Easy Payment Gateway, a payment and fraud gateway, has just closed an investment round of six million euros. This is the third round closed by the startup, which defines itself as a platform for managing and configuring all means of payment of a company, as well as all fraud tools.

About Easy Payment Gateway

Founded in 2014, Easy Payment Gateway is a payment platform that brings together more than 200 international solutions in a single, simple and easy-to-use interface. According to its founder, Alex Capurro, "it is the ideal option to start selling quickly and easily in new markets, as it integrates the most used payment methods in each market, especially suitable for paying in local currency, with the confidence of local users".

The company, which expects a €1M turnover by the end of 2017, is established in Spain, the UK and Gibraltar and has plans to grow in Israel, Malta and the US.

Easy Payments Gateway has been attracting investor support since the very year of its founding. So far it has completed 4 rounds of investment raising a total of €11M.

In its previous rounds, the company obtained the backing of Ran Tushia, business angel of Wix.com or Avishai Abrahami, founder of the same project, as well as Optimizer Invest, a Swedish fund with an office in Marbella. This latest round, which has just closed, has been led by Alejandro Betancourt and Andreas Mihalovits.

The objective of this new round is to increase the current technical team, to strengthen the commercial team in London and Madrid and to open new offices in Malta and Israel.

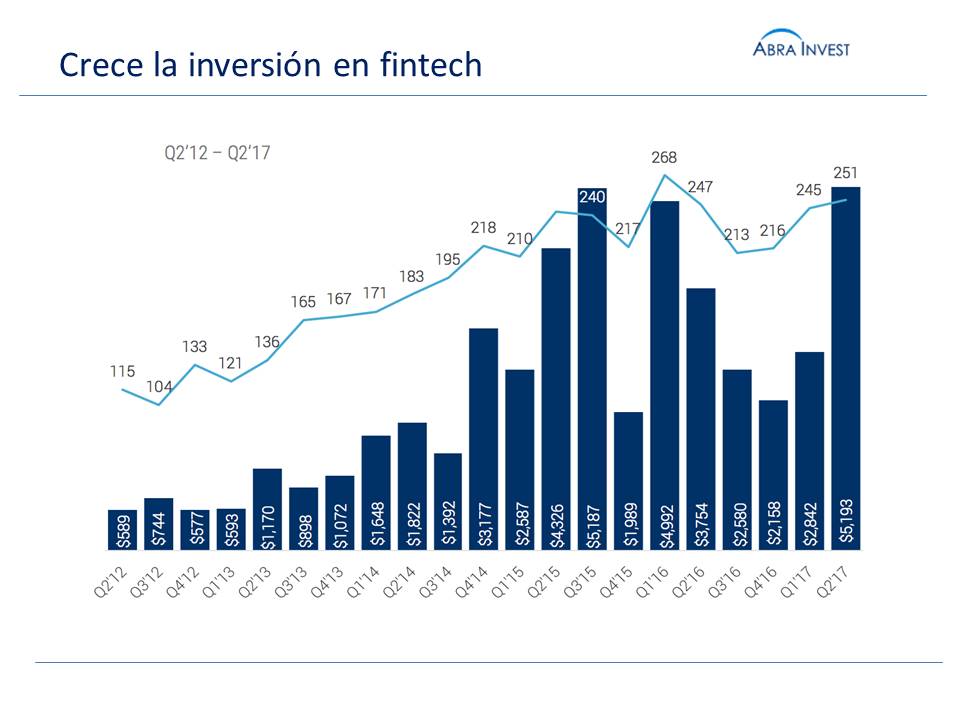

Fintech investment grows in 2017, surpassing the record achieved in 2016

Investment in the fintech sector has grown in the second quarter of 2017, reaching a record 251 deals and a total amount exceeding $5B. If this pace continues, investment in 2017 looks set to be higher than in 2016.

With new investments, 5 new "unicorn" companies have emerged in the second quarter of 2017, with a valuation of more than one billion dollars. These include a company in the same segment as Easy Payment Gateway (Avidxchange), two investment management platforms, Clover and Addepar, a health insurance company (Bright Health) and a company specialising in blockchain (R3).

Other posts that may interest you

Fintonic: The Spanish fintech that has received $25M

Signaturit raises €2.8M in its second investment round

If you are looking for investors, you want to buy or selling a companyplease contact us. Abra-Invest has a team of experts in each area at your disposal. Call +34 946424142 or fill in the contact form.