposition in the financial services market by integrating high-quality advisory and portfolio solutions into its existing digital offering.

Fintel Description

Fintel has established itself as a key player in the fintech sector, providing advanced support services and tailored digital solutions for financial management and advice. With the acquisition of RSMR, Fintel aims to enhance its advisory capabilities and offer a more comprehensive set of wealth management solutions to its clients.

Description of RSMR

RSMR's expertise in financial advice and reputation in wealth management make it a valuable addition to Fintel's portfolio. This collaboration will enable Fintel to offer more comprehensive, data-driven advisory services to support financial advisors and improve client outcomes across its platform.

Strategic Reasons for the Acquisition

Through this acquisition, Fintel is well positioned to strengthen its influence in the financial services sector, offering a broader and more integrated range of services for today's dynamic market needs.

UniCredit acquires Aion Bank to expand its digital banking solutions

Italian banking giant UniCredit has acquired Aion Bank, a digital bank known for its customer-centric and technology-driven approach. The acquisition aims to strengthen UniCredit's position in the European digital banking landscape by leveraging Aion's digital capabilities and personalised service model.

About UniCredit

UniCredit, a leading global banking player, has long focused on innovation in financial services. The acquisition of Aion Bank aligns with its strategy to offer technology solutions to its broad customer base, integrating digital services into its core offering.

About Aion Bank

Aion Bank brings a unique combination of digital banking and personalised service that caters to both individuals and businesses, making banking easier and more accessible. Aion's robust digital platform will enable UniCredit to offer enhanced services tailored to the needs of modern customers.

Strategic Justification of the Acquisition

With Aion Bank's technology and customer-centric model, UniCredit can accelerate its digital transformation, enhancing its ability to deliver efficient and customer-friendly banking experiences across Europe. This acquisition, completed in July 2024, reflects the continued evolution of traditional banks in response to the digital age.

Innovative FinTech solutions support demand for new digital financial solutions

These transactions underline a trend: FinTech companies are merging to create robust, global platforms that offer efficient and user-friendly services at scale. The acquisitions highlight a forward-looking shift, with digital-first banking, innovative tax solutions and comprehensive financial advisory services at the core of growth strategies. This consolidation signals an evolution of the industry, with technology-driven financial services providers aiming to meet changing market demands and serve digitally savvy customers.

At Baker Tilly Tech M&A Advisors, we bring our experience and expertise to the processes of acquiring companies in the technology sector. In our news section, you will find articles where we analyse the latest transactions involving technology companies.

If you need advice on any process of the sale and purchase of companies, you can contact our experts without obligation.