2016 has been a good year for Spanish M&A. The number of M&A transactions has grown by 20% this year, exceeding €100,000M in 2016 through more than 1,600 transactions. This is largely due to the confidence of foreign investors in our country.

2016 has been a good year for Spanish M&A. The number of M&A transactions has grown by 20% this year, exceeding €100,000M in 2016 through more than 1,600 transactions. This is largely due to the confidence of foreign investors in our country.

Shopnet Broker is a Spanish company created in 2000 that offers technological services for the insurance sector. The company operates through two subsidiaries: Segurosbroker, to serve the end customer, and e-Correduría for the professional insurance market, as well as in Spain, Portugal and Mexico.

The MAXCOLCHON group has closed a capital increase subscribed by KEREON PARTNERS. The funds raised will allow the group to meet its ambitious growth plan and make the international leap. MAXCOLCHON has been advised by ABRA INVEST for the successful completion of the transaction.

The new ISG will serve more than 700 customers, including the 75% of the world's largest companies, and the efficiencies gained by the combination of the two firms will result in an estimated €7M in savings in the first 18 months.

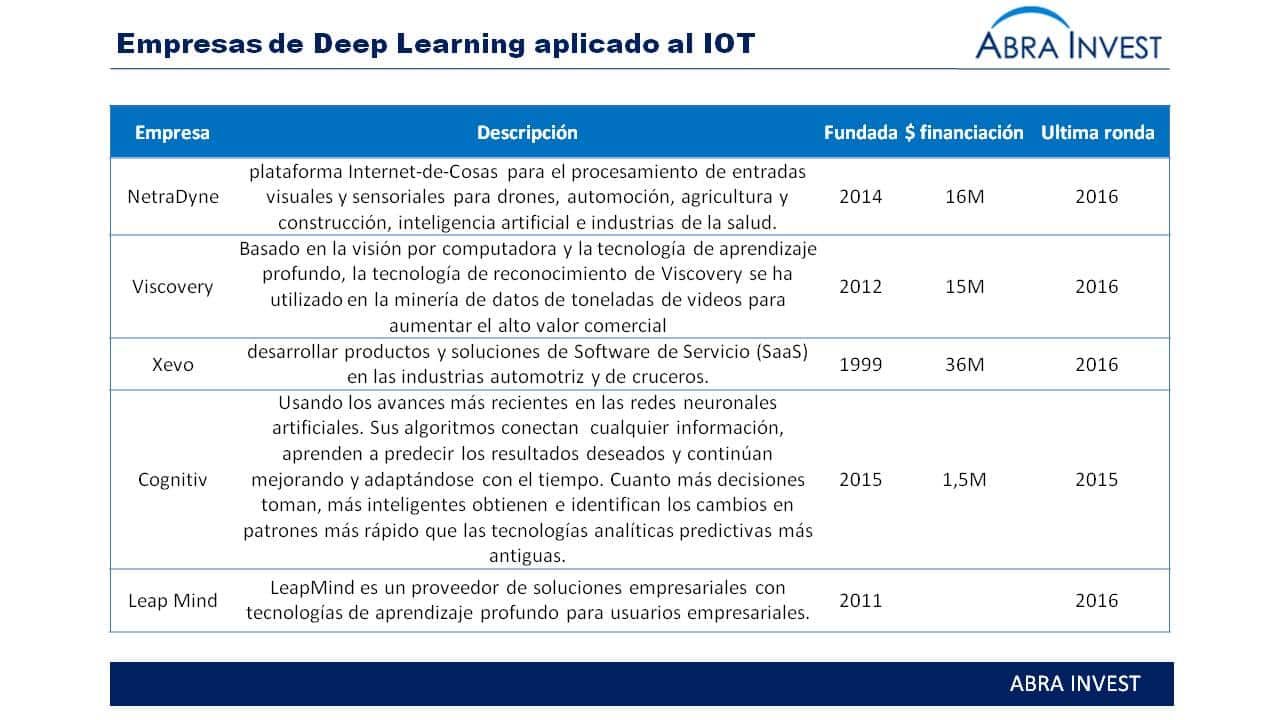

Zementis is specialised in Artificial Intelligence and Machine Learning, which makes it possible to reinforce the technological proposal of the German Software AG for the IOT. Software AG had already incorporated Zementis' ADAPA (Adaptive Decision and Predictive Analytics) into its Digital Business Platform to offer real-time analysis and greater visibility of business data to organisations.

Prosegur is immersed in a restructuring process with the aim of transforming its current management model divided into geographical areas to a new model by business type. The plan is to divide the operations of Prosegur Cash, Prosegur Security and Prosegur Alarms and to be able to potentialise each area.

Dutch company Affidea, which offers diagnostic imaging solutions, continues to grow in Europe and has acquired Spanish company Q-Diagnostica to enter the Spanish market. About Affidea, a venture capital-driven company headquartered in the Netherlands, and...

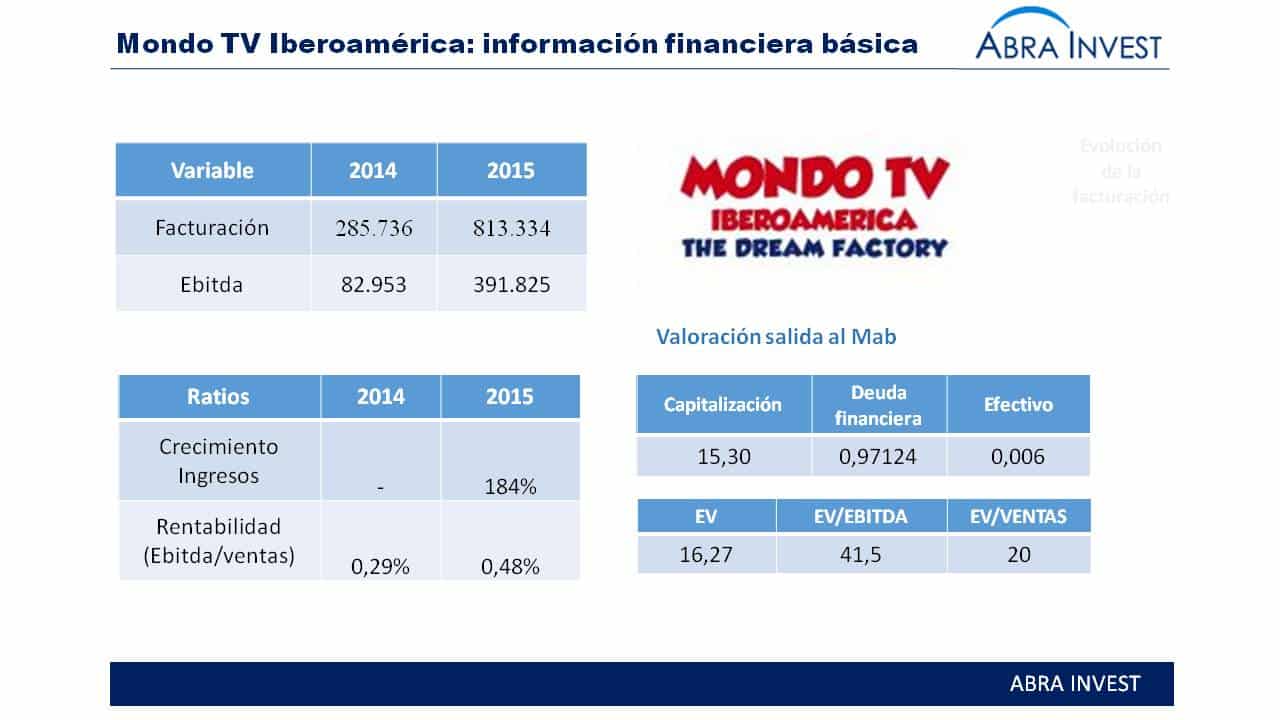

In December, three companies were listed on the alternative stock market. Pangaea Oncology in the biotechnology sector, Mondo TV in the media sector and Clever Global, in the tics sector. We already informed you about Clever Global's operation in this post last week.

Axon partners has led the €4M round in which Banc Sabadell has also participated (the firm was a finalist in a BStartup 19 acceleration programme) and has also raised public funding from Enisa. About Adsmurai Founded in January 2014, Adsmurai...

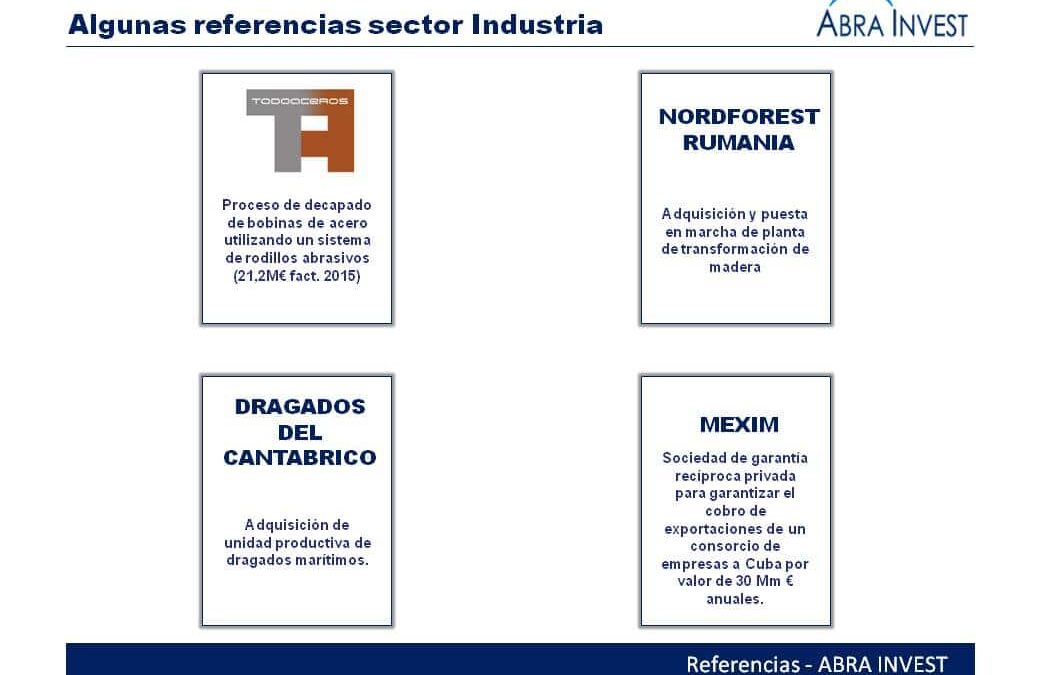

We analyse the industry sector in detail from our Corporate Finance perspective. In addition, we talk about some references of the sector that can be useful for entrepreneurs immersed in this type of activities.

Udekta Capital is a new venture capital fund for companies that are on MAB or plan to exit in less than two years. In addition to Udekta, IEBS has created its first fund and KKR has announced a new fund for technology companies, which has its sights set on Spain.

Biotech deals: corporate finance, M&A, investor search, funding, biotech venture capital