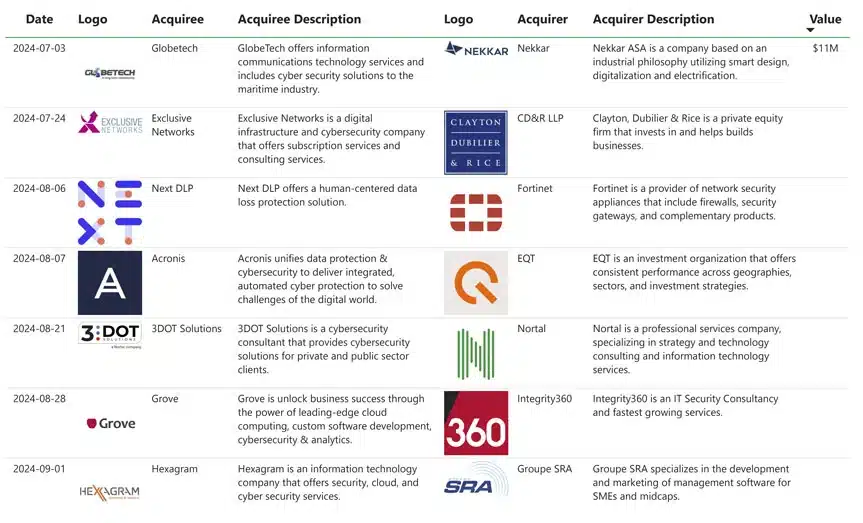

The cybersecurity has witnessed a significant wave of strategic acquisitions in recent months as companies seek to expand their capabilities and address the growing demand for robust digital protection. Five notable deals, including acquisitions by major companies such as Fortinet, EQT and Integrity360, highlight this trend of consolidation and investment in innovative cybersecurity solutions. These deals are reshaping the competitive landscape, with companies looking to integrate new technologies, enhance service offerings and strengthen their market position in an increasingly digital world.

Nekkar strengthens maritime cybersecurity with acquisition of Globetech

In a strategic move to strengthen its digital and electrified maritime solutions, Nekkar ASA acquired Globetech in July 2024 for $11 million. This acquisition reflects Nekkar's commitment to enhance its capabilities in cybersecurity and digital services, aligning with its vision of smart and sustainable innovation.

Nekkar description

Nekkar ASA is known for its industrial approach that integrates smart design, digitalization and electrification. The company operates at the intersection of technology and sustainability, offering solutions across multiple industries, with a growing focus on the maritime sector.

Globetech description

Globetech is a leader in information and communication technology services, offering robust cybersecurity solutions tailored to the maritime sector. Its expertise addresses critical challenges in safeguarding digital infrastructures in maritime operations.

Strategic Justification of the Acquisition

The acquisition enables Nekkar to integrate advanced cybersecurity into its maritime offering, creating a comprehensive digital ecosystem. It also positions Nekkar to meet the growing demand for secure, efficient, and sustainable maritime operations, enhancing its competitive edge in a digitally evolving industry. The acquisition of Globetech underscores Nekkar's strategic focus on innovation and sustainability, paving the way for smarter and safer maritime solutions in an increasingly digital world.

CD&R LLP expands its digital infrastructure footprint with acquisition of Exclusive Networks

In July 2024 Clayton, Dubilier & Rice (CD&R LLP) made an offer to acquire Exclusive Networks, a leader in digital infrastructure and cybersecurity. The move signaled CD&R's intention to strengthen its portfolio in the growing cybersecurity and subscription-based services market. Last November, the UK company obtained the necessary clearance to close the transaction.

About CD&R LLP

CD&R LLP is a prestigious private equity firm with a long-standing history of building successful businesses across various sectors. Its investment strategy focuses on identifying high-growth opportunities and providing operational expertise to maximize long-term value.

About Exclusive Networks

Exclusive Networks specializes in cybersecurity and digital infrastructure solutions, offering a combination of subscription services and consulting expertise. The company's global reach and innovative solutions make it a key player in the rapidly evolving digital security market.

Strategic Reasons for the Acquisition

This acquisition allows CD&R to capitalize on the growing demand for cybersecurity services. Exclusive Networks' expertise aligns with CD&R's investment focus, creating opportunities for operational synergies and market expansion. Positions CD&R to leverage Exclusive Networks' capabilities to serve a broader customer base and drive innovation in cybersecurity solutions.

With the acquisition of Exclusive Networks, CD&R underscores its commitment to fostering growth in critical technology sectors. This move consolidates its position as a key player in the rapidly expanding cybersecurity industry.

You can learn how to create business growth opportunities in this article explaining how mergers and acquisitions can support market expansion strategy.

Fortinet acquires Next DLP to strengthen its cybersecurity solutions

Fortinet, a global leader in network security solutions, announced the acquisition of Next DLP, a company specializing in human-centric data loss prevention (DLP) solutions. This strategic move demonstrates Fortinet's commitment to enhance its cybersecurity portfolio, address evolving risks and strengthen its position in the growing data protection market.

Fortinet description

Fortinet is a renowned provider of advanced network security devices, including firewalls, security gateways, and related products. It serves businesses of all sizes, offering cutting-edge solutions for a secure and efficient digital ecosystem.

Next DLP description

Next DLP focuses on innovative, human-centric data loss prevention solutions that enable organizations to protect sensitive information. Leveraging behavior-based analytics, Next DLP addresses insider threats and ensures compliance with data security regulations.

Explanation of the strategic reasons for the acquisition

The acquisition took place in August 2024 and aligns with Fortinet's strategy to expand its cybersecurity offering. Next DLP's expertise in data loss prevention complements Fortinet's portfolio, enabling the integration of advanced DLP capabilities into its solutions. This acquisition positions Fortinet to address the growing complexity of insider threat and data security challenges.

The acquisition of Next DLP reinforces Fortinet's leadership in cybersecurity, demonstrating its commitment to innovation and comprehensive threat prevention. This move equips Fortinet to offer greater protection to organizations in an increasingly data-driven world.

EQT expands its digital portfolio with strategic acquisition of Acronis

In August 2024 EQT, a global investment powerhouse, launched a proposal to acquire Acronis, a leading provider of unified data protection and cybersecurity solutions. This transaction has would underscore EQT's commitment to advancing digital innovation and strengthening its position in the rapidly evolving cybersecurity and data management sectors.

EQT description

EQT is an international investment organization focused on delivering sustainable growth across geographies and industries. Known for its strategic focus, EQT drives value creation through long-term partnerships and transformational investments.

Acronis Description

Acronis offers integrated cyber protection solutions that combine data backup, cybersecurity and disaster recovery on a unified platform. Aiming to address the complexities of the digital age, Acronis enables businesses to safeguard their data against evolving cyber threats.

Strategic Justification of the Acquisition

The transaction is pending customary regulatory approvals and is expected to close in the first or second quarter of 2025.

If approved, EQT's acquisition of Acronis would align with its objective to invest in technology-driven companies. Acronis' innovative solutions complement EQT's portfolio, enhancing its ability to meet the growing demand for comprehensive cybersecurity and data protection services. The acquisition would also create opportunities to expand Acronis' global reach and accelerate technological advancements. With the acquisition of Acronis, EQT would strengthen its leadership in the digital infrastructure space, driving growth through innovation while addressing critical cybersecurity challenges in an increasingly interconnected world.

Integrity360 acquires Grove to strengthen its cloud and cybersecurity services

Integrity360, a rapidly growing IT security consulting firm, acquired Grove, a leader in cloud computing, software development, cybersecurity and analytics in August 2024. This strategic move enhances Integrity360's offering and aligns with its mission to provide leading-edge IT security solutions to its clients.

About Integrity360

Integrity360 is a renowned IT security consultancy, renowned for its innovative and customized services. As one of the fastest growing companies in the industry, it provides its clients with advanced solutions to safeguard their operations and drive digital resilience.

About Grove

Grove specializes in enabling business success through next-generation cloud computing, custom software development, robust cybersecurity and advanced analytics. Their expertise lies in delivering transformative solutions that enable organizations to thrive in a digital world.

Strategic Reasons for the Acquisition

This acquisition enables Integrity360 to integrate Grove's expertise in cloud computing and bespoke development into its portfolio, enhancing its ability to provide comprehensive cybersecurity and cloud-based services. The combined strengths of both companies position Integrity360 to address evolving customer demands and remain at the forefront of the competitive cybersecurity landscape. With the acquisition of Grove, Integrity360 solidifies its position as a leader in cybersecurity, expanding its capabilities and accelerating its growth trajectory in the era of digital transformation.

Strategic acquisitions in cybersecurity sector drive digital resilience and innovation

The recent surge in acquisitions within the cybersecurity sector underscores the industry's continued evolution. As companies face increasing threats, they are making strategic moves to enhance their portfolios, integrate advanced technologies and better meet customers' cybersecurity needs. This trend will continue as digital transformation and security become critical to organizations' success.

From Baker Tilly's tech-sector M&A advisory team, we provide growth consultancy services to maximize your company's value. Contact our team of mergers and acquisitions specialists to enhance your business's appeal and achieve a successful sale.