What is the FinTech sector?

Financial technology (hence the abbreviation) uses technology to offer financial services and products to customers. In other words, the financial activity carried out through the use of the Internet of Things (IoT), Big Data, mobile applications, etc. In this way, access to financial products, for example, is much more decentralised and accessible to users who want it, with clearer and more detailed objectives than those of other types of financial services (see the objectives in our Market Research).

The adaptation of financial companies to this type of products with a more technological approach is the order of the day. More and more companies are being created in order to meet the demand, as it is not only the big banks that offer this type of services, there are numerous companies that focus on the different segments offered by the FinTech sector, such as WealthTech, InsurTech, RegTech, among others. You can see the segmentation in our 2021 Investment Report.

On the other hand, this increasingly well-known sector presents numbers in terms of number of acquisitions and financing received in considerable growth. On the other hand, as mentioned above, there are more and more companies dedicated to these technological services.

Opportunities in the FinTech sector

The FinTech sector offers many investment opportunities as explained in the Market Research conducted by our expert analysts in the FinTech sector. From the percentage of companies created, describing the financing received and even assessing the number of rounds to be carried out in 2023.

Of the 17,000 companies in the sector, more than 7,000 have been financed, raising a total of 277 billion dollars through 18,000 financing rounds. In the report you can see the distribution of the rounds by the phase in which they are carried out (Seed, Early, Late...).

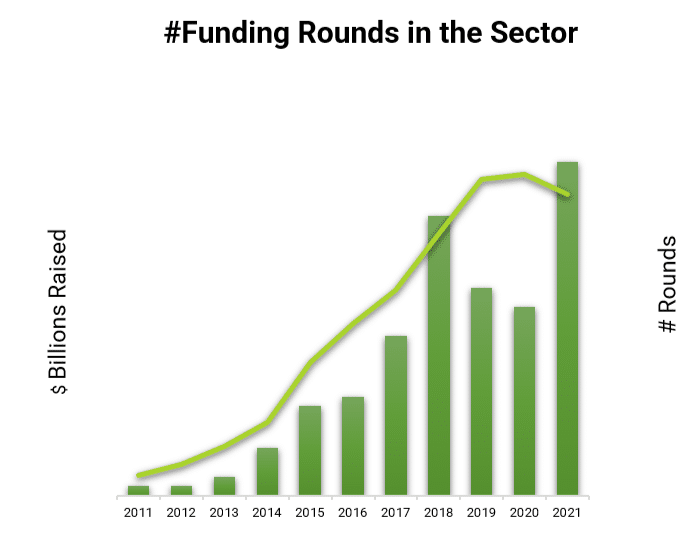

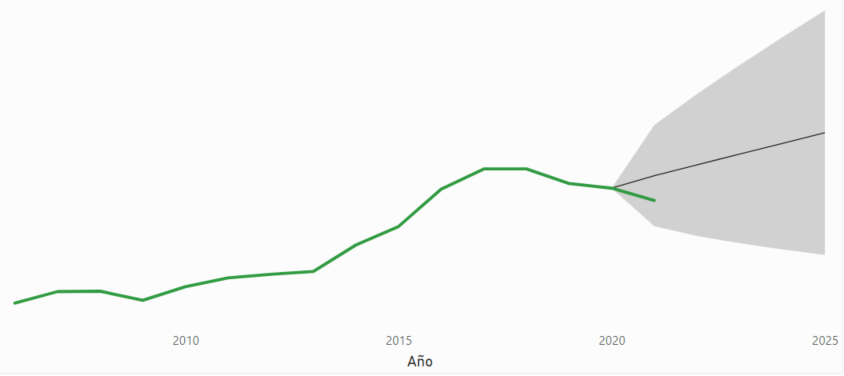

Funding received

The following graph shows the evolution of the funding received and the number of rounds per year. We can see the large amount of money raised in 2021 ($69 billion), being still halfway through the year and having conducted around 150 fewer rounds than in 2020, when 2867 rounds were conducted. In the Report you can see why almost twice as much money was raised in 2021 as in 2020; macro rounds conducted by the sector's leading FinTechs.

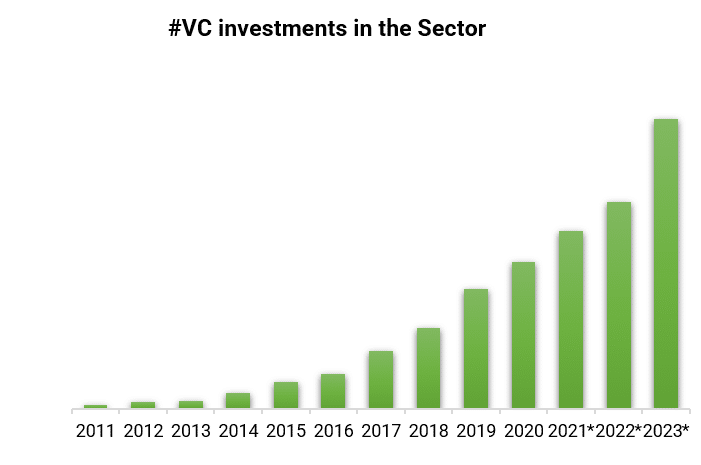

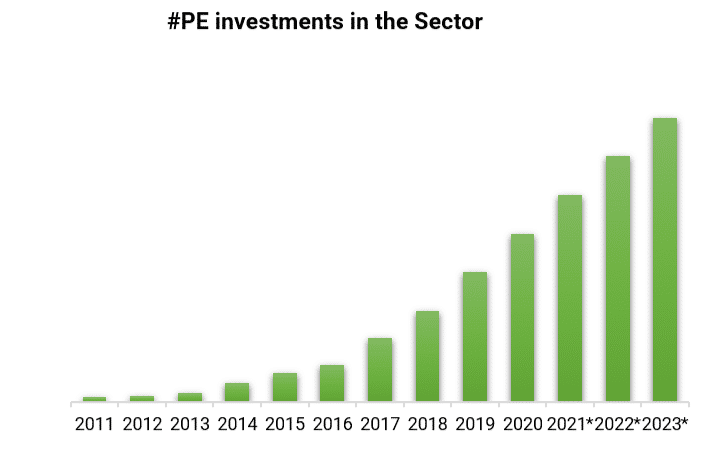

Investments

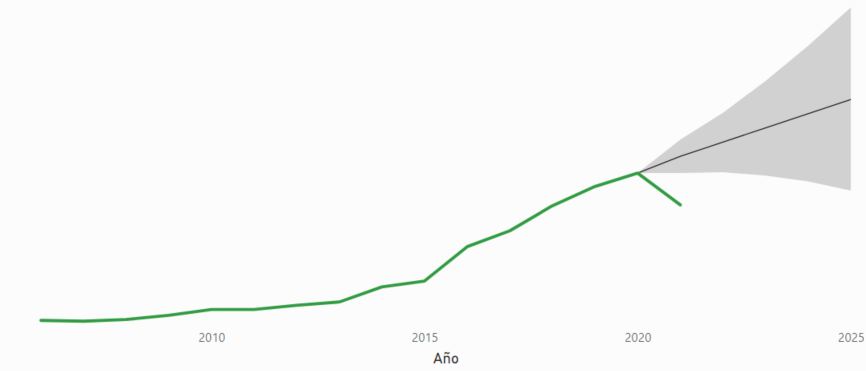

In terms of the number of investments made by VCs, a clear growth can also be seen, with a prediction for 2023 of almost double the number of investments made by Venture Capital in 2020 (with 1,095 companies invested in 2020). The number of companies invested so far is 4,641. It is very interesting to note that 80% of the operations have been carried out in the last 5 years, marking a more than positive trend. In the report you can see which are the most active VCs and the most recent investments in the sector.

In the same way, Private Equity is also investing more in the FinTech sector, with more than twice as many investments by 2023 as in 2019. PEs have invested in 2,981 companies in the sector, with 80% of these investments also made in the last 5 years. In the report you can see who are the most active PEs and the most recent investments in the sector.

Acquisitions

At the same time, the number of acquisitions is also impressive. This report shows the data for the FinTech sector, which is Financial Services in general, and then looks at the acquisition data more specifically for FinTech companies. The projection offered by both graphs are positive, with the Financial Services graph being slightly less steep. Having boomed in 2018 with a total of 1,236 companies in the Financial Services sector acquired, the last two years have seen the number drop although it is expected to rise again. In fact, so far in 2021, there have been more acquisitions than last year, 1,091.

Financial services

On the other hand, in a more focused way, in the FinTech sector, the positive trend can be clearly seen, as in no year have there been fewer acquisitions than in the previous one. So far, the same number of acquisitions have been made in 2021 as in 2019, no less than 166.

In the report you can see the latest operations carried out in terms of acquisitions and the distribution of Europe and the United States and the top companies with the most acquisitions so far.

Are you interested in acquiring companies? You can contact our advisors here in complete confidentiality.

FinTech

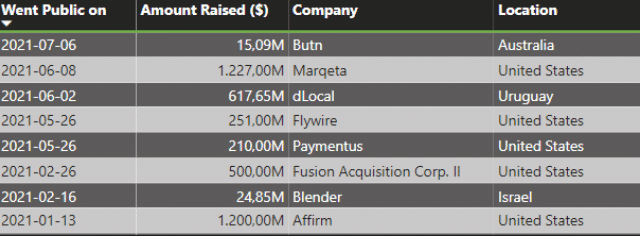

Initial public offerings (IPOs)

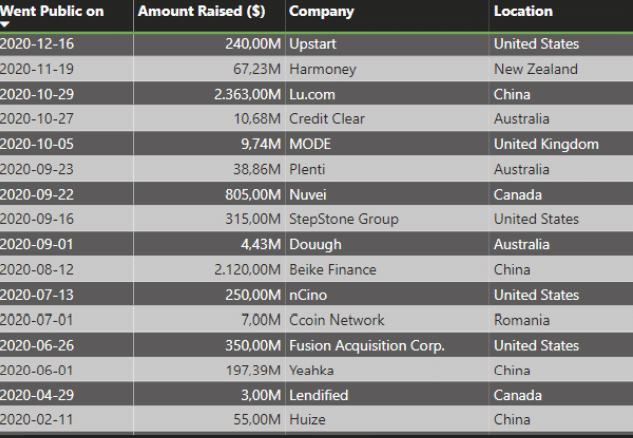

The last sections of the report show the latest IPOs. In 2020, 8 IPOs are shown with a majority of US companies. On the other hand, in 2020, 16 IPOs are shown, the majority of which are Chinese and US companies.

2021

2020

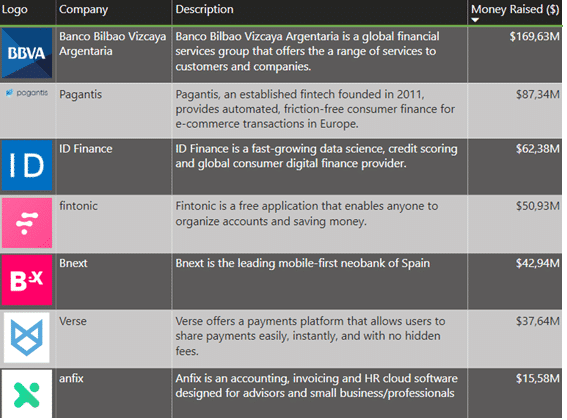

Spain Overview

Finally, a brief overview of the sector in the Spanish market is provided, showing how many FinTech companies exist in Spain, those that have raised funds, the number of rounds raised, the amount of money raised, the number of acquisitions and which companies have gone public also the top according to financing received.