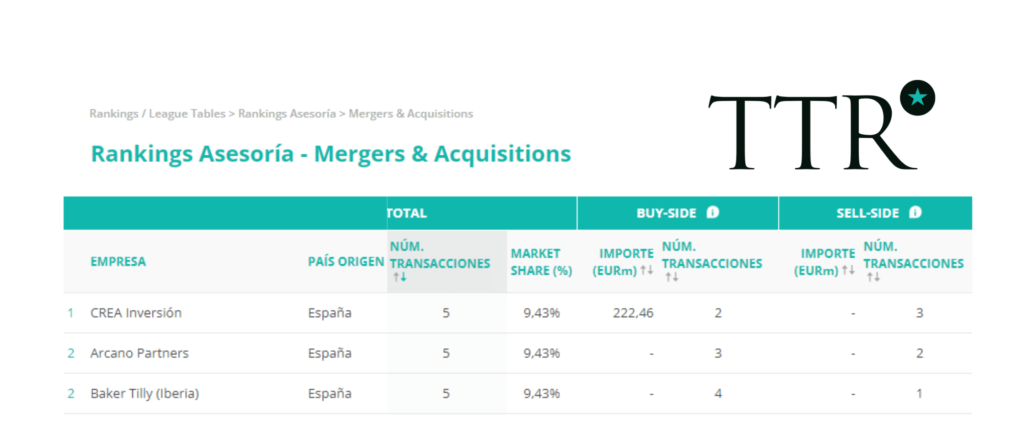

As every year, the M&A financial and legal advisory rankings are coming out. In the Iberian Peninsula, Baker Tilly Global Deal Advisory has advised on a total of 15 transactions in 2022 (13 of them public), 7 buy-side transactions and 8 sell-side transactions. This places Baker Tilly in Iberia in the top 5 M&A advisory firms in general and among the three M&A advisory firms that have closed the most deals in the technology sector according to the database. Transactional Track Record (TTR).

The differential value of our team - M&A Advisory

Transactions advised by the Baker Tilly Tech M&A The values of its offerings in 2022 reflect the values of its mainly SME-oriented offerings:

- Sector expertise especially in the technology sector being the leader in terms of number of transactions.

- International outreach: 5 transactions have involved an international entity.

- Full service: M&A advice is complemented by legal and transaction services, providing agility and coordination.

- Versatility in type of operation and type of investor: balance between sellside and buyside. Used to negotiating with all types of investors such as venture capital, strategic investors and family offices.

Against the tide

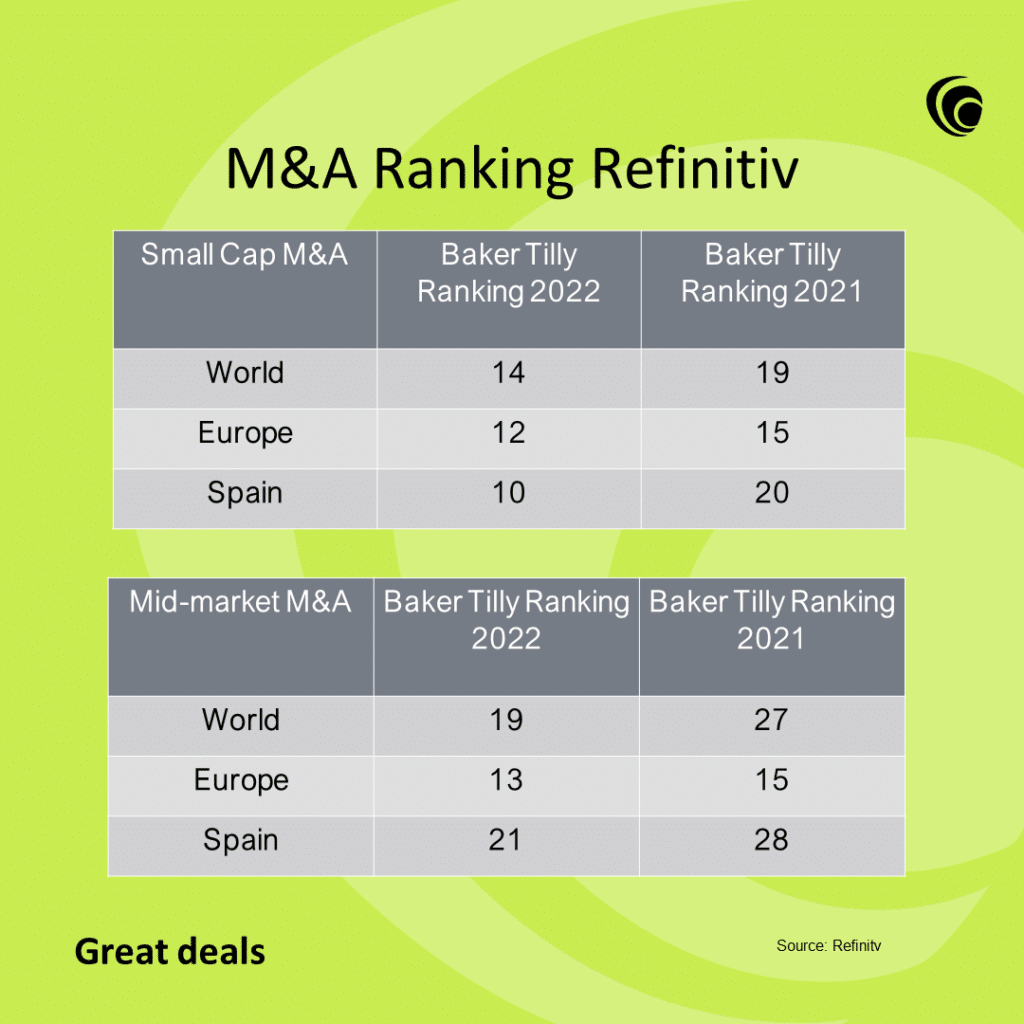

According to Refinitiv's annual ranking we also continue to grow, reaching the Top 10 in the Mergers & Acquisitions (M&A) financial advisory market in Spain. Despite a market decline of more than 20% in Europe and globally, we were able to grow by 10 positions in the small cap and 7 positions in the Mid-market.

Below, we will discuss the most significant transactions of each type of advice we have provided during 2022.

Sell-side:

- The IDP Engineering Group formalised the purchase of Ecointegralat the beginning of 2022. IDP thus integrated two new strategic business lines (energy and technology). (+info)

- Mengual, a company that sells wood hardware, sold a minority stake in April 2022 to the private equity firm Suma Capital, which is carrying out this transaction through its fund for SMEs in traditional sectors, SC Growth Fund II. (+info)

- JIS (Nadal Badal SA) was sold in June to the security company CDVI Group. The JIS lock manufacturer has grown over the years to become a world leader in electric locks and electric strikes. (+info)

- In July 2022, Itaca Capital bought Gravity Works, a company that installs safety systems for hazardous work. (+info)

- Viube Foods (Mikso Chips) was purchased in August 2022 from the Chips and snacks manufacturer, Apex Group. The Apex Group thus reaffirms its growth strategy and successfully positions itself in Catalonia, where it will have its seventh production plant. (+info)

- Innovar Tecnologías, Microsoft Partner, founded in 2008, was acquired in October 2022 by the Techedge Group. Innovar and Axazure (also acquired by Techedge) will thus become one of Microsoft's most powerful partners in Spain in this business segment. (+info)

Buy-side:

- IMF Smart Education closed in February the acquisition of the Paradigma Group. MFI thus continues its commitment to the health sector. (+info)

- Namirial, a platform company of the Ambientafund, bought Evicertia in February, thus closing the environmental sustainability investor's second international transaction since it took a stake in Namirial's capital. (+info)

- Visma, a leading European technology company, closed its acquisition of Declarando, a specialist in accounting and tax software for the self-employed in Spain, in April 2022. (+info)