As always at the end of an old year and at the beginning of the new year, summaries, top lists, rankings, classifications, etc. of all kinds of things are made. And so we also make our summary of the year 2021. Undoubtedly, a year still marked by the COVID-19 pandemic, but already with a recovery of the economy compared to 2020.

Baker Tilly jumps to the top spot as M&A advisor in the technology sector

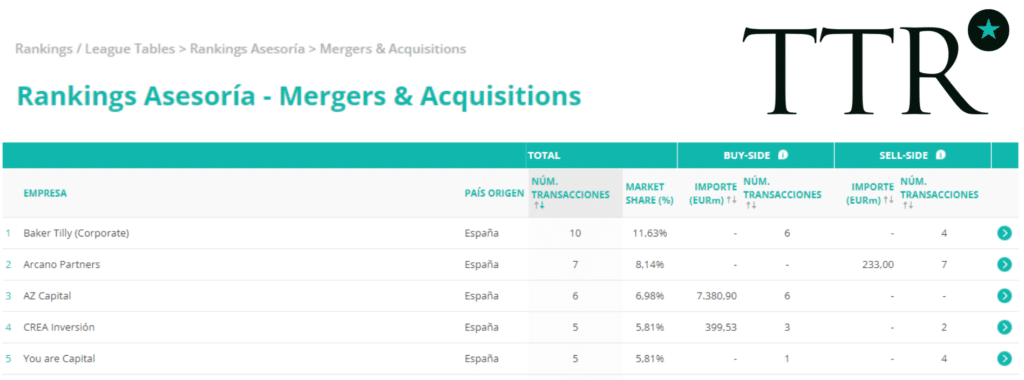

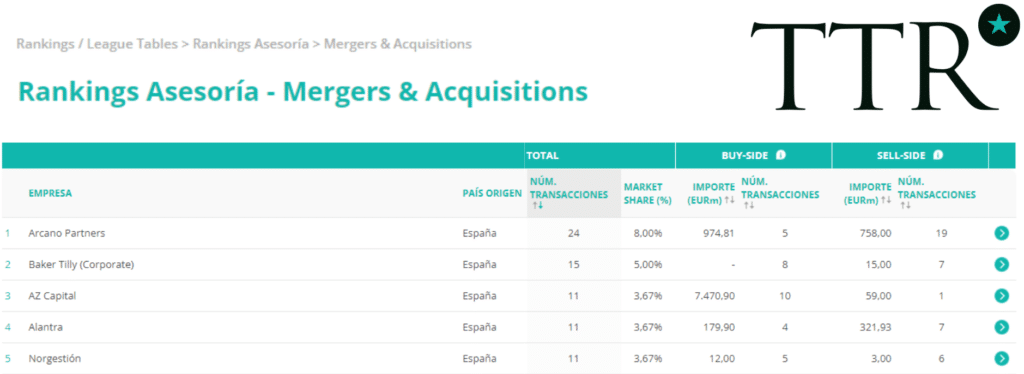

En la península ibérica, Baker Tilly Tech M&Aha asesorado este año en un total de 17 operaciones (15 de ellas de carácter público), 8 operaciones en buy-side y 9 operaciones en sell-side. Con 10 de las 17 operaciones en el sector tecnológico, ocupamos el primer puesto por número de operaciones en este sector y el segundo puesto en general según la base de datos Transactional Track Record (TTR).

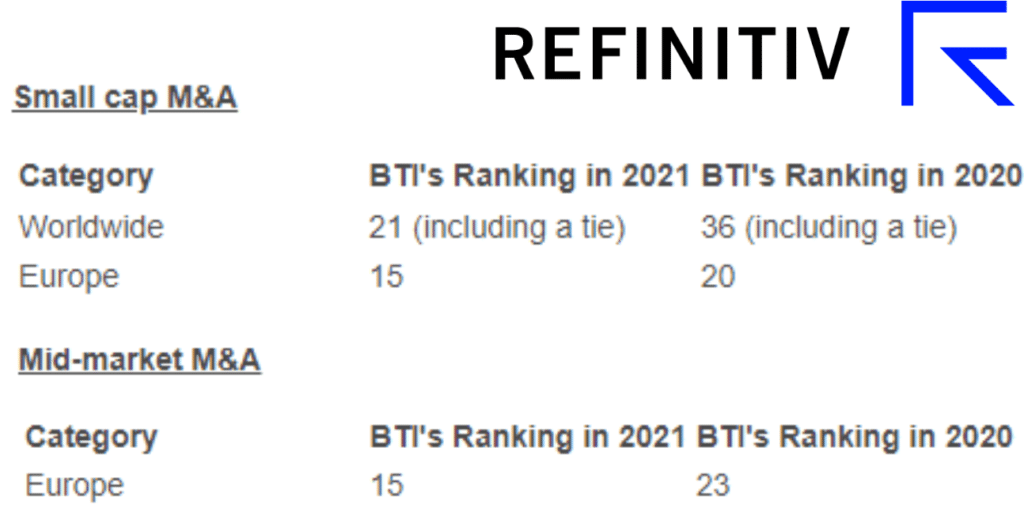

Baker Tilly rises to 15th position in Europe among small&mid market M&A advisors in 2021

According to the Europe M&A Review ranking conducted by Refinitiv, Baker Tilly International was ranked 15th in 2021 (by number of transactions completed), both in the Small Cap market (132 deals) and in the Mid-Market (133 deals).

The differential value of our team

Las transacciones asesoradas por el equipo de Baker Tilly Tech M&Adurante el 2021 reflejan los valores de su oferta principalmente orientadas para las PYMES:

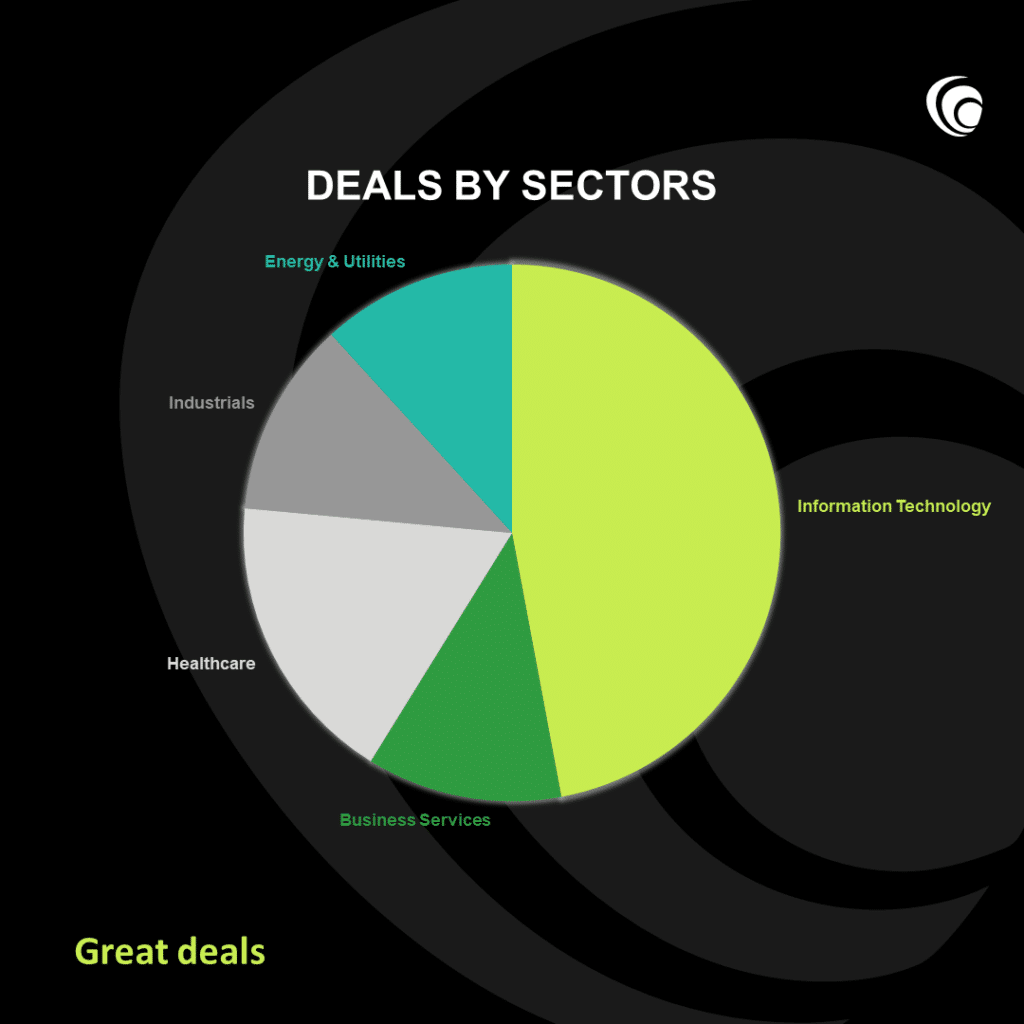

- Sector expertise especially in the technology sector being the leader in terms of number of transactions.

- International outreach: 6 transactions have involved an international entity.

- Full service: M&A advice is complemented by legal and transaction services, providing agility and coordination.

- Versatility in type of operation and type of investor: balance between sellside and buyside. Used to negotiating with all types of investors such as venture capital, strategic investors and family offices.

Below, we will discuss the most significant transactions of each type of advice we have provided during 2021.

Sell-side:

- Externalia, a software company for CAE management, has been acquired by BSG holding in a Buy&build process in the field of business solutions. (+info)

- Dapda Digital Engine, a company specialising in digital solutions and services for the automotive industry, has been acquired by MotorK in a business move that aims to expand MotorK's geographic reach in Spain (+info)

- BCN Science, dedicated to healthcare communication and technology in Madrid, LATAM and Central Europe, was acquired by Evidenze Group Europe with the intention of accelerating its international expansion. (+info)

- Cannabinoids Spain, specialising in active pharmaceutical ingredients from medicinal plants, was acquired by Grow Group PLC, enabling Cannabinoids to meet its long-term objectives and Grow Group to enhance its position in the medical cannabis sector by entering the Spanish market.

- Baratzthe national leader in library software, was acquired by TSS, a specialist in mergers and acquisitions of vertical software (+info)

- First Line of Sight, specialising in point-of-sale advertising, was bought by Grupo La Plana.+info)

- Macrolibros was acquired by Graficas Ceyde in February 2021 with the aim of increasing its customer base and expanding into new business verticals. (+info)

- A business group specialising in the distribution of construction products and interior design finishes (building supplies, construction, sanitary ware, kitchens, flooring, flooring, etc.) was acquired by a private equity firm specialising in the acquisition, management and sale of industrial and service companies in the "low market" segment in December 2021.

- A long-established company with a proven track record in the advisory and management of medicines and healthcare products was acquired by a private investor through private equity backing at the end of December 2021.

Buy-side

- Dili Trust, a provider of corporate governance software solutions, acquired Gobertia in July to expand the market to Spain and Latin America and gives Gobertia's customers access to the solutions offered by DiliTrust. (+info)

- A well-crafted international family office of Dutch origin has made its first investment in Spain in April 2021 by injecting capital in Feltwood Ecomateriales, a company that manufactures packaging technology with ecomaterials, which will also acquire support in the development of the international business. (+info)

- BSG-Clavei, a specialist for software in the footwear and textile sector, acquired 100% of SG Software, Wolters Kluwer's official distributor in Almeria, in January. The group now has the largest team of specialists in Wolters Kluwer solutions with more than 25 years of experience. (+info)

- In March of the same year BSG-Clavei acquired Clave Sistemas Informaticos, a specialist in the development and implementation of IT solutions for the agri-food sector. It thus reinforces its inorganic growth by strengthening its position as a software manufacturer for the agri-food sector. (+info)

- Henko Partners, a Spanish private equity fund founded in early 2021, closed its first two buyout deals in December, acquiring Galician companies Mmypem and Teiga-TMI. Mmypem specialises in commissioning services for power generation plants and Teiga TMI provides electrical and mechanical services mainly for the energy and industrial sector. Henko Partners aims to create an international engineering and technical services group with a focus on energy transition and digitalisation. (+info)

- In December the merger of valantic with ABACO Consulting was agreed. In order to meet all the needs of its customers and to achieve its own growth ambitions, valantic now joins forces with one of Portugal's leading SAP Gold Partners, Abaco Consulting. (+info)

- In 2021, private equity Accel-KKR closed its first deal in Spain by acquiring one of the most active software private equity firms in Europe: Endalia. Since 2013, when Accel-KKR established its European presence, it has completed 52 investments in the EMEA region. (+info)

- In 2021, the purchase of Alumipres by the investor Vergara Industrialhas been agreed. Thanks to the transaction, Vergara Industrial successfully continues its growth strategy in the industrial sector, generating synergies with the rest of its businesses.