Typeform, the Spanish leader in web forms, raises more than €29M in a round led by General Atlantic. The company has tripled its turnover in the last year and has been included in the list of the 100 'hottest' startups in Europe by Wired magazine.

Blinkfire, social media campaign analytics startup, closes €1.34M round

Blinkfire, a startup founded in 2013 to measure the impact of advertising in sports, has received its second round of investment of €1.34 million.

Equinix buys Spanish data centre Itconic for €215M

The Carlyle Group has sold Itconic, the largest provider of neutral data centre, connectivity and cloud infrastructure solutions in Spain and Portugal. The buyer was Equinix, Inc. a Nasdaq-listed company specialising in interconnection and data centre services. The purchase price amounted to €215M. The agreement was signed on 8 September 2017, and the acquisition is expected to be completed in the fourth quarter of 2017, subject to regulatory approvals.

Alantra launches new fund to invest in Spanish companies and a new debt fund

Alantra is finalising the launch of its new investment fund focused on taking minority positions in small and medium-sized listed companies in the Iberian market. This vehicle, the third of its kind to be launched by the firm, will have a size of between...

Seedtag, Spanish startup of In-Image Advertising, closes €1.5M round

The company, created in 2014, has multiplied its turnover by 10 in just one year. The company's challenge will be to consolidate its position in Spain, replicate the success achieved in Italy, France and Mexico and continue investing in the development of a technology that allows, among other things, the programmatic buying of In-Image Advertising.

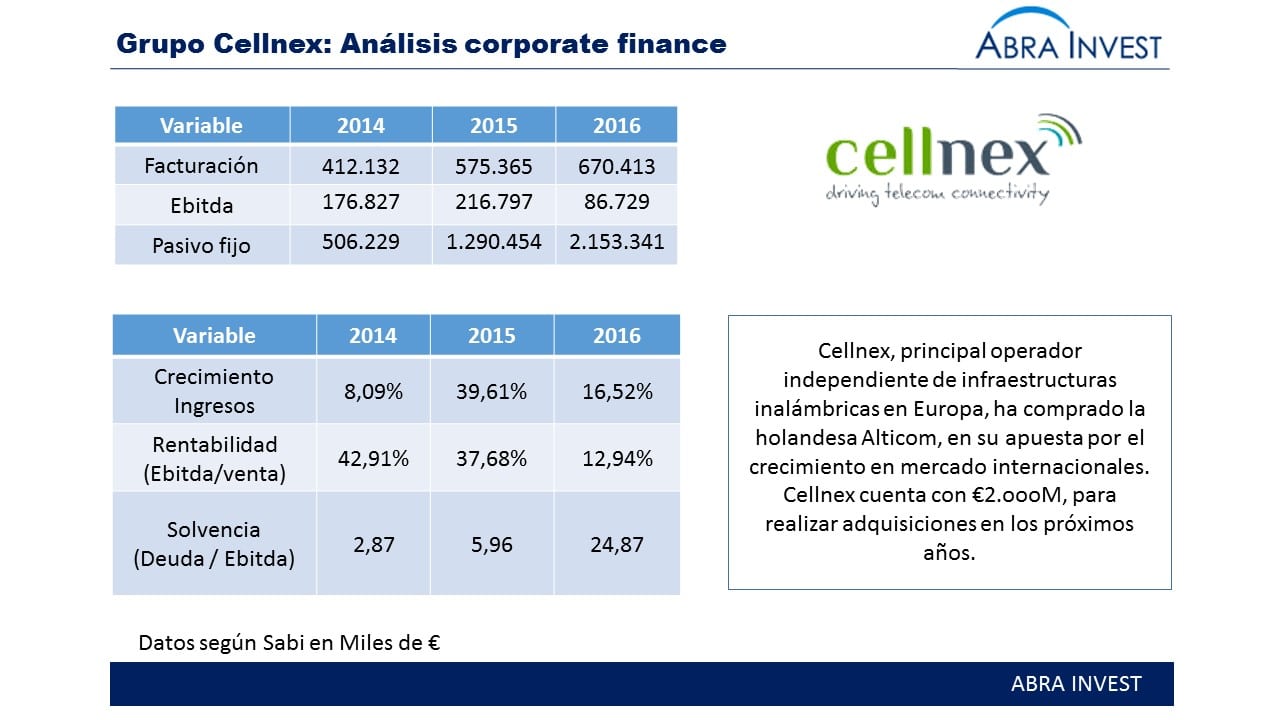

Spanish telecoms firm Cellnex buys Alticom to grow in the Netherlands

Cellnex Telecom has completed the acquisition of Dutch infrastructure operator Alticom. The transaction, which has been closed for €133M, will result in the addition of 30 new towers in the Netherlands and will provide the company with €11.5M of EBITDA in 2018.

Cybersecurity: a growing sector, with $$1.6B of investor support in Q2 2017

Investment in cybersecurity is growing, both in terms of the volume invested and the number of transactions carried out. Proof of this are the 6 investment rounds that have been closed for an amount greater than $100M in the last quarter of 2017 (Trim2). This shows that the sector is maturing.

2017 will be the year of a new record for private equity funds in Spain

In recent months, private equity funds have closed deals such as the sale of Mémora to Ontario Teachers' for €500M or the sale of Pronovias by BC Partners. With sales like these, and many others, the year looks set to be exceptional for the sector....

IoT investment to grow by 15% in 2017, companies like Daqri have raised rounds of more than $200M

According to Everis, the number of deals in the sector will be 9% lower than last year, while investment volume will grow by 15%. This is a sign that the sector is in the process of maturing, fewer deals are being done, but each company is betting more heavily. In terms of the countries leading the sector, the USA is the biggest forerunner.

Amazon has bought 17 companies in the last 3 years, its goal: to provide better services to its customers.

In June, Amazon made its biggest purchase ever with the acquisition of the Whole Foods supermarket chain for $$13.7 billion. With this purchase, Amazon has the staff and strategic locations to provide a better food delivery service....

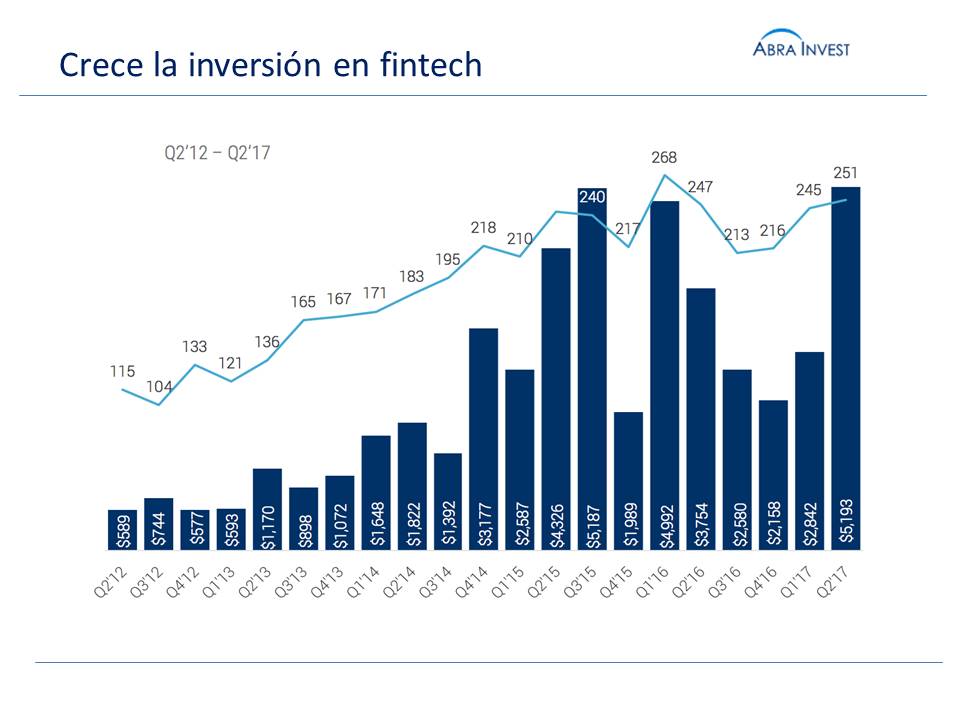

Kantox, the fintech company, turns to software technology and receives €5M

Kantox, the fintech company that operates in the exchange of currencies for companies, has closed a €5 million round raised by its own shareholders. Co-founder and CEO Philippe Gelis confirmed yesterday that the round will bring the company closer to break even, which is expected to be reached "by the end of 2017".

Easy Payment Gateway, fintech company operating in Spain, closes €6M round

Easy Payment Gateway, a payment and fraud gateway, has just closed an investment round of six million euros. This is the third round closed by the startup, which defines itself as a platform for managing and configuring all means of payment of a company, as well as all fraud tools.