Axon partners has led the €4M round in which Banc Sabadell has also participated (the firm was a finalist in a BStartup 19 acceleration programme) and has also raised public funding from Enisa. About Adsmurai Founded in January 2014, Adsmurai...

Industry

We analyse the industry sector in detail from our Corporate Finance perspective. In addition, we talk about some references of the sector that can be useful for entrepreneurs immersed in this type of activities.

New funds in December: IEBS, KKR and Udekta capital

Udekta Capital is a new venture capital fund for companies that are on MAB or plan to exit in less than two years. In addition to Udekta, IEBS has created its first fund and KKR has announced a new fund for technology companies, which has its sights set on Spain.

Health and Biotechnology

Biotech deals: corporate finance, M&A, investor search, funding, biotech venture capital

Information Technology and Innovation

Energy

We analyse some references in the Energy sector and you can check them in the following table. Econova or Corsica Partners make up this ranking.

Michelin buys Restaurantes.com for further E-commerce growth

Michelin is betting on E-commerce. In the last two years it has bought 4 companies to grow its online sales in both the tyre and passenger experience sectors.

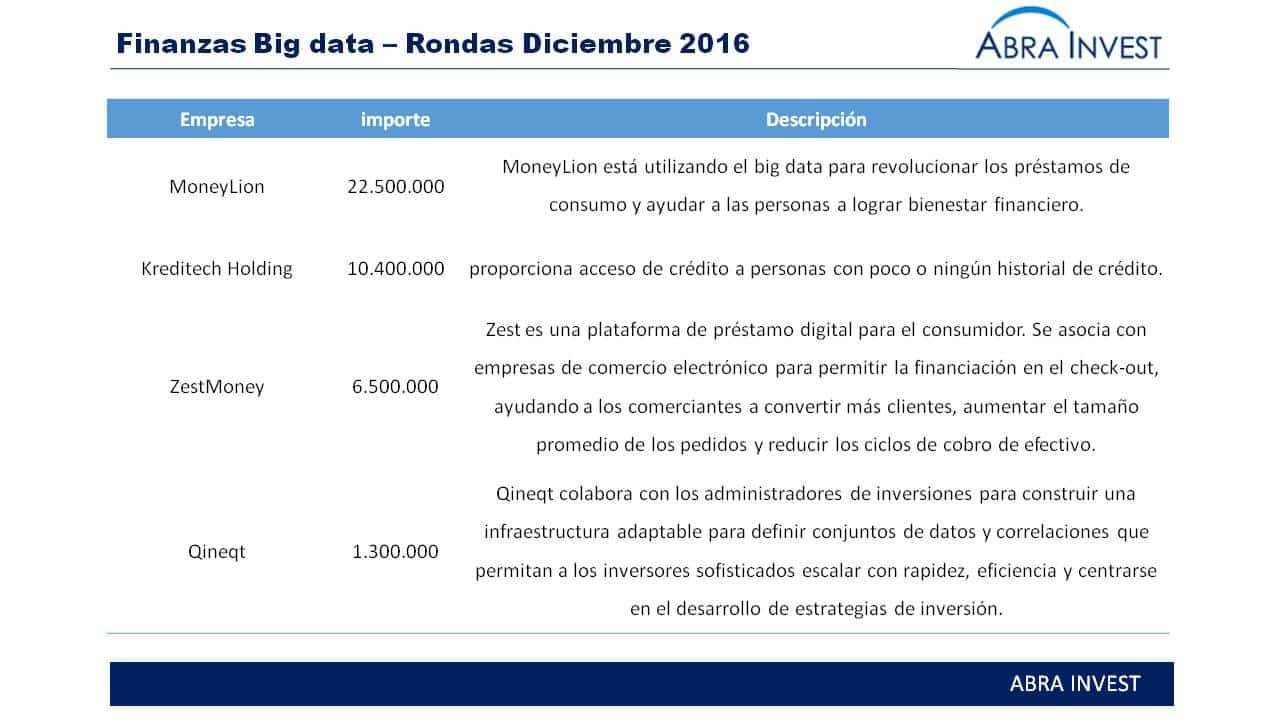

Datio, a joint venture between BBVA and Stratio to lead big data in the financial sector, is born

The use of big data in the banking sector has numerous applications, such as being able to offer customers solutions that adapt to their needs, predict customer behaviour, detect the possibility of fraud, etc. BBVA has realised the importance of big data for its sector and is investing in this area.

ClinicPoint welcomes Ona Capital into its shareholding structure

ClinicPoint, the marketplace to find doctors online at the best price, has received a new round of €800,000, giving entry to Ona Capital.

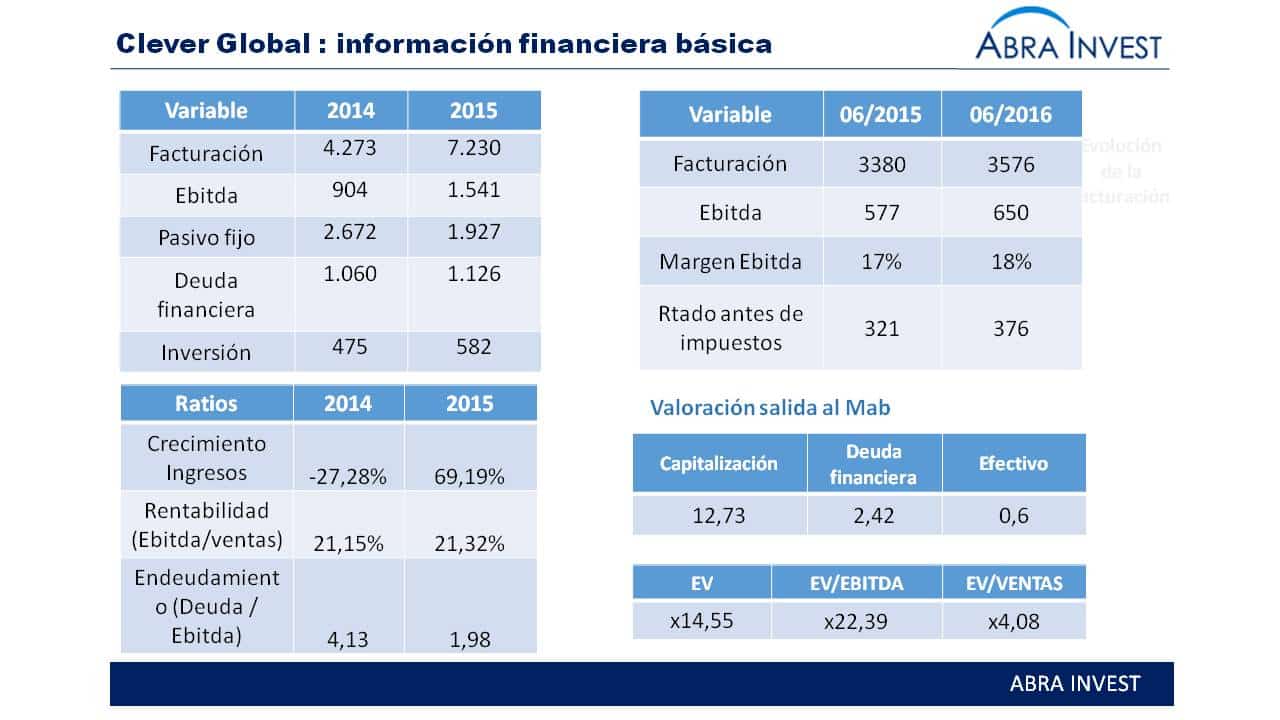

Clever global exits on Mab and grows 11% on its first day

CLEVER Global is a technology services and outsourcing company specialising in global management of suppliers and contractors, coordinating in real time all the elements (companies, workers, vehicles and machinery) involved. This company has gone public on the Mab with the aim of making its growth strategy a reality.

What operations have there been in cybersecurity in December 2016?

Cybersecurity companies need to grow both in innovative technology and in new markets if they are to be competitive in an industry that is constantly innovating. One of the ways to grow is through acquisitions. Akami, for example, has made 17 acquisitions in the sector in order to position itself as one of the leading companies. In addition, private equity is also making acquisitions with the aim of growing companies and then being able to sell. Golden Gate Capital, for example, invested this month in Neustar.

CornerJob, one year old and $35M lifted.

Cornerjob, a Spanish job search app, lets you know within 24 hours if your CV has been selected for an interview. This app, which was launched in the French and Italian market in 2015, has already received a total of $35M and the support of international investors.