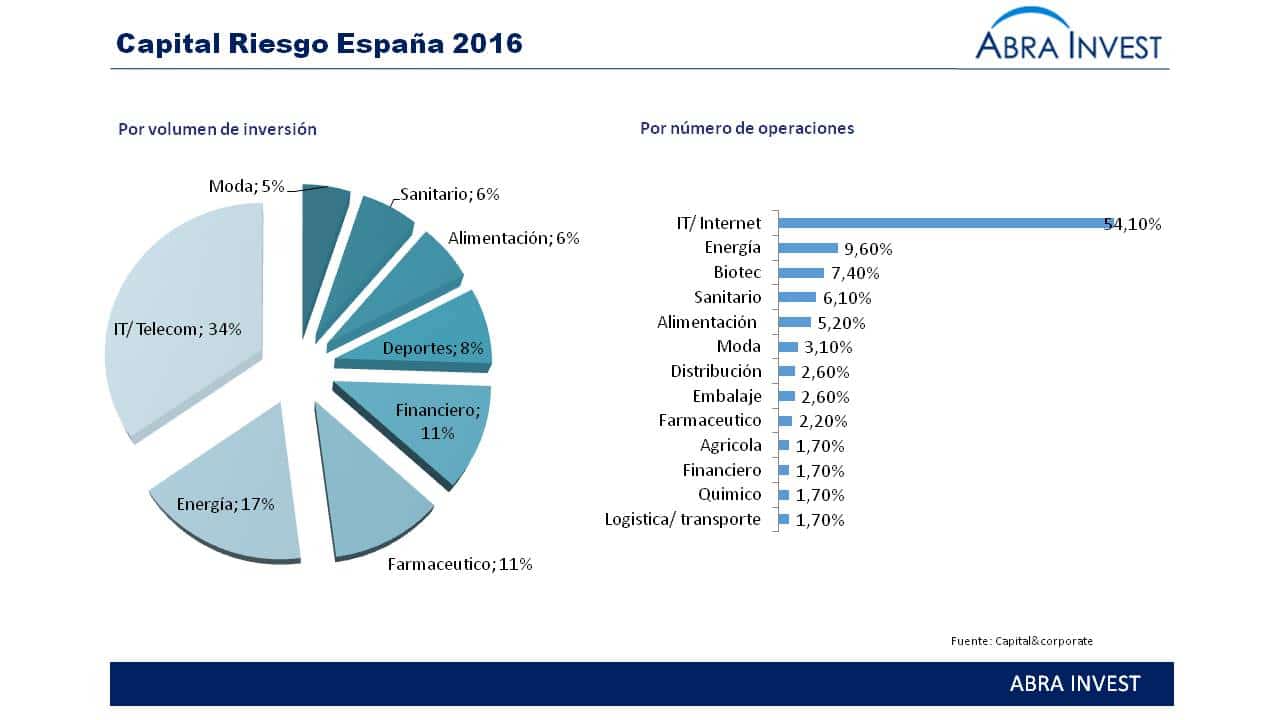

Venture capital investment in Spain in 2016 totalled €3,100M, an increase of 5% compared to 2015. Two deals (Hotelbeds and Renovalia) for more than €1,000M of deal value and 6 for more than €100M contributed to this result. In terms of the most active sectors, the IT/Telecom/Internet sector is in first place.