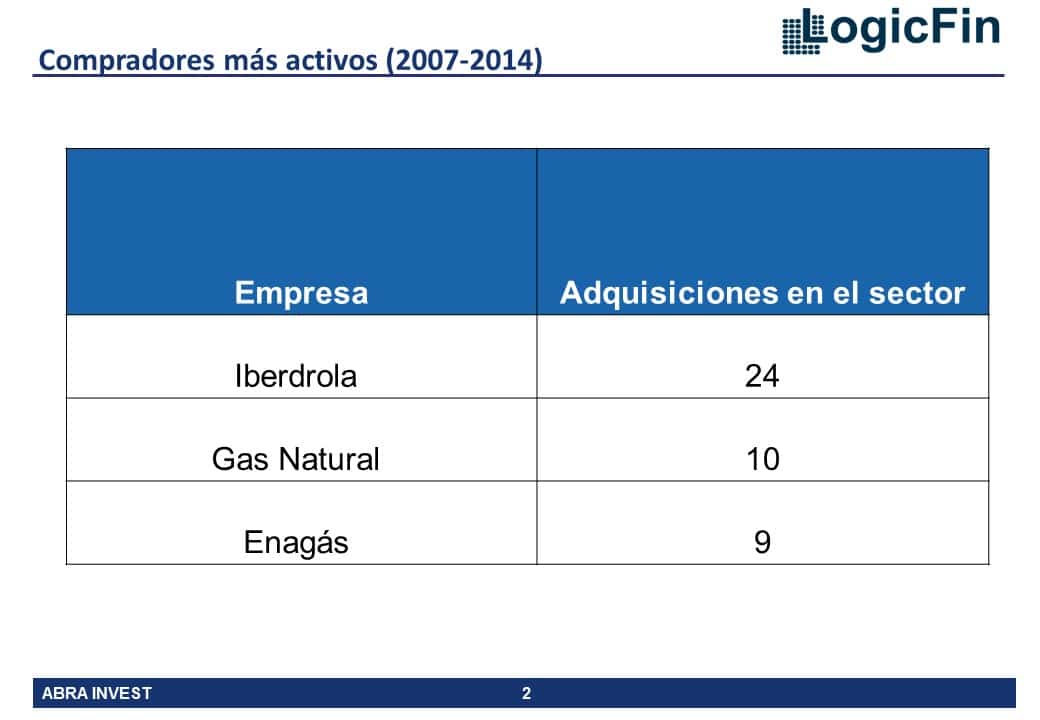

Most active buyers

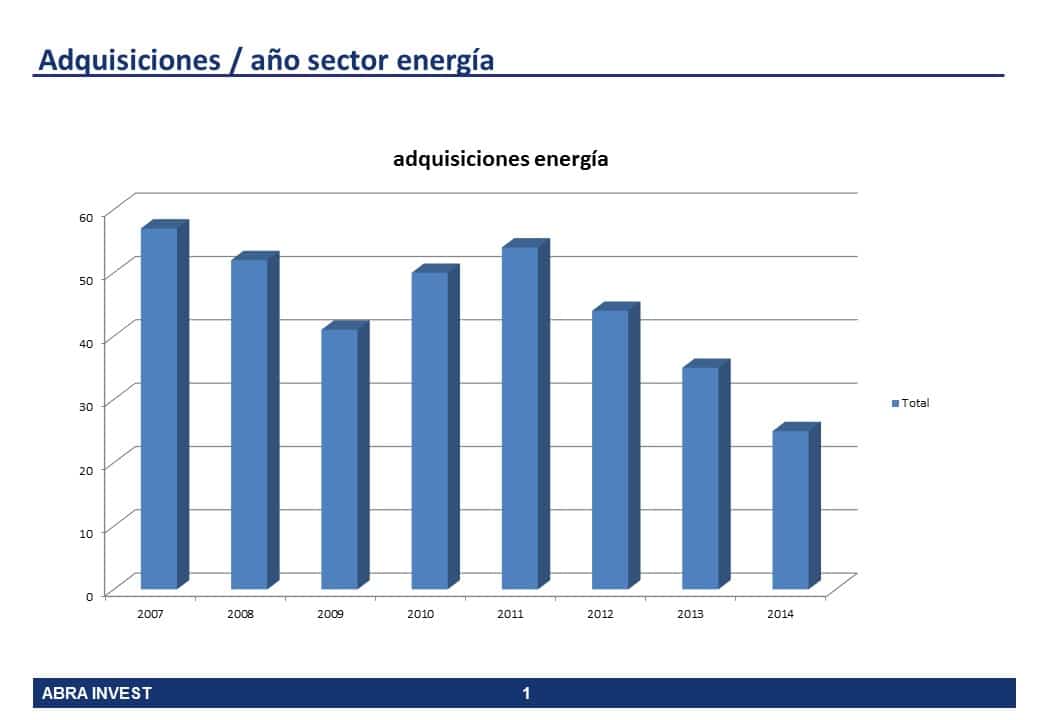

The most active buyer in the sector since 2007 to date has been Iberdrola, which has made 20 mergers and acquisitions in the sector, although the purchases made by this energy giant have been decreasing over the last few years due to the energy reform in Spain, among other reasons.

Iberdrola that had inverted Spain, especially in the renewables sector, has decided to change its policy of mergers and acquisitions.

"Currently, as it has publicly announced, it is analysing purchases in markets with stable regulation such as the North American market financed with sales of assets in Spain or renewables in Europe" analyses Diego Gutierrez from ABRA INVEST.

Natural gas has also been one of the great purchaserss in the sector, its largest operation was the acquires from Unión Fenosa in 2008 to the ACS, Caixanova and Caixa Galicia.

This October Gas Natural has announced the purchase of the Chilean electricity distributor CGE 2.6 billion euros. At the end of 2013, the group had set itself the priority of accelerating its growth in Latin America before 2015, at a time when a reform of the energy sector in Spain, which translates into new taxes on production, is weighing on the results of companies in the sector. With this new purchase, Gas Natural will acquire the first electricity distribution company in Latin America.icity and natural gas in Chile.

Enagas has also decided to invest abroad and in 2014 bought 30% from Coga and 22% from TGP for 348 million euros.

Other posts that may interest you

We take a look at private equity investment in the energy sector

list of energy venture capital investors Spain

We are currently preparing a report on the current state of crowdfunding as an alternative means of financing. If you are interested in receiving this report, leave us your email address and we will send it to you once it has been prepared.