Software Infrastructures Sector, 2023: Industry Valuation Report, Market Trends and Key Companies

The Infra Software Industry Valuation Report 2023, prepared by experts in advising on the sale and purchase of technology companies, provides a detailed and comprehensive analysis of the sector. This study takes an in-depth look at 91 leading infra software companies, providing a rigorous analysis of financial statements, market characteristics and valuation multiples.

In an ever-evolving digital environment, understanding the market valuation and financial health of infra software companies becomes crucial. This report not only acts as a guide for investors, business leaders and industry experts, but also provides an in-depth analysis of the financial and valuation factors affecting the dynamics of the infra software market.

Market Dynamics and Strategic Vision on Software Valuation Infra 2023

The Infra Software industry underwent a significant transformation in 2023, which was driven by a number of trends that shape its dynamics and require a strategic vision for business success. These emerging forces are a reflection of evolving technology and changing consumer preferences, presenting challenges and opportunities for software companies.

Key trends in Software Infra:

- Rise of cloud infrastructure: The adoption of cloud solutions continues to increase, consolidating itself as a dominant model in the infra software market. IaaS (Infrastructure as a Service) and PaaS (Platform as a Service) platforms are at the heart of this trend, providing unprecedented flexibility and cost optimisation. La adopción de soluciones en la nube sigue en aumento, consolidándose como un modelo dominante en el mercado de software infra. Las plataformas de IaaS (Infrastructure as a Service) y PaaS (Platform as a Service) están en el centro de esta tendencia, proporcionando flexibilidad sin precedentes y optimización de costes.

- Automation and Orchestration: Artificial intelligence and automation are revolutionising infrastructure management, enabling more efficient and less error-prone processes. The ability to deliver automated solutions becomes essential to improve operational efficiency.

- Data Management and Analytics in Infrastructure: The growing importance of Big Data has driven the demand for advanced tools for data management and analytics in infrastructure. Real-time analytics solutions are becoming indispensable.

- Cybersecurity and Infrastructure Protection: Growing security concerns are driving demand for specialised infrastructure cybersecurity software. Data protection and risk management have become key priorities for infrastructure software companies.

- Integration of Emerging Technologies: The incorporation of technologies such as blockchain and IoT is opening up new possibilities for infra software development, shaping the future of infra software with innovative applications and disruptive solutions.

Analysis of Software Sector Financial Statements Infra

The report conducts a detailed analysis of the financial statements of infra software companies, covering aspects such as revenues, cash flows and leverage. This analysis provides valuable insights into the financial stability and profitability of companies in the infra software sector.

Valuation Analysis by Market Multiples in the Infra Software Sector

The Report provides a comprehensive assessment of market multiples for listed companies in the sector, helping investors and business leaders to better understand market dynamics and make informed decisions.

Various key multiples have been evaluated, including:

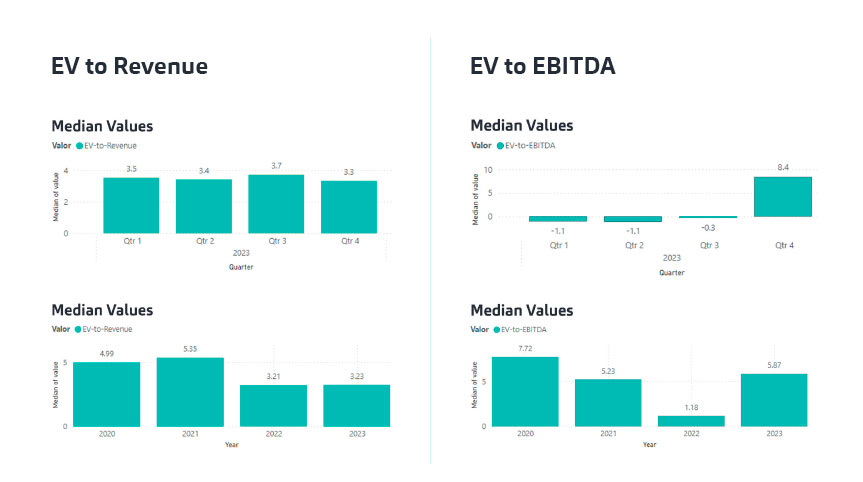

- Enterprise Value/Income Ratio (EV/Income): It compares the total value of the company (including debt and market value) with its total income. It is essential for assessing the valuation of a company in terms of its ability to generate revenue.

- Enterprise Value/EBITDA Ratio (EV/EBITDA): It compares the total value of the company with its EBITDA (earnings before interest, taxes, depreciation and amortisation). It is used to assess the operating profitability of a company.

- Enterprise Value/EBIT Ratio (EV/EBIT): It compares the total value of the company with its EBIT (earnings before interest and taxes). It provides a similar measure to EV/EBITDA, but takes into account depreciation and amortisation.

These multiples are of particular importance when valuing companies in the infra software sector.

Leaders in the Infra 2023 Software Market

The report identifies outstanding companies recognised for their high valuation in terms of financial multiples. These companies are distinguished by their continuous innovation, strong growth track record and exceptional ability to generate value for their shareholders. One such example is Oracle.

The analysis of these companies highlights their ability to achieve higher financial multiples compared to the sector average, highlighting their significant position and impact on the infra software market.

Valuation report

Infra 2023 Software Sector Valuation Report

Download the full report here and stay informed about the financial status and latest news of the most important companies in the market.