After gathering information about the economic and technological results achieved by the companies that have participated in the first 5 Innterconecta calls, we summarise the results obtained.

2016, a good year for the e-health sector in Spain?

Although there is still a long way to go, the e-health sector in Spain is taking off. The number of Spanish startups in the e-health sector grew by 53% in 2015. The challenge now is for these companies to have the resources to grow. At the moment, the companies that...

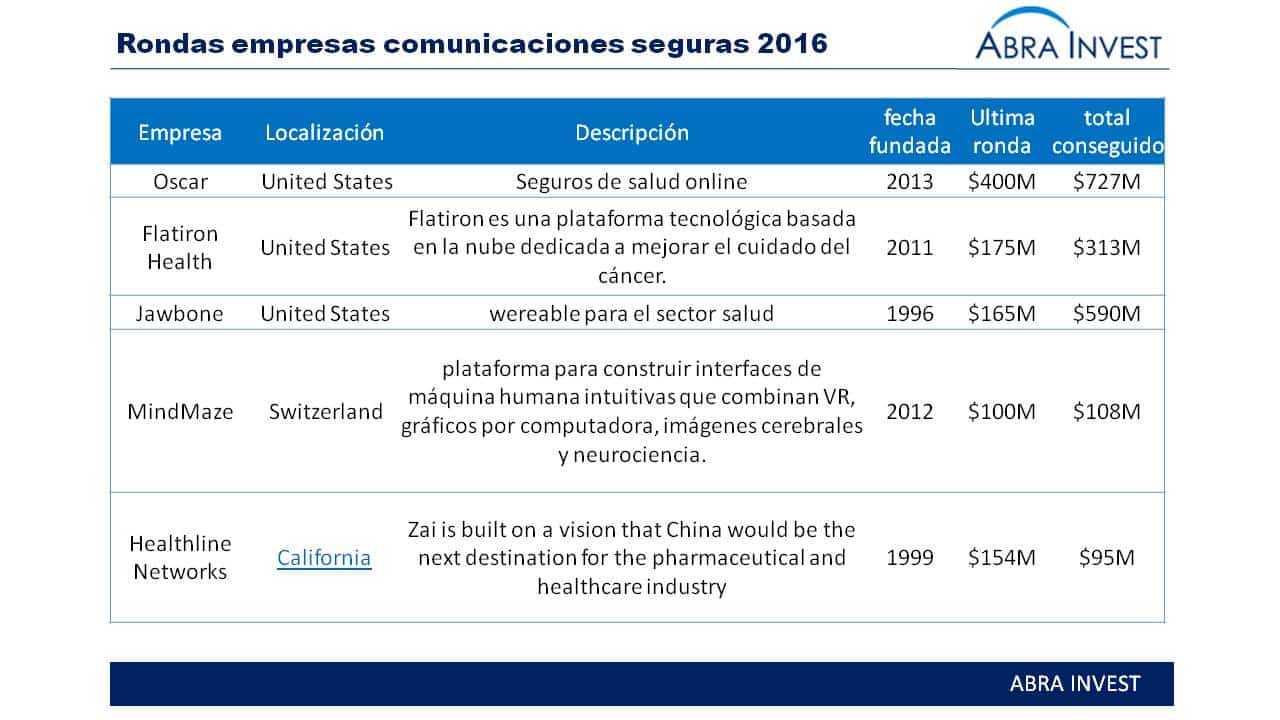

Cybersecurity is growing at a rate of 12% in Spain

The ciberemprende 2016 programme closed this week with the Venture Day, which was attended by a hundred investors, entrepreneurs and cybersecurity professionals. The winners of the programme were Techvolucion and Keynetic. But not only the acceleration programmes have been successful, this year we have detected large rounds in Spanish cybersecurity companies and acquisitions by international companies.

Mergers and Acquisitions grow by 20% in Spain in 2016

2016 has been a good year for Spanish M&A. The number of M&A transactions has grown by 20% this year, exceeding €100,000M in 2016 through more than 1,600 transactions. This is largely due to the confidence of foreign investors in our country.

Shopnet Broker plans to increase capital and incorporates Preventiva's Afin2 product

Shopnet Broker is a Spanish company created in 2000 that offers technological services for the insurance sector. The company operates through two subsidiaries: Segurosbroker, to serve the end customer, and e-Correduría for the professional insurance market, as well as in Spain, Portugal and Mexico.

MAXCOLCHON Group increases capital to reinforce its expansion advised by Abra- Invest

The MAXCOLCHON group has closed a capital increase subscribed by KEREON PARTNERS. The funds raised will allow the group to meet its ambitious growth plan and make the international leap. MAXCOLCHON has been advised by ABRA INVEST for the successful completion of the transaction.

ISG buys competitor Alsbridge to create outsourcing consultancy giant

The new ISG will serve more than 700 customers, including the 75% of the world's largest companies, and the efficiencies gained by the combination of the two firms will result in an estimated €7M in savings in the first 18 months.

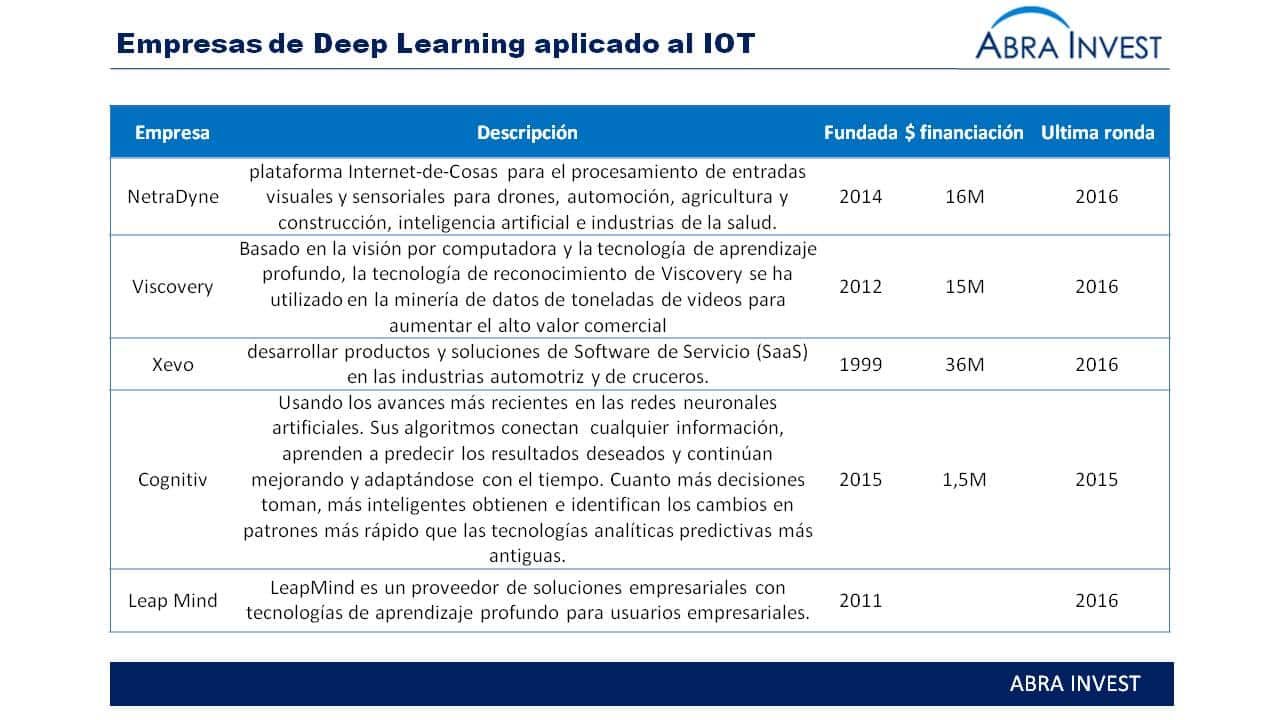

Software AG buys Zementis, specialising in deep learning software

Zementis is specialised in Artificial Intelligence and Machine Learning, which makes it possible to reinforce the technological proposal of the German Software AG for the IOT. Software AG had already incorporated Zementis' ADAPA (Adaptive Decision and Predictive Analytics) into its Digital Business Platform to offer real-time analysis and greater visibility of business data to organisations.

Prosegur floats its Cash subsidiary on the stock exchange to grow in its three divisions: Alarms, Security and Prosegur Cash.

Prosegur is immersed in a restructuring process with the aim of transforming its current management model divided into geographical areas to a new model by business type. The plan is to divide the operations of Prosegur Cash, Prosegur Security and Prosegur Alarms and to be able to potentialise each area.

Diagnostic imaging company Affidea buys Q-Diagnostica to enter Spain

Dutch company Affidea, which offers diagnostic imaging solutions, continues to grow in Europe and has acquired Spanish company Q-Diagnostica to enter the Spanish market. About Affidea, a venture capital-driven company headquartered in the Netherlands, and...

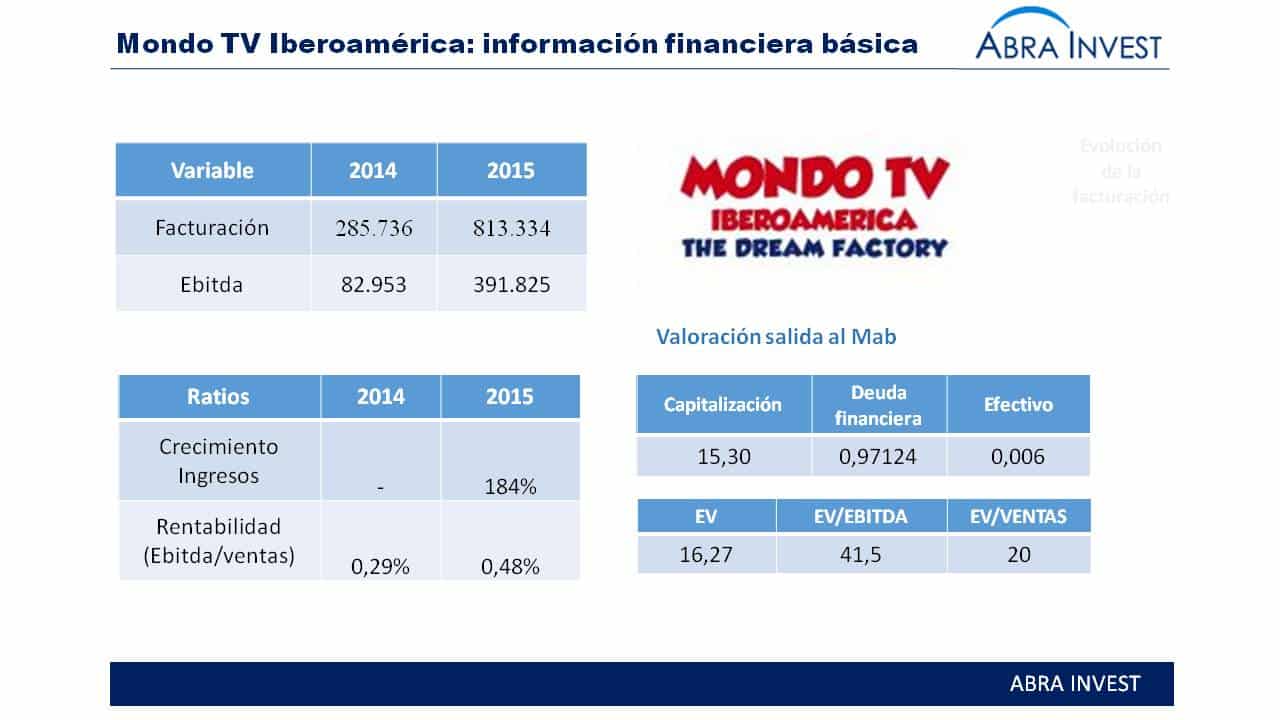

Pangaea Oncology, Mondo TV and Clever Global go public on Mab in December

In December, three companies were listed on the alternative stock market. Pangaea Oncology in the biotechnology sector, Mondo TV in the media sector and Clever Global, in the tics sector. We already informed you about Clever Global's operation in this post last week.

Adsmurai, a Spanish company that optimises advertising campaigns, receives a €4M round of funding.

Axon partners has led the €4M round in which Banc Sabadell has also participated (the firm was a finalist in a BStartup 19 acceleration programme) and has also raised public funding from Enisa. About Adsmurai Founded in January 2014, Adsmurai...