Device monitoring, energy savings, wireless charging of devices, low-power wi-fi are some of the applications that the internet of things is enabling. We have carried out a study of which technologies are being invested in.

Device monitoring, energy savings, wireless charging of devices, low-power wi-fi are some of the applications that the internet of things is enabling. We have carried out a study of which technologies are being invested in.

Accenture said in a report in 2011 that the healthcare sector would be the most affected by the development of the Internet of Things. Logic-fin's study confirms that this is becoming a reality: diagnosis of illnesses, support for doctors through the Internet of Things,...

The deadline to participate in the grants for the Promotion of Technological Sectors of the Community of Madrid, in the framework of the Regional Strategy for Research and Innovation for Smart Specialisation (RIS3), within the Operational Programme of the Community of Madrid for the period 2014-2020, is now open. The deadline will be open for one month only.

On 15 January 2015, the Ministry of Economy and Industry announced the opening of the Challenges for Collaboration programme before the end of the month. This programme is the former Innpacto, whose objective is to finance experimental development projects carried out in collaboration between public and private research centres and companies in order to promote research aimed at solving society's challenges through the development of new products and services.

The call is open for the 6th H2020 challenge, fTI-Pilot, which aims to support the European economy by offering grants to innovative companies and organisations to enable them to bring innovative ideas to the market. It is the only challenge that is open to proposals in any area of technology or application.

The IT investment sector remains the most active sector in terms of deals. But there are aspects that are changing: new segments, other types of investors, etc.

Investors have seen European cloud computing companies as a source of opportunity. As a result, investment rounds are growing by 30% each year and since 2009 they have established themselves as one of the preferred sectors for investment.

In 2014 it was time for Corporations to take a leading role in innovation investment. Moves are coming from the US for Corporations to bring their strategic input to the fore as an advantage over Venture Capital.

The call for applications for the Emprendetur international programme opens on 9 January for companies operating in the tourism sector whose exports do not exceed 40% of their turnover at the time of application.

KPMG's prospective report on private equity in Spain, based on a survey completed by 129 executives from 113 private equity firms, shows signs of optimism, reinforced by the good results obtained in 2014.

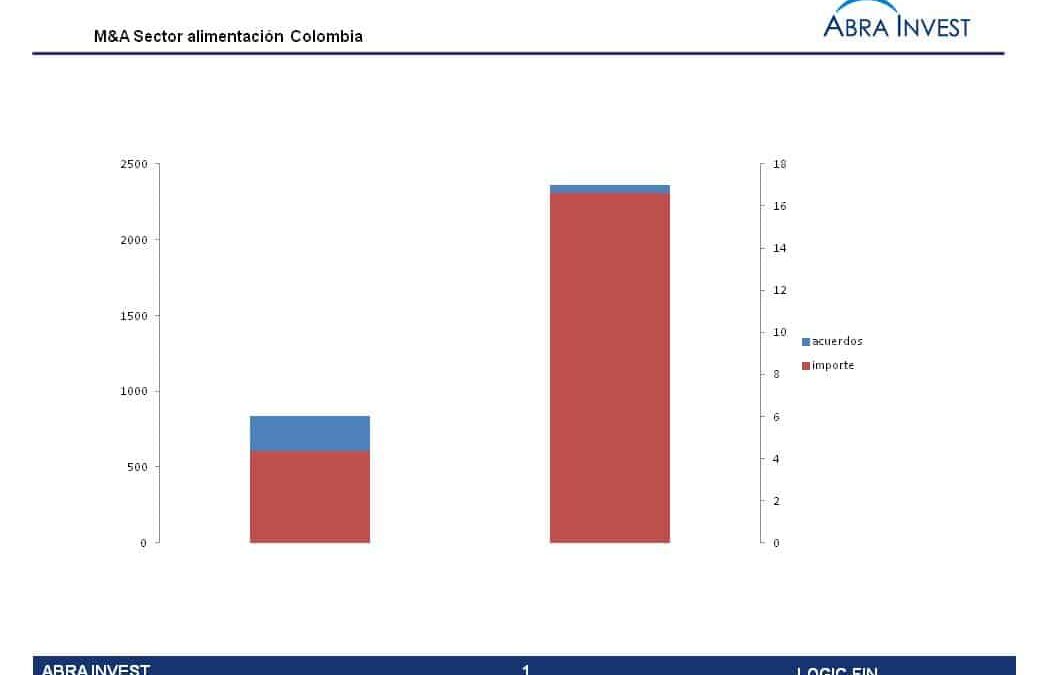

2014 has been a good year for M&A in Latin America, with our analysis highlighting the growth of activity in Colombia and Brazil.

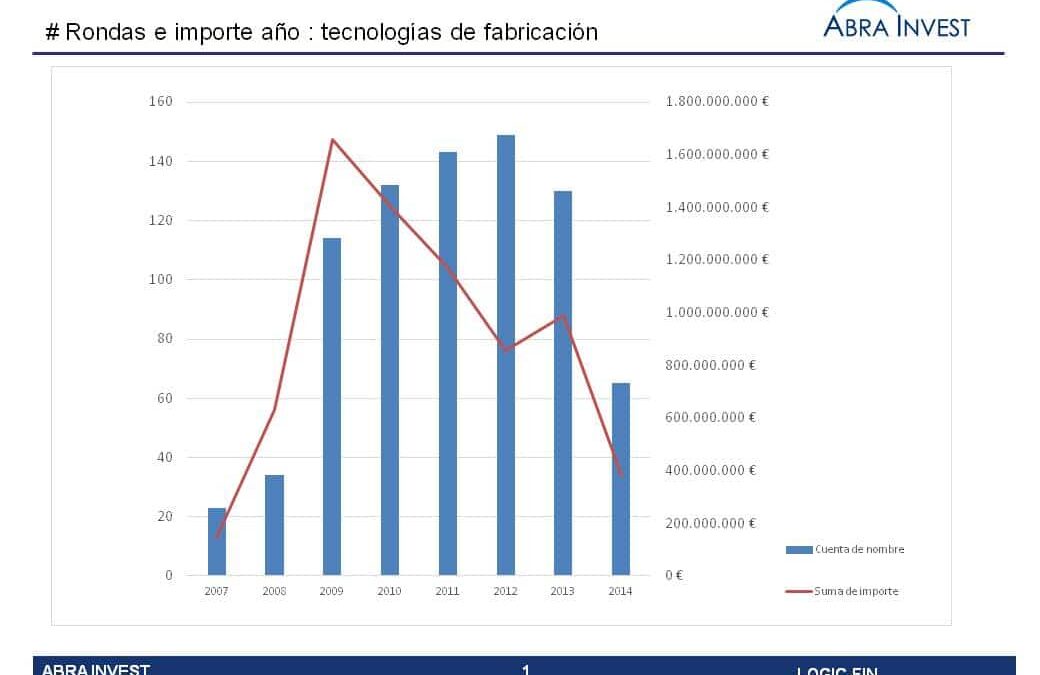

Starting in 2009, the manufacturing technologies sector, which enables time- and cost-saving manufacturing, attracted many investors. A total of 790 rounds and an amount of $7.236M has been raised in the sector to date. In the following we will take a look at...