Main transaction: Springwater enters Aernnova

The Swiss fund Springwater acquired last April the 30% of Aernnova for an amount of round 150m.

"Springwater is betting heavily on Spain, and in just a year and a half it has closed seven transactions, the latest of which was the purchase, together with Gowaiiof four divisions of Pullmantur a Royal Caribbean, entre ellas su aerolínea y es que de momento Springwater está apostando fuerte por el sector turismo y las comunicaciones, pero también tiene interés en el sector de la ingeniería, por lo que puede ser una gran oportunidad para el sector aeronáutico en España» afirma Diego Guiterrez de Abra Invest.

Most active sub-sectors

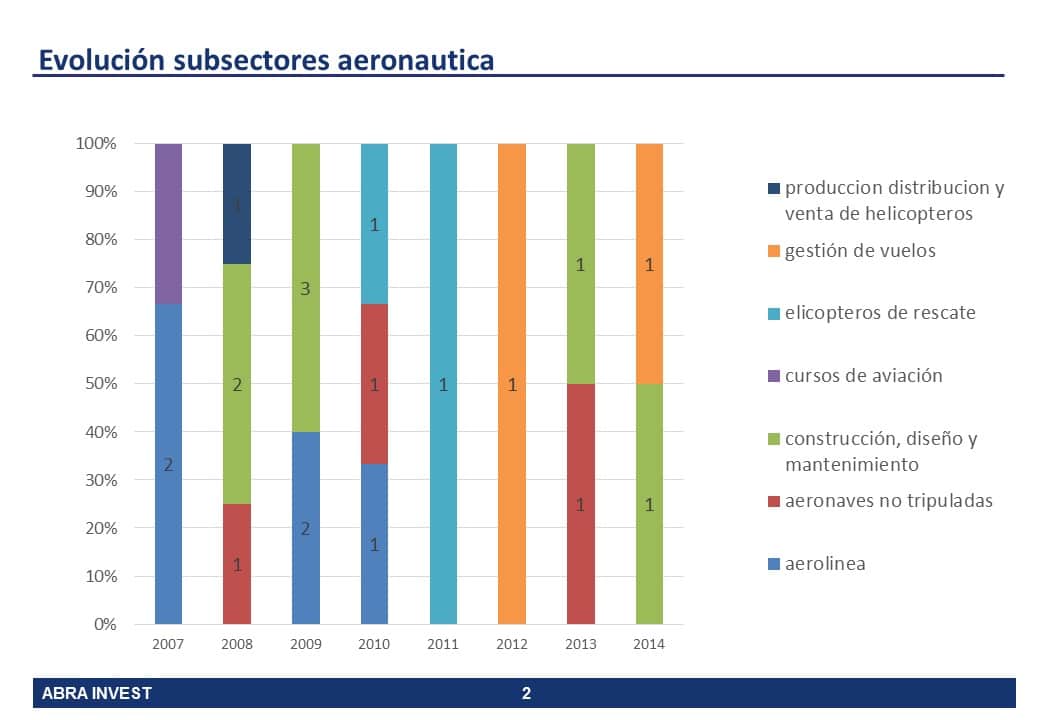

In the years from 2007 to 2009 the most active sectors were airlines and aircraft construction and design, but the crisis has taken a heavy toll on Spanish airlines and many of those companies that had been receiving funding in the period 2007-2009 went bankrupt.

The aircraft design and construction sector has also been affected by the crisis and investors preferred to invest in other sectors, perhaps less affected by the crisis or which have taken advantage of the circumstances of the crisis, such as Voloteaa search engine for cheap online travel which in 2012 received funding from CCMP Capital Advisors . In 2013, however, venture capital returned to aeronautical construction with Soprea's participation in Elimco, an expert in the integrated management of products such as automatic test systems, simulators, on-board wiring, cockpit control units, consoles and highly complex on-board equipment.

Other related studies

List of aviation industry risk capital

We are currently preparing a report on the current state of crowdfunding as an alternative means of financing. If you are interested in receiving this report, leave us your email address and we will send it to you once it has been prepared.