Neotec is a cdti programme to support the creation and consolidation of new technology-based companies, through a non-refundable grant that covers 70% of the operating budget for the first two years. The beneficiaries were announced in March 2016....

Navarrese companies now have 4 calls for R&D grants (2016-2019) worth €26.7M

The Government of Navarra has approved a multiannual allocation of €26.7M for R&D projects of companies, strategic projects, Manunet II and industrial doctorates. These grants will be paid out of the 2016, 2017, 2018 and 2019 budget years.

Spanish technology companies grow abroad through acquisitions: ADTZ and UserZoom

Adtz and UserZoom, which have made acquisitions in the last month, are two examples of Spanish companies that have made a commitment to innovation, have received the support of investors and are now betting on the international market to continue growing.

Clerhp structures exits the mab up 10.24%

On 8 March, Clerp, an engineering company that wants to grow in the Latin American market, was listed on the MAB as a growth company.

Telefonica open future: Corporate venture capital grows in Spain

Corporate investment in new startups is a win-win solution for large corporations to incorporate new innovations and for startups to get the funding and expertise they need to grow their business. In an ever-changing world, companies have to constantly innovate to maintain their position in the market. At the same time, new companies are being created that develop cutting-edge products and services that require external capital to be successful. A few days ago we learned that Telefonica Open Future invested in 600 startups in 2015.

Reindus: Aid for Reindustrialisation and Promotion of Industrial Competitiveness

The Ministry of Industry, Energy and Tourism has published the calls for applications for aid for Reindustrialisation and Strengthening of Industrial Competitiveness in 2016, for which there is a financial endowment of more than €757 million. Application deadline: from 18 April to 1 June 2016.

Caixa Capital Risk invests in Inbiomotion

It seems that biotechnology is finding investors in our country. A few weeks ago we told you that Inveready had invested in Cuantum and Ab-biotics, this week we learned that Oncostellae, which received a €1M round is looking for funding, and Caixa Capital Risk has led a €2.2M round in Inbiomotion.

Divestment of Avet Ventures in the Catalan company Nuroa

Investors are benefiting from acquisitions in the classifieds technology market. Last year we saw Cabiedes and Partners successfully sell Trovit to Japan's Next CO. We also witnessed how the sale of Milanuncios was one of the most successful divestments in the history of Spain for an entrepreneur. Now we have learned that Mitula Group has bought the Catalan company Nuroa.

Iberoeka Argentina and Iberoeka Uruguay open calls for proposals

The Iberoeka calls aim to promote the technological internationalisation of Spanish companies in Latin America through the development of collaborative R&D projects of a business nature. A few weeks ago, we announced the Iberoeka...

What are the keys to getting your startup funded? Odilo and Immfly as an example

There is a significant amount of capital seeking to be invested in innovation projects, but investors are looking for successful operations and are guided by criteria such as scalability, strong technological component and internationalisation capacity. Odilo and Immfly, which received €1.3M and €2.4M this February, are two examples.

New venture capital funds for SMEs: Meridia capital and Closa Gordon Investment

Meridia Capital and Closa Gordon, two companies familiar with investment, have decided to move into private equity and are setting up funds to invest in Spanish SMEs.

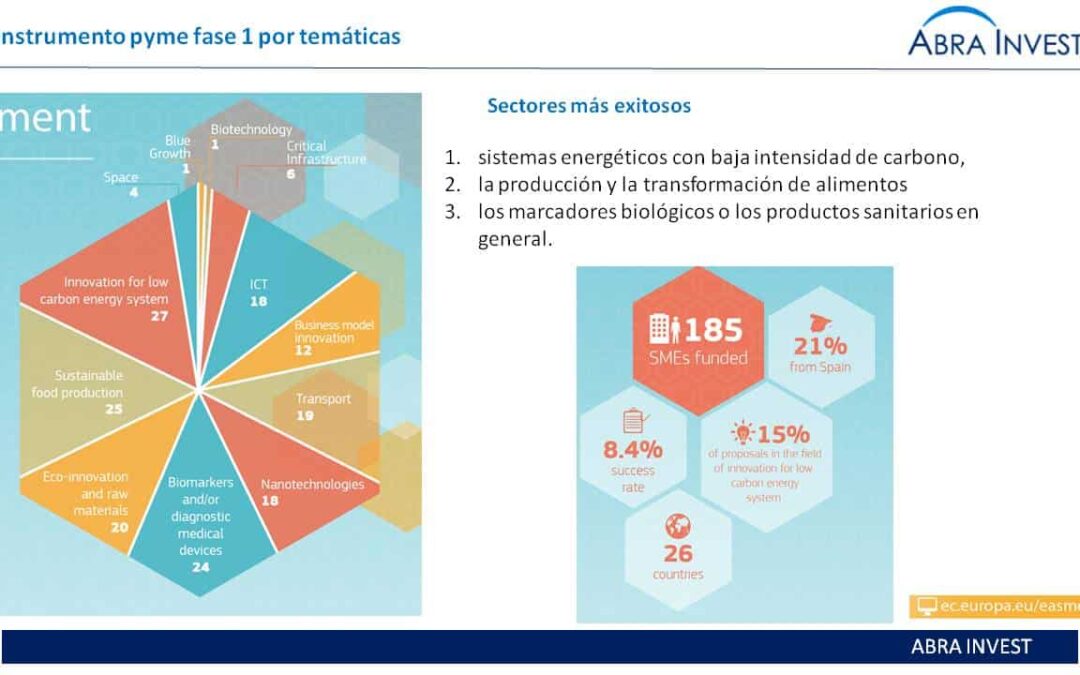

Spain leading country in participation in SME instrument phase 1 (November 2015)

From the last SME instrument phase 1 call, with cut-off date November 2015, 185 companies have been selected out of the 2057 proposals submitted. The projects come from 22 different countries, Spain with a participation of 22%, which means 39 projects, is the country where more projects have been selected. These companies will receive €50,000 in funding.