Veeva has recently closed the acquisition of Physicians World, a full service provider in the so-called "Physician's World". speakers bureau.

The terms have not been made public.

In the following lines, we examine and analyse the valuation of the firm and its new financial statements.

MEETING VEEVA

Founded in 2007, Veeva provides cloud-based business services in the life science.

Its products and services enable its customers to adapt to and benefit from the constantly evolving environment in which they operate through cloud-based platforms.

Its solutions unify the processes, documents and data that are essential for the development of its customers' businesses.

They do this through a series of interconnected and unified platforms, which allow companies to simplify their operations from regulatory, quality or marketing issues.

GROUPING INTO CATEGORIES

Its products are grouped into the following categories:

- Quality ManagementQuality management: for the administration of quality processes, process control and risk management.

- Document ControlThe new system: allows for the proper processing and management of the crucial documents that they have to deal with in the sector, as well as the processes of compliance they have to carry out.

- Training ManagementThe new platform: optimises processes and increases process productivity and agility by unifying employee training, content and quality on a single platform.

- Regulatory Managementsoftware that offers solutions to the needs faced by companies in the sector in such important issues as the Compliance. Also the regulatory ones, allowing a better response to changes and demands that may arise in the regulations.

- Claims ManagementCustomer complaints, and the significant consequences that can result from them in this sector, are very important. That is why this solution allows you to manage them better, reducing their risk, speeding up the response and ensuring the quality and reputation of the company.

- Enterprise Content Management (ECM): enables the management, visualisation and analysis of documents and data across different channels, countries and functions. It introduces greater speed, transparency and ease of use to this branch of any business activity.

- Vault PlatformThis platform integrates all the solutions offered by Veeva, and allows them to be customised and optimised to the needs of each client through the use of the cloud.

THE ACQUISITION OF PHYSICIANS WORLD

Physicians World is a leading service provider of the so-called speakers bureau, or speakers' bureau.

It offers all services, from nomination to event organisation, training and logistics, in particular for the pharmaceutical industry in the USA.

Veeva has decided to acquire it in order to be able to offer a comprehensive solution for organising and carrying out events for professionals in the sector, combining its knowledge of technology and management of this type of event.

With a partnership that has been building for four years now, this acquisition was a logical extension of that partnership.

It responds to the demands of its customers who asked for an integration of the two services in order to obtain a better integration between the two.

In addition, of course, it also results in a new valuation of the company.

VEEVA RATING

We now analyse and assess Veeva's economic and financial situation and its future prospects as a leader in the sector. life science.

FINANCIAL ANALYSIS

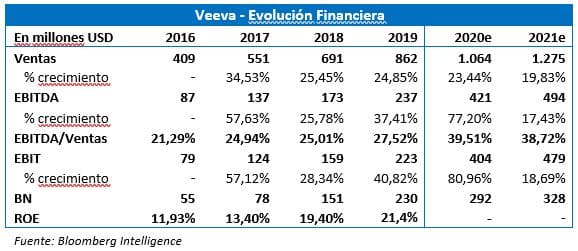

Veeva's sales growth exceeded 20%.

Although new customer acquisition may be reduced in the future, the sale of its products as complements to those already purchased by existing customers should help to maintain this good growth.

Similarly, EBITDA, EBIT and EBITDA/Sales are growing at a very high rate.

This indicates the company's ability to increase its sales without incurring excessive expenses or investments that could weigh it down.

On the other hand, net profit did not show any weakening, but continued to grow in line with other items.

At the same time, it manages to maintain an ROE of around 17%, well above that of its competitors.

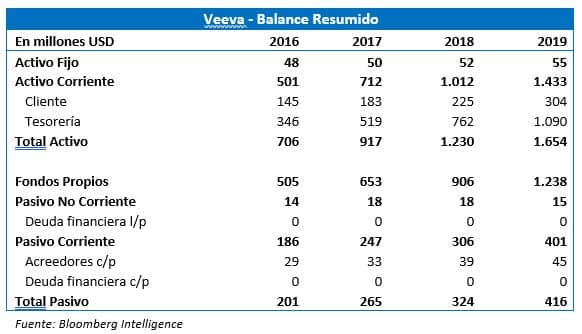

The balance sheet shows a commensurate growth in sales, with a significant increase in cash.

The latter could be used to continue the company's expansion plans and strengthen its position as a leader in the sector.

Debt levels are in line with the company's situation and most of the financing comes from positive funds, which is very positive and reduces risk.

QUOTATION AND MULTIPLES

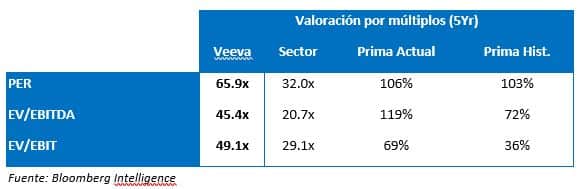

Veeva's multiples are above their comparables, but not far from what has been seen historically.

The large size of these multiples and of the sector in general is striking, which can be explained by the strong growth of the sector, the high margins and the very nature of the sector.

Here, the expected returns on the products developed far exceed those of any other sector.

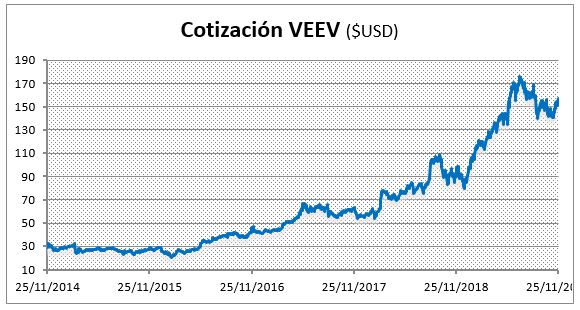

Veeva's share price has shown strong growth since 2014, without experiencing any significant falls.

It seems to reflect the evolution of the company's financial situation in recent years, and the good profitability it has managed to maintain over the years together with strong growth.

If the company's prospects are sustained in the future, and Veeva continues to expand its business into products and solutions that truly add value to what its customers demand, its valuation could increase.

Should this happen, it would even see an increase in its multiples and share price.

If so, it would further distance itself from its comparables.