Last year Civen was one of the largest private equity deals in Spain: it bought Hotelbeds for €1165M. Now, 6 months later, Civen has managed to double the size of Hotelbeds by buying two companies: Tourico, which operates in the American market and GTA, which operates in the Asian market.

Top Doctors receives another €3M round, led by a Russian investor.

The round aims to consolidate Top Doctors in the markets in which it operates: Spain, Italy, UK, Chile, Mexico, Colombia and the US, as well as the possibility of opening up markets in Germany and France. The company currently has 120 employees. Forecasts indicate that, when it completes its expansion plan in 2018, the workforce will rise to 160 people.

Insight Venture Capital has just bought data recovery company Spanning Cloud, what other deals have been done in this niche market?

At the beginning of the year we announced that Logtrust, a Spanish company received $11M to continue growing globally. Among the services this company offered were data recovery. Now Spanning has been bought by Insight Venture.

Adea, a document management company, buys SDM

Adea ingeniería documental compra SDM, con el objetivo de adquirir una base tecnológica, que le sitúe en la vanguardia de la gestión documental digital. Experta en la automatización de cualquier procedimiento documental, SDM ofrece avanzadas herramientas de...

Arab company Alfanar buys Spanish smart grid provider ZIV

Avantha group, which bought the Basque company in 2012, is selling the ZIV group in order to reduce debt, strengthen its balance sheet and build a financially stronger company.

Merkle, a leading US data consultancy, buys Spanish company Divisadero

Performance marketing and data usage agency Merkle has acquired Spanish data and analytics consultancy DIVISADERO in order to expand its operations and data offering in Europe.

Dexma, which uses big data for energy efficiency, receives €1M

The company has received a round led by Inveready, with the aim of consolidating its growth in the European market, focusing on countries such as the UK, Italy, France, Belgium and the Scandinavian market. In parallel to its expansion in Europe, the resources will also support the launch of a new energy consumption analysis tool called Energy Grader.

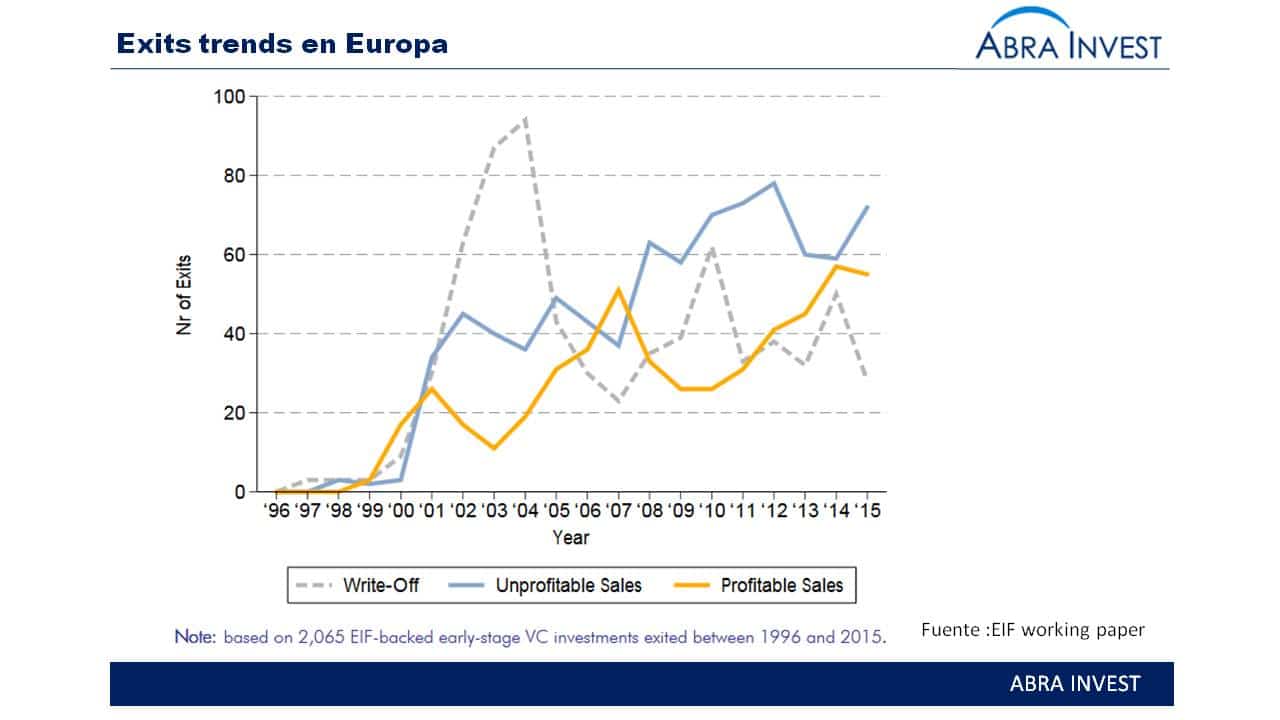

Perspective on the European venture capital scene by the european investment fund

As can be seen in EIF's report on European venture capital divestments, European venture capital investment has grown considerably over the past 10 years. From 2010 onwards, these investors began to make exits, encouraged by the recovery of the technology industry, evidenced by increases in Nasqad and venture capital valuations, while interest rates were low.

New funds March: Trea ,Telegraph capital and Nexxus Iberia

In March, new funds have come to light with different purposes: internationalisation towards Latin America, promotion of new technologies and direct lending. This shows that venture capital activity in Spain continues its positive trend.

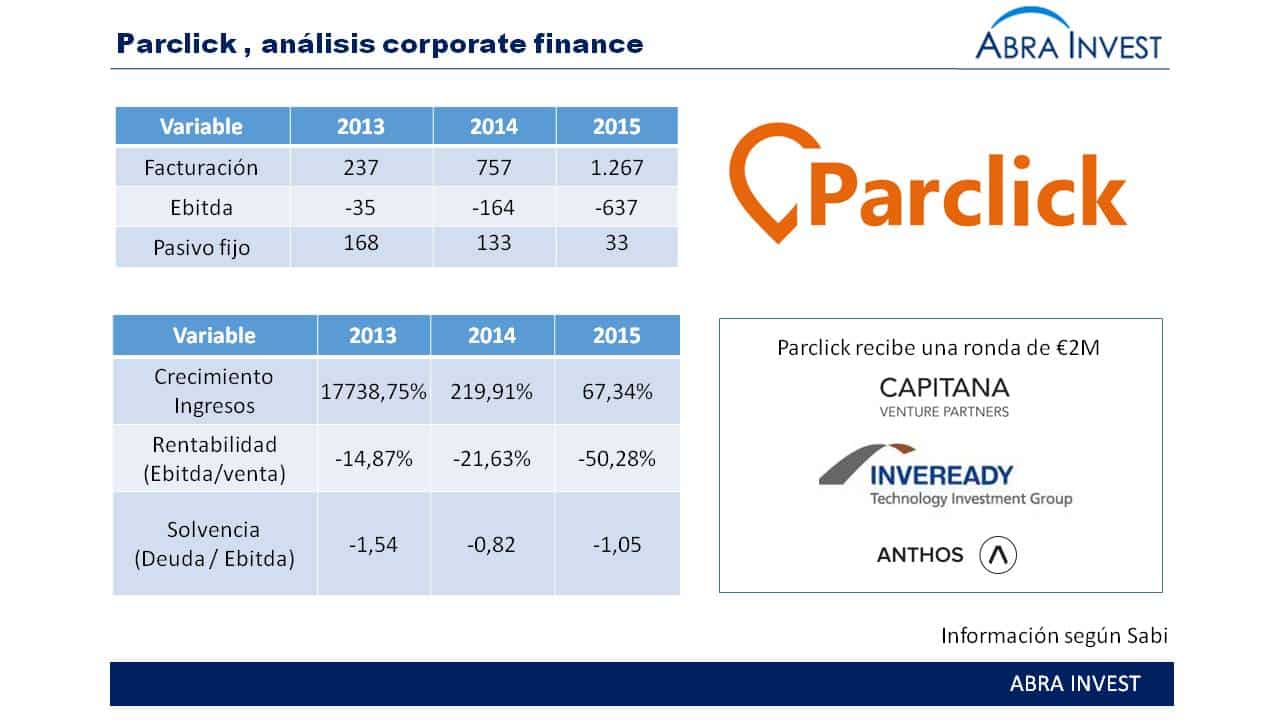

Parclick, a Spanish parking reservation company, closes €2M round

Parclick, the Spanish online parking booking app, closes a €2M round to strengthen its presence in the 170 cities where it is present in France, Italy, Portugal and Spain, and to open up to new markets, with a special focus on Central European countries.

Software AG expands its commitment to IoT with purchase of Cumulocity

Karl-Heinz Streibich, CEO of Software AG, said: "With the acquisition of Cumulocity, we are strengthening our market leadership and facilitating our customers' access to IoT by bringing them the benefits of an expanded, holistic product portfolio that combines physical sensor data with innovative analytical software solutions.

Artá Capital buys the 60% from Satlink, a Spanish satellite telecommunications company for the maritime sector.

With the entry of Artá Capital, Satlink, which is pursuing a policy of international growth, will enhance its growth process and take advantage of existing opportunities for expansion into new markets and products.