Baker Tilly Tech M&Aes una empresa de corporate finance con expertise en el sector tecnológico que se diferencia del resto de firmas por este gran enfoque tecnológico. Contamos con una oferta de M&A especializada en el sector tecnológico con un enfoque europeo y ocupamos recurrentemente puesto en el top10 en el mid y small market tanto a nivel internacional, europeo y español.

Baker Tilly GDA, corporate finance firm, in the top 3 in the technology sector.

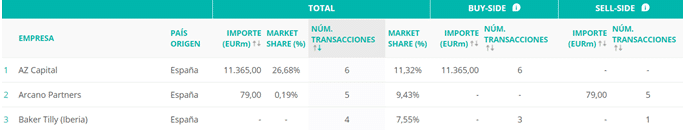

Baker Tilly is currently the third largest mid-market M&A advisor in the technology sector in Spain:

The image, which refers to the ranking obtained from the TTR source, shows the 3 consultancies/consultancies that have closed the most deals in Spain in 2020 in the technology sector.

Specifically, our firm closed during 2020, and despite the complicated moment we are going through due to covid-19, a total of 4 mergers and acquisitions.

Among the deals we have closed in recent years are the following two operations:

Two of our most outstanding deals:

Accel-KKR acquires Endalia

As we already talked about it, in one of our post previousthe most recent transaction, on which the Baker Tilly Corporate Finance team advised, was the acquisition of Endalia by Accel-KKR.

On this occasion, Baker Tilly has advised the acquiring party in what has been its first investment in Spain in a sector we are already familiar with: human capital management and payroll software.

Given the fragmentation of the human capital management and payroll landscape in Spain, Accel-KKR, is looking for targets of M&A transactions and mergers and acquisitions complementary and consolidation mainly in Spain.Possible fits include consolidation in the human capital management space, payroll oriented software and services, and learning management software for employee training.

Provindence joins Imaweb

In 2019 it was agreed to sell Imaweba software company focused on the automotive dealership market, to Providence, the world's largest industry-focused private equity firm, with approximately $ 40 billion AUM (assets under management) and a primary focus on education, communications, media and information technology.

In the transaction Baker Tilly advised the selling party's shareholders.

The two successful deals mentioned in this post, as well as our track record, are a reflection of the great expertise that Baker Tilly Corporate Finance has in the technology sector. Our current position is another step towards achieving our mission: to become the European leader in the mid-market.