Monotype, a Nasqad-listed typeface design company, has bought for $130M Olapic, a startup founded by 3 Spaniards in 2010 that has developed a tool that allows any company to interact with its customers through photographs.

Countercraft, Spanish cybersecurity company receives €1M in investment

Countercraft, la empresa que desarrolla herramientas de engaño para detectar, descubrir y manipular a los adversarios que cuenta tan solo con 9 meses de vida ha recibido una ronda de €1M de inversores como Adara Ventures, Orza y Wayra. Sobre Countercraft...

Venture capital invests in innovations in the tourism sector

In the last month several startups offering services in the tourism sector have received funding of more than €1M. These young companies, which are no more than 2 years old, are applying technology to revolutionise the tourism sector and want to grow in order to be competitive in the market.

Atrys to list on Mab tomorrow (Friday) after capital increase

Atrys will make its debut tomorrow on the MAB, after receiving the approval of the MAB incorporations committee. The company, which is the 35th company to be listed in the growth company category, is engaged in the provision of diagnostic services and medical treatments and the development of new therapeutic modalities and diagnostic tools.

Swedish industrial automation communication company HMS buys Spanish company Intesis Software

HMS Industrial Networks, listed on Nasqad in Stockholm, has acquired all the shares of Intesis Software, a leading Spanish provider of advanced communications solutions and systems integration for building automation.

Salupro receives €6M in funding from Q-Growth, Bonsai and K Fund

The price comparison website for medical devices for dental and veterinary clinics has received €6m to enable it to grow abroad and digitise processes.

Top 10 mobility startups to watch

In the last year we have seen several rounds of investment in Spanish companies that use mobile in their business model. All the companies detected are young companies, founded since 2011. Some of these companies, such as Cabify, have received a large amount of funding.

Invent Pharma and Palex: Healthcare M&A June 2016

Private equity firms are driving the healthcare sector in Spain. This month we learned that Corpfin has bought Palex, a medical device company, to provide it with sufficient liquidity for mergers and acquisitions. In addition, Apax...

News new funds: Fondico, BeAble, Artá Capital and Sabadell

Fondico quiere que el capital riesgo en España coja fuerza y acaba de anunciar una nueva convocatoria. Además estamos viendo cómo se están captando recursos para nuevos fondos, que invertirán en empresas muy diferentes, desde empresas tecnológicas industriales recién...

Izertis, the technology consultancy firm, continues to grow and buys the Basque Desinor and the Catalan Alsys.

Izertis es una consultora tecnológica y soluciones TIC de alto valor añadido que opera en diversos sectores como telco, turismo, ingeniería y distribución, que ha conseguido crecer y expandirse geográficamente en estos años de crisis gracias a una política de...

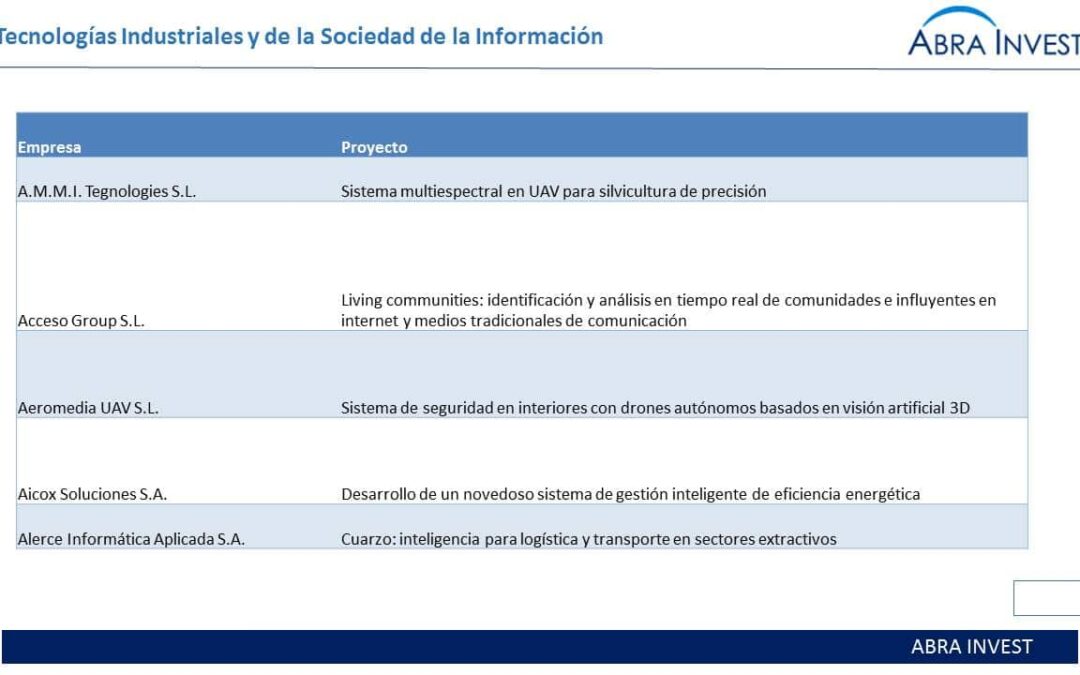

cdti approves more than €65M for 125 R&D&I projects and 65 projects supported with feder funds in March

The Board of Directors of the Centre for the Development of Industrial Technology (CDTI), a body attached to the Ministry of Economy and Competitiveness, has approved 125 new R&D&I projects with a total budget of more than 85 million euros.....

Beabloo, a specialist in digital marketing onmicanal and Big Data has bought Metriplica, focused on online analytics.

Technology company Beabloo has bought online analytics company Metriplica for €2M to improve the services Beabloo provides to its customers, making progress in attracting online consumers to physical shops. Customers will be able to link...