What is the "PaaS" sector?

Platform as a Service (PaaS) is a cloud service. Previously, if a customer wanted to develop or host an application, they had to have an infrastructure and a physical database (often disproportionately large), but with PaaS, the company can now ask a cloud service provider for the hardware and software tools needed to develop this product and, in turn, provide you with the space to host the app.

PaaS was first pioneered by Fontago, a British company, which developed a product called Zimki that consisted of a code execution platform that allowed users to build and deploy web applications and services. This is a PaaS service.

The difference between the other similar sectors, such as SaaS and IaaS, lies in the degree of control and access between them, with IaaS having much greater control and access than SaaS, for example, and PaaS being in between.

Scope and coverage of the study

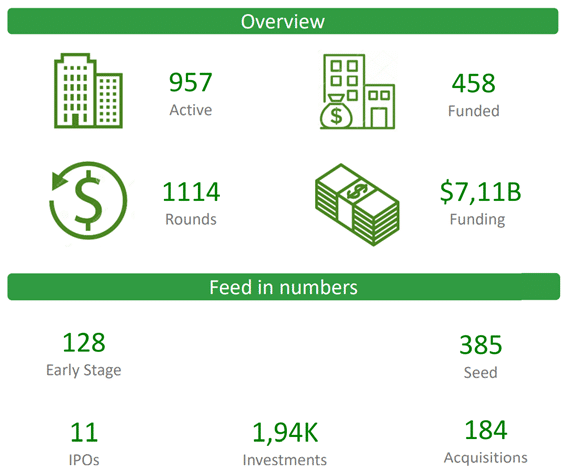

This study covers 991 companies worldwide labelled within the "PaaS" category.

All data on companies, acquisitions and financing rounds were extracted on 23 March 2021. Deals, rounds and companies founded after this date have not been included.

Principal investment trends

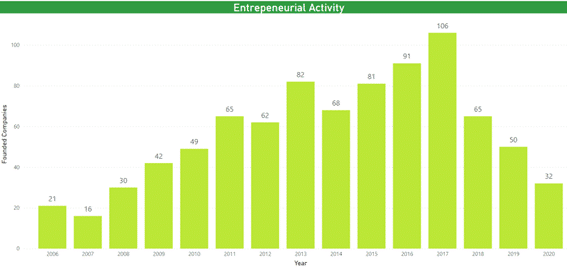

If we analyse the progression that exists in the sector in terms of companies founded in recent years, we can observe that there has been a constant growth for 10 years (2007 to 2017), reaching a maximum of 106 companies created in the last year. As we can see, the values are larger than those of its "sister" IaaS sector, indicating that PaaS is a larger sector than IaaS. Like the IaaS and SaaS sectors, in the last three years, the PaaS sector has also experienced a considerable drop in the number of companies founded, with a total of only 32 start-ups in 2020.

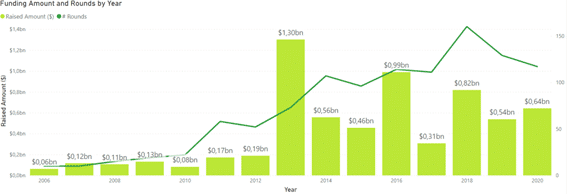

On the other hand, if we analyse the rounds of financing carried out and the fundraising of each one in recent years, we can observe a somewhat more irregular evolution than the aforementioned. It is worth highlighting the year 2013, in which there was a disproportionate growth and in which over 1.3 billion dollars were raised in that year's own rounds. This is due to the fact that large companies in the sector, such as Pivotal, carried out rounds that raised around one billion dollars. In turn, it is normal that the following years have seen half of the funding of that atypical year 2013, although it is true that in 2016 there was a big increase in terms of the amount raised, reaching almost a billion dollars.

Finally, the evolution of the last three years shows a slight drop in the number of rounds raised, despite the fact that by 2023 the number of rounds is expected to grow by 20%. The same is true for the total money raised, which is expected to reach around $900 million by 2023.

Analysis of the acquisition activity

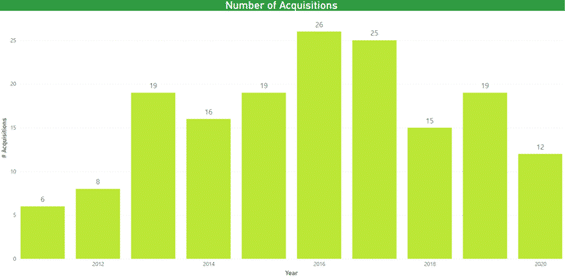

Regarding the evolution of the number of acquisitions made in the PaaS sector, with the acquiring company belonging to the sector, we observe something similar to what happens in the graph of the companies founded and the funding made. In 2013 there was a somewhat atypical peak and in 2016-2017 the same thing happened again, reaching a peak of 26 acquisitions in 2016.

Finally, in terms of stock market activity in the sector, there are very few companies (according to Crunchbase) that have gone public. Exactly 10 companies have been listed on the stock market in the last 15 years. The last two are Agora.io, a US company that allows developers to add high-definition interactive broadcasting, voice and video to mobile and web applications through a software development kit, and AUCloud, an Australian company that provides PaaS and IaaS services to Australian-only companies.

[services_shortcode]