Excom wants to grow in Spain and it does so through acquisitions and commercial agreements with companies in the sector, proof of which is that in the last year it has bought Wifiways, Central Phone, Ipok and Internet Canarias.

Excom wants to grow in Spain and it does so through acquisitions and commercial agreements with companies in the sector, proof of which is that in the last year it has bought Wifiways, Central Phone, Ipok and Internet Canarias.

Leading 3D design software firm Solid Angle has gone back to the market and bought Solid Angle, its first Spanish acquisition.

Abac, with €230M, has raised the largest fund in Southern Europe for a start-up fund manager and UC has raised a fund for SMEs that have the potential to grow in Asia, especially in India. Abac raises a €320M fund from foreign investors to invest in...

The EdTech sector is receiving funding. In 2016 we have detected more than 80 rounds of funding in the sector. Among them, $150M Age of Learning stands out for its size. In Spain, the round closed by Aba English is the largest round ever closed...

"Why invest in fashion in Spain? Because there is tradition and industry and there are prospects for a recovery in consumption after years of contraction; fashion is a sector that has the best companies in the world and, consequently, the best talent in the world," says Fernando Elío Dolz de Espejo, investment director at ProA Capital.

In the last month we have heard about two Spanish companies that focus on the fight against cancer, Immunostep and Idp Pharma, which have received funding.

One of the advantages of a MAB listing is the generation of liquidity that allows the company to grow inorganically. As proof of this, in the last year we have seen several companies from very different sectors listed on the MAB that have made acquisitions, such as Clerph, Inkemia, or Bionaturis.

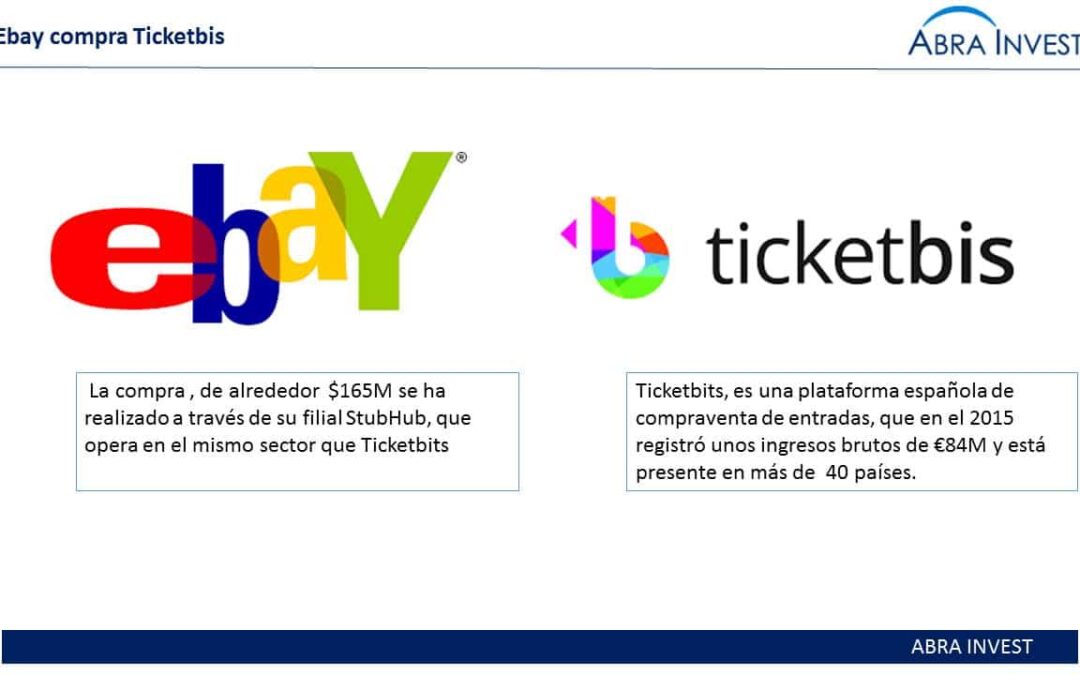

Ticketbits, a Spanish ticketing platform founded by Ander Michelena and Jon Uriarte in 2010, recorded gross revenues of €84M in 2015 and is present in more than 40 countries.

In the last month we have seen venture capital divestments in Spanish companies, some of which, such as the sale of Tyba, have been beneficial for investors. Others, such as the sale of Otogami, have been made so that the company can continue its activity.

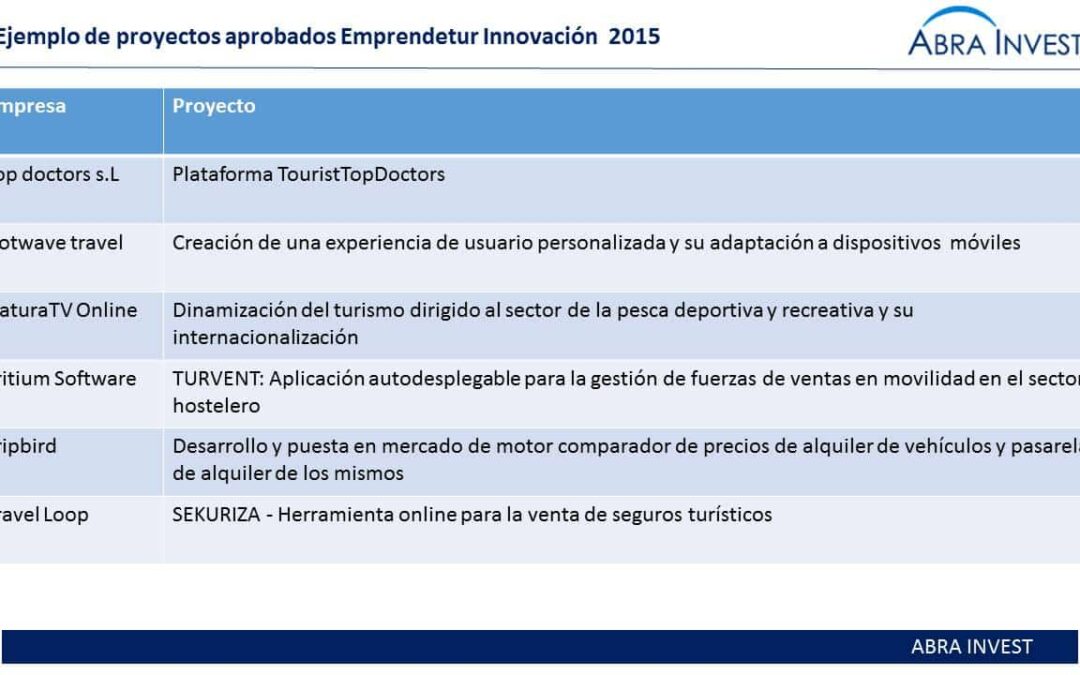

Minetur has approved the Emprendetur R+D+i programme for innovative projects in the tourism sector. This programme is divided into two sub-programmes: Empredetur I+D (€10M) and Emprendetur Desarrollo de Productos Innovadores (€35M). The grants will be in the form of...

"The United States is an interesting market for exporting sausages. Distribution is very fragmented, it is possible to sell at a price at which producers and distributors make money, and there are few Spanish exporters who have a long-term strategic plan to enter the USA. Moreover, there is a high sales potential because people want to eat different things".

Spanish technology companies want to make the leap into the international market and to do so they are merging with each other to gain strength or are carrying out M&A operations with foreign companies. In April, in addition to the big purchase of Privalia by Vente Privée, we have seen other operations such as the merger between Wallapop and Letgo in the US or the purchase of the Spanish company HallStreet by TimeOut.