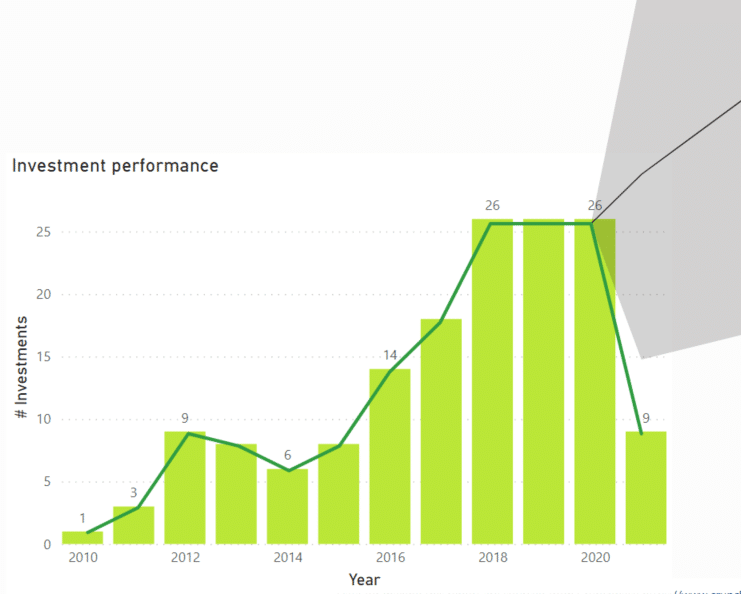

Evolution and projection of the sector

Private Equity has made a total of 189 investments in pure Industrial Manufacturing companies. As far as 2021 and future years are concerned, the evolution is more than positive as shown in the graph. The year 2021 is incomplete because we are practically in the middle of the year. However, in the forecast it can be seen that the trend is to start growing.

S-UBG, 3 investments in Industrial Manufacturing

In terms of Private Equity with the most investments, we would highlight S-UBG Groupa German group that offers investment to companies with high growth potential. They invest in successful medium-sized companies with their own capital, which makes long-term investments possible.

S-UBG Group has a very diverse portfolio, ranging from mechanical engineering or medical technology companies to service providers. In the manufacturing sector, the German firm has invested in three companies. Two of them are very recent as they were realised in October 2020. The other was realised in November 2007.

S-UBG acquisitions in 2020

The companies financed last year belong to a group of companies specialised in the production, processing and finishing of glass. They are ClimaPlusSecurita German group with almost 30 companies specialised in glass. The companies of this group invested by the most active Private Eqiuty in the sector, S-UBG, were Thermoglas Niederrhein and Glas Trienes, both companies based in western Germany. Thermoglas Niederrhein specialises in insulating glass and Glas Trienes in safety glass.

Acquisitions in 2007

The S-UBG Group's third investment in the sector was in RATTAY, a leading German supplier of metal hoses and expansion joints for a wide range of industries.

Forecast

Despite the fact that this German private equity firm only invests in Germany, it has a very positive future projection, since, in addition to Germany being the country with the second largest industrial manufacturing business, the industry is undergoing a shift towards digitalisation as mentioned in the Investment analysis carried out by Baker Tilly's specialists in the sector (click here to see it). This means that for the near future many industrial companies will be created or modified into companies with great projection, prototype companies for S-UBG to invest in. Therefore, this German firm has a possible strategy to follow by focusing on industrial companies that help the digitalisation of the sector.