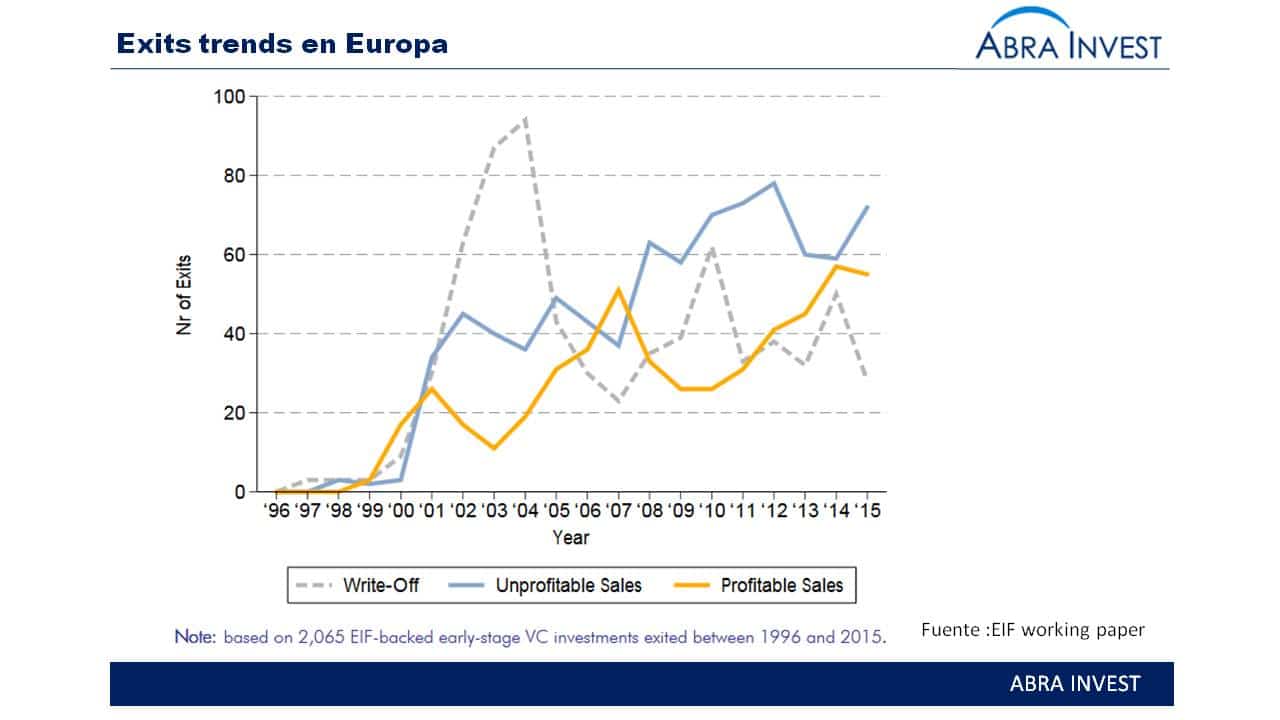

As can be seen in EIF's report on European venture capital divestments, European venture capital investment has grown considerably over the past 10 years. From 2010 onwards, these investors began to make exits, encouraged by the recovery of the technology industry, evidenced by increases in Nasqad and venture capital valuations, while interest rates were low.