What is the "EdTech" sector?

Educational Technology (EdTech sector) is a very broad concept that refers to the process of design, analysis, development, implementation and evaluation of learning in all its forms with the aim of improving the educational process by making it more engaging, inclusive and individualized. In other words, it could be defined as the use of technological resources, processes and systems to improve or manage the learning process.

Here are several examples of tools that complement and improve teaching: virtual reality, personalized education, open online courses, flipped classroom, b-learning (blended learning) and artificial intelligence.

There are various types of EdTech companies, from those dedicated to online training, such as Coursera, to those that offer certain tools for the virtual classroom (Blackboard) or face-to-face (XSEED).

The term EdTech has had a great impact on society, especially in the last year as, due to Covid-19, it has been highlighted and gained relevance within the education sector in general. It was to be expected that technology education would see a rise in these next few years, but not this soon. The global pandemic has accelerated the process by which people have been compelled to continue their learning through online education platforms. In turn, it has been seen globally that online learning is possible, which is why the EdTech sector has experienced such growth in the last year, as this study demonstrates.

Scope and coverage of the EdTech sector study

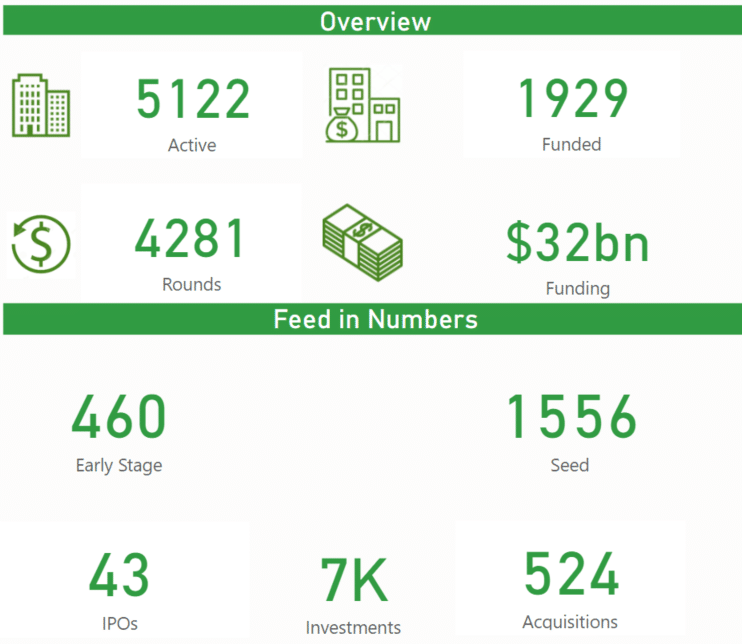

This sector analysis covers 5325 companies worldwide tagged within the category "EdTech".

All data on companies, acquisitions and founding rounds were extracted on March 15, 2021. Deals, rounds and companies founded after this date have not been included.

Principal investment trends

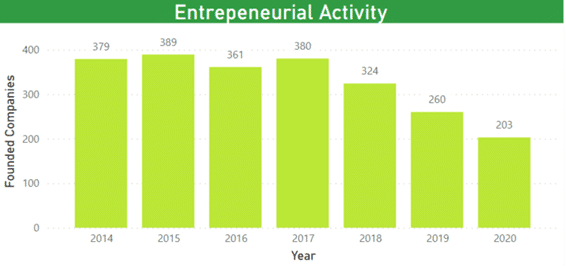

The number of companies created in the last seven years, as shown in the graph below, has been progressively decreasing. It should be noted that this decline in the creation of companies in the sector does not mean that it is not growing, since, as we will see later and as this study identifies, there are several factors that ensure the growth of the sector. Being 2020 an atypical year due to COVID-19, it is logical that not as many companies have been created as in previous years, although it is true that 2019 had already suffered a significant decline.

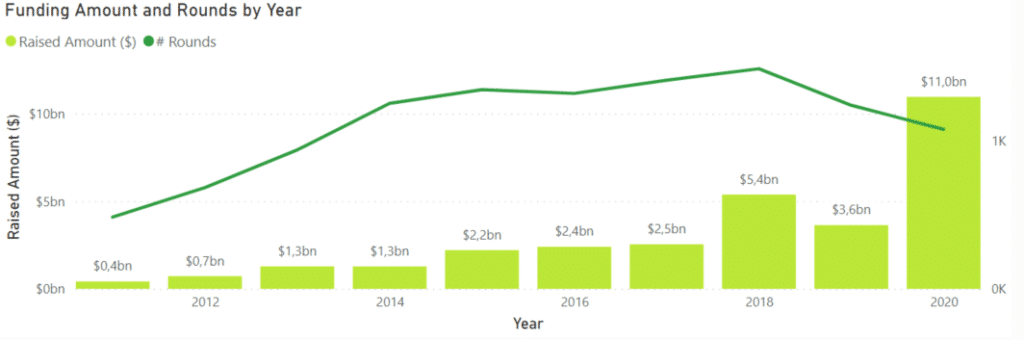

In this case, as mentioned in the previous point, we see a clear growth in terms of the amount of funds raised in the financing rounds carried out per year. As we have been saying, 2020 has been a singular year since, as can be perfectly observed in the graph below, despite having carried out fewer rounds (evolution of the dark green line), it has been raised almost three times more than the previous year, going from $3.6 billion in 2019 to $11 billion in 2020. This past year has seen giant rounds by industry leaders, as explained and detailed in the study.

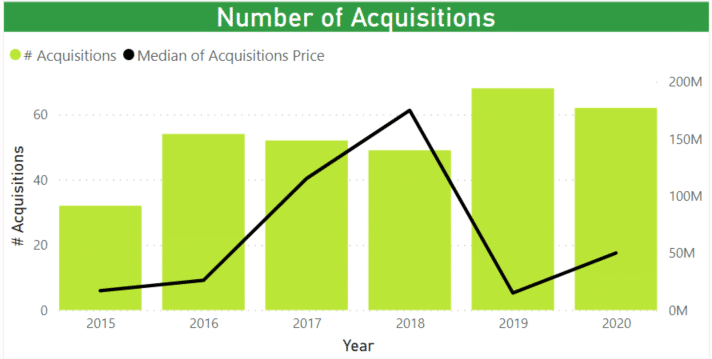

On the other hand, with regard to the evolution of acquisitions, it presents a rather stagnant growth, represented through the columns and, being the median of the price of acquisitions of each year, the black line. It is worth highlighting the year 2019, which has seen the highest activity in terms of acquisitions, coming to present almost 70 movements in the sector, with the acquired company belonging to the EdTech sector.

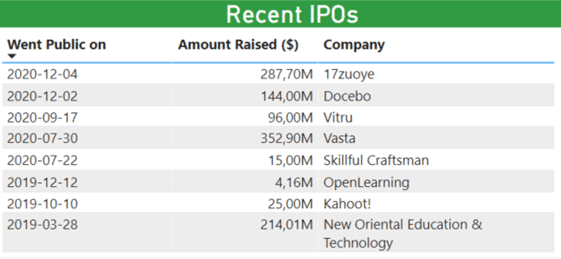

Finally, this table shows the latest IPOs carried out to the present. Of the 8 that appear, three are Chinese companies (17zuoye, Skillful Craftsman and New Oriental Education & Technology), which makes it clear that China has a strong presence in this sector.