Microsoft continues to gain a foothold in the cloud business with its latest acquisition. In addition to the efforts that the American company is making to develop this line of business, it is also putting a lot of emphasis on acquiring companies in this sector. This includes the purchase of Movere, a technology provider.

GETTING TO KNOW MICROSOFT

Microsoft is a company founded in 1975 by Bill Gates and Paul Allen. As its name implies (short for Microcomputer Software), does not manufacture computers, but focuses on the development, design, sale, licensing and support of various software products.

Best known for its Windows operating system, Microsoft also offers software for servers, electronic devices, enterprise, internet and intranet. More recently, it has also developed various hardware products such as Xbox video game consoles and Microsoft Surface tablets. However, it is worth noting in this regard the company's breakthrough in the new technologies that have been emerging in recent years: virtual reality, augmented reality, cloud computing and software developers.

It is precisely the cloud business that is gaining more importance in Microsoft's business model and continues to grow at double digits. It is currently considered one of the technology companies best positioned to capitalise and take advantage of the growing demand for cloud products, even ahead of Amazon, according to Anurag Rana and Gili Naftalovich, analysts at Bloomberg Intelligence.

Particularly relevant is the change in culture that has taken place with the arrival of Satya Nadella as CEO, which has led to an increase in the software open-source, increased collaboration with competitors and greater accessibility.

In this line, it has completed its latest acquisition of Movere, a technology provider specialising in cloud migrations with more than ten years of experience. The purchase is particularly relevant for Microsoft as it will make it easier for its customers to evaluate and decide which workloads they want to migrate to the cloud, facilitating this task and creating important synergies with the American company's cloud product, Azure.

MICROSOFT VALUATION

Due to the profound changes that the company has been making in recent years, as well as its recent mergers and acquisitionsIn this respect, it is advisable to analyse the company's financial situation and its future prospects in depth from a corporate finance perspective.

FINANCIAL ANALYSIS

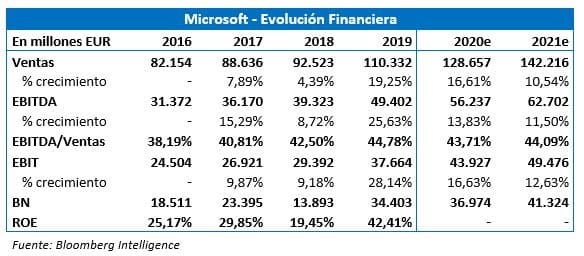

The strong growth in sales is largely driven by Microsoft's cloud business, which, as mentioned above, continues to grow at double-digit rates and now exceeds EUR 40 billion. Moreover, taking into account obsolescence as well as hardware refresh cycles, these sales are also expected to increase in the future.

Gross margin should not deteriorate, and may even continue to grow as in recent years given the company's trend towards cloud products, which offer higher margins. However, recent investments in this segment and the former purchases of LinkedIn and GitHub are likely to slow the pace of growth.

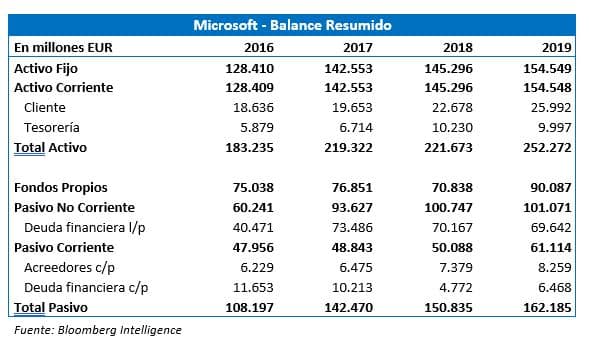

In terms of the balance sheet, all items are growing and varying in line with the company's growth, with no signs of alarm.

MULTIPLES AND QUOTATION

Microsoft's multiples have experienced strong growth over the last five years thanks in large part to increased sales. The strategy adopted to work more closely with competitors and the adoption of software open-source has been appreciated by its customers, resulting in accelerated sales and profit.

Overall, multiples are well above their historical average, highlighting the improvement in the market's valuation of Microsoft.

This increase in multiples is reflected in the share price. The price has almost tripled in the last five years, which together with the strong increase in multiples suggests that Microsoft's share price reflects the strong growth seen in its financial statements and the company's strong future prospects.