Fox Corporation has recently completed the M&A transactions-y-mergers and acquisitions-m-a/">procurement of Credible Labs, a fintech which offers a marketplace online to get loans.

The deal is worth around $265M, and will give the American company control of 67% over the startup.

In the following lines we analyse this operation and assess Fox's current situation.

WHO IS FOX

21st Century Fox is a a US multinational corporation primarily active in the audiovisual sector.

In this way, it produces and licenses news, sports and entertainment content for distribution via cable television, webcasting and other media. streaming, different telecommunications companies and online distributors.

In addition, through its subsidiaries, it also operates studios, theatres and various recording studios.

It came into being in 2013 after the split from News Corporationwhich, after a series of scandals that caused concern among its shareholders, decided to split the company in two: 21st Century Foxmedia-oriented and News Corp. more focused on the publishing sector.

The company's business model is divided into several brands, including:

- 21st Century FoxCable TV: considered one of the world's largest providers of cable TV services, with more than 1.8 billion subscribers and a presence on six continents.

- Blue Sky StudiosThe animation studio, which has released a total of 12 films, including the sagas of Ice Age o It has been nominated for several Oscars.

- National Geographiccable television channel focused on the production and distribution of documentaries related to scientific exploration, history, nature and culture, among others.

- Twentieth Century FoxOne of the world's biggest film producers. He has made great films such as Star Wars, Avatar or most of the films Marvel has brought to the screen.

WALT DISNEY

21st Century Fox made headlines in the mainstream media after it was acquired by Walt DisneyThe agreement became effective at the beginning of 2019.

Known as one of the largest deals in Hollywood history, the transaction was closed at around $71.300M.

The huge impact it generated, and continues to generate, is due to the size of the two companies, whose merger has created an entertainment giant of a size never seen before.

The decision of the acquiresDisney's planned launch of its own VOD platform on the Internet, is aligned with the launch of its own VOD platform by streamingNetflix-style.

PURCHASE OF CREDIBLE LABS

The takeover of Fox by Disney has not prevented the former from continuing its corporate finance activity.

Moreover, it has recently closed the purchase of Credible Labsfor an amount close to $265M.

Credible Lbas is a fintech company that offers a marketplace where you can find loans to finance university studies, the purchase of a house or even credit card debts.

The value added by Credible translates into:

- The simplicity of the process

- Customisation of loan terms

- The constant updating of the available offer.

According to Fox, the purchase is part of the company's ongoing digital strategy to build a closer and more direct relationship with consumers.

FOX VALUATION

Due to the major changes that Fox has undergone in its organisational structure following the takeover by Disney, and in order to analyse and assess this company its current situation, we examine its financial statements, below.

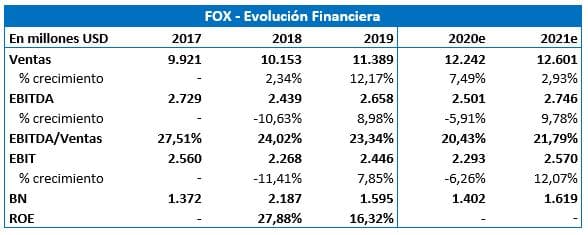

FINANCIAL ANALYSIS

The sale to Disney has left 21st Century Fox with business lines focused on cable television, and more specifically on news and sports.

This new approach, moving away from the more volatile and uncertain lines, should help the company to achieve and maintain stable growth in its sector.

Revenues, EBITDA and EBIT continue to grow at a good pace, and show no signs of weakness in the company's margins.

Net profit will decline due to the loss of Fox's higher-margin business lines, but will recover steadily in the coming years, according to Fox's forecasts. Bloomberg Intelligence.

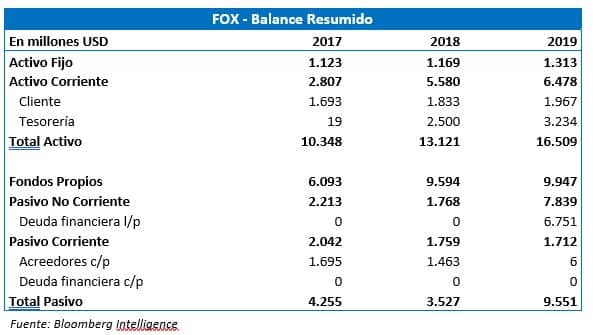

The balance sheet reflects a sound economic situation, with no items presenting particular risks.

The increase in cash, due to the sale to Disney, as well as the increase in financial debt, to be able to undertake the operations it has carried out in the sector, is relevant.

These are, for example, purchases that have exceeded $570M (NextStar and Credible Labs), as well as the share buyback programme it intends to undertake.

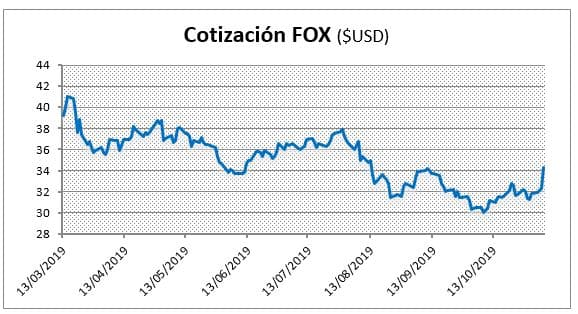

QUOTE

Fox's share price, reflected since the execution of the sale to Disney, has been heavily depressed so far this year, having already lost about 7.5%.

This decline is a consequence of the doubts arising from the transformation that the company must carry out and its transition towards a new business model, focused on audiovisual information, instead of the pure entertainment in which it has been operating in recent years.

We will have to wait and see whether Fox is able to adapt to its new situation and continue to lead the audiovisual industry.