In December, three companies were listed on the alternative stock market. Pangaea Oncology in the biotechnology sector, Mondo TV in the media sector, and Clever Global, in the ICT sector. We informed you about Clever Global's operation in this post last week.

About Pangaea Oncology

Pangaea Oncology is the latest to make the leap to the alternative stock market, after closing a capital increase 3.8m. Based in Barcelona, this company specialises in oncology diagnostics and treatments. Its activity is divided into three business areas: the personalised medicinewhich it develops through the Rosell Oncology Institute (IOR), wholly owned by Pangaea %, the pharmacology and diagnostic R&D.

Pangea was floated on the Mab on 29 December at a price of 2.7 €/share and ended the day on 2 January at a price of 3.22 €/share, an increase of more than 19%.

Reasons why Pangaea has decided to exit to Mab

-Enable a mechanism that, when the time comes, will enable the Company to raise financial resources, if so decided by its governing bodies.

-Increasing the diversification of Pangaea's funding sources, facilitating access to additional equity to finance investments and growth.

-Having quoted values that are suitable for staff loyalty.

-Having an objective valuation of the company through the trading of the Company's shares in the market. This will provide the Company with a market value for possible and potential future corporate transactions.

-Facilitating the Company's inorganic growth through the acquisition of other companies that may be considered strategic to the business model.

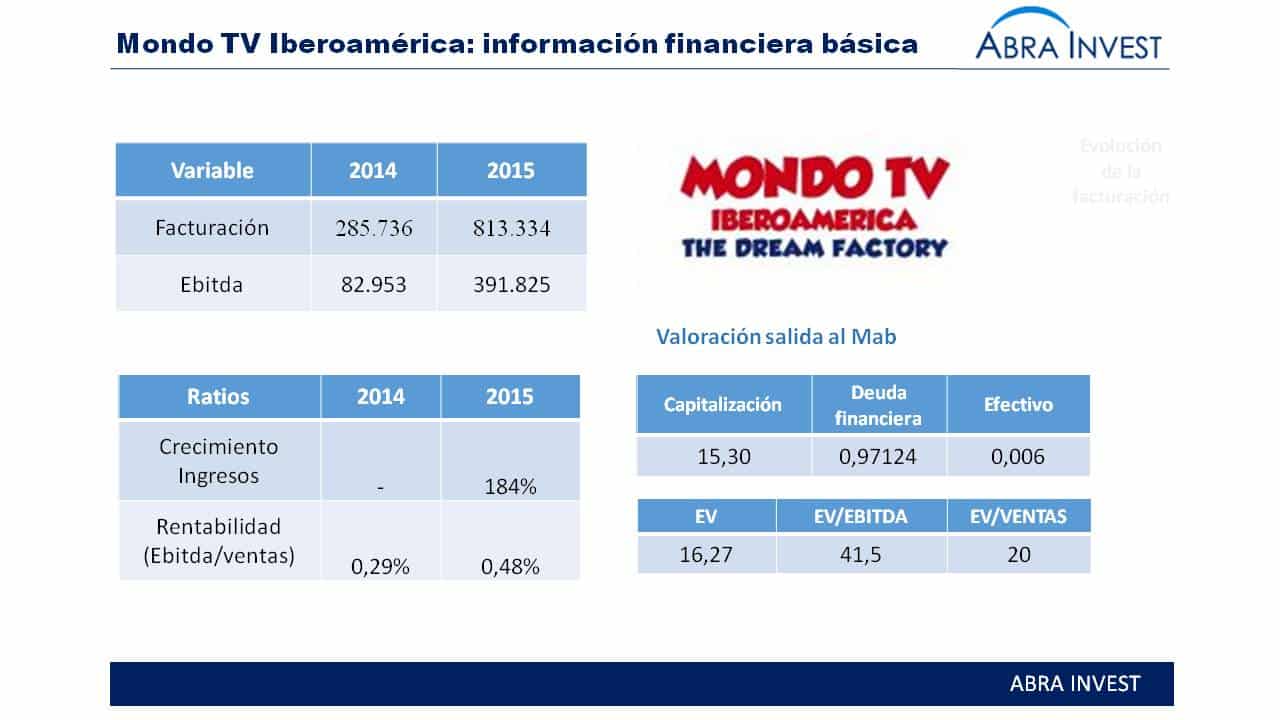

About Mondo TV Iberoamerica

Mondo TV Iberoamerica, based in Madrid, distributes animation content in the Iberian and Latin American markets, and youth fiction series in Europe. A subsidiary of Mondo TV, listed on the Star segment of the Italian Stock Exchange, it is the sector leader in Italy.

The company has not carried out a capital increase during the MAB listing process. The valuation that has been accepted is 1.53 euros per share which means a total capitalisation of € 15.3M as the company has 10 million shares. On 2 December the shares were down to a price of €1.1/share.

MONDO TV ITALIA paid a dividend in kind to its shareholders in the form of 9 MONDO TV IBEROAMÉRICA shares for every 100 MONDO TV ITALIA shares, representing 25.85% of the share capital.

If you are looking for investors, you want to buy or selling a companyplease contact us. Abra-Invest has a team of experts in each area at your disposal. Call +34 946424142 or fill in the contact form.

Clever global exits on Mab and grows 11% on its first day