At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

The Mergers and Acquisitions Handbook: Essential Elements

Every organisation, regardless of size or experience, has the potential to succeed in mergers and acquisitions. However, realising this potential requires the right people to ask the right questions and to design effective strategies for integration and post-acquisition operations.

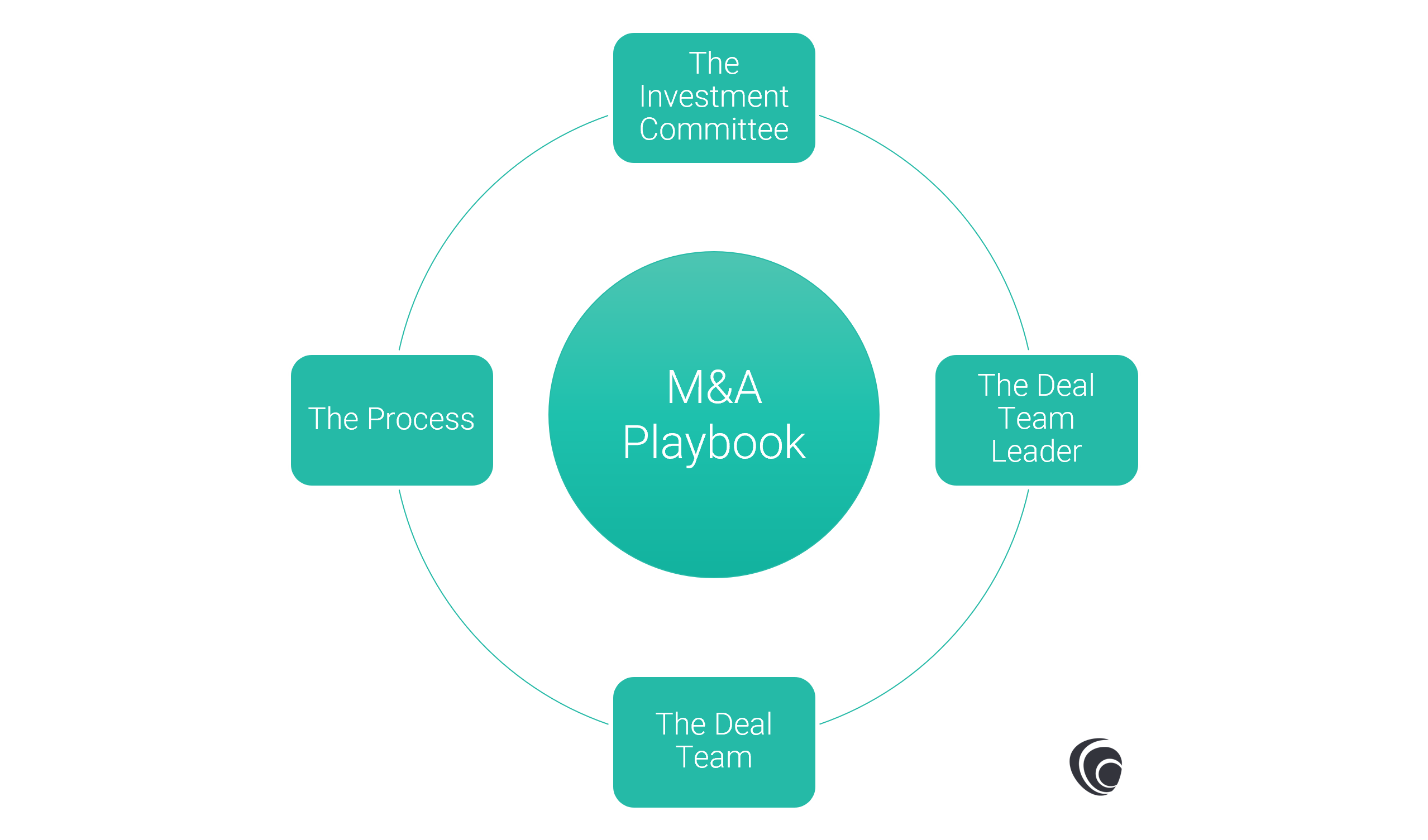

In the world of M&A, the cases is not a matter of chance. It requires a meticulously crafted M&A manual, a roadmap to guide organisations through the intricate negotiation landscape. In this practical guide we will look at the key elements of an M&A manual.

The Mergers and Acquisitions Handbook

This guide is a detailed M&A manual that describes the processes and procedures that an organisation follows when carrying out merger and acquisition transactions. Its main objective is to ensure that each step of the process, from initial evaluation to post-transaction integration, is carried out in a consistent and efficient manner. By providing a clear structure, the M&A manual helps to reduce uncertainty and minimise risks associated with these operations.

So what elements should a handbook include and how detailed should it be? To begin with, it should describe the key decision-makers. It should clarifying responsibilities The process for these decision-makers, defining the decisions they are expected to make and articulating the process they expect their teams to follow. This ensures that decisions are made in an informed and comprehensive manner, without overlooking any critical factors. The handbook usually begins with the investment committee, which establishes a solid foundation for the decision-making process:

The Investment Committee

The Investment Committee is responsible for overseeing the entire mergers and acquisitions process. It is composed of experienced executives with diverse competencies and is tasked with ensuring disciplined decision-making, assessing the viability of deals and safeguarding the organisation from undue risk. While committees can slow down decision-making, their collective wisdom mitigates the multifaceted risks inherent in M&A transactions.

Rather than being an obstacle, the committee provides an additional layer of security and ensures that informed and careful decisions are made at every stage of the process. Its role is essential to ensure that the organisation's investments are sound and aligned with its long-term strategic objectives.

Investment Committee Protocols

Investment committee protocols dictate the level of committee involvement in each deal. Whether reviewing each transaction or intervening at critical junctures, the clarity of the protocols streamlines decision-making and fosters alignment between negotiating teams and stakeholders. Regular points of contact with the investment committee ensure transparency and facilitate timely approvals. In addition, clear protocols and regular communication with the committee help to keep all stakeholders informed and ensure that decisions are made effectively and in line with the organisation's strategic objectives.

The negotiating team leader

A key element of the M&A handbook is the team leader The negotiation team leader is responsible for guiding the deal from conception to completion. Whether assessing potential targets, negotiating terms, or coordinating due diligence efforts, the negotiation team leader orchestrates a symphony of activities, ensuring the alineación con los mandatos del comité de inversión y los objetivos de la organización. Su papel es fundamental para garantizar que el proceso de fusión y adquisición progrese con fluidez y eficacia, y que se logren los resultados deseados en términos de valor y estrategia para la organización.

As the liaison point between the deal team and the investment committee, the deal team leader plays a crucial role in communication, decision-making and expectation management throughout the M&A process.

The negotiating team

As the deal process progresses, the team expands to include functional experts from financial, legal, regulatory, IT and other backgrounds. Each member brings specialised knowledge and a unique perspective, conducting due diligence to uncover potential risks and opportunities. Functional team leaders oversee the due diligence activities in their areas, garantizando el rigor and compliance with the handbook. This collaborative, multidisciplinary approach ensures that all critical areas are carefully considered and informed decisions are made throughout the M&A process. It also facilitates effective communication between the various teams and ensures the consistent and successful execution of the transaction.

Functional team leaders

Appointed by the investment committee, functional team leaders oversee due diligence in their respective areas, ensuring that critical details are not overlooked. This approach ensures that qualified experts lead the assessment in each area, providing assurance to the committee and clarity of accountability. In addition, simplifica la comunicación y la organización by having a single point of contact per functional area. Identifying these leaders in advance is crucial, as they must understand both the specific techniques and the overall context of M&A deals. Their experience and judgement help to streamline the due diligence process and make informed decisions on critical aspects of the deal.

External advisors

While in-house expertise is at the core of M&A activities, organisations often seek the support of external advisors, such as lawyers and accountants. These advisors bring specialised knowledge and skills, complement in-house teams and agilizan la ejecución de las operaciones. However, decisions to engage external advisors are made judiciously, taking into account the complexity and scale of each deal. It is important to carefully assess whether additional expertise or resources not available in-house are required, and whether investment in external advice is justified in terms of the potential benefits it can bring to the M&A process.

Define the process

Behind the success of mergers and acquisitions is a well-defined process that outlines the stages of deal execution and the corresponding actions required. From the pre-letter of intent (LOI) phase through to post-closing activities, each stage requires claridad, coordinación y cumplimiento of the protocol. Defining the process enables negotiation teams to address challenges in a methodical way and to achieve satisfactory results.

By setting out a clear and detailed framework for each stage of the merger and acquisition process, practical guidance is provided for mantener el enfoque and consistency throughout the operation. This facilitates informed and efficient decision-making, as well as effective management of resources and team activities. In addition, by defining the process, clear expectations are set, which reduces the likelihood of errors or misunderstandings during the execution of the operation.

Facilitating successful mergers and acquisitions

In summary, the M&A manual is a vital tool for organisations embarking on merger and acquisition activities. It helps to define key decision-makers, establish clear procedures, and assign competent leaders and teams. By judiciously utilising both internal resources and external advisory services, and by defining a detailed process from inception to post-closing activities, the handbook ensures that the M&A process is transparent and transparent. toma de decisiones bien informada and risk mitigation, fostering successful outcomes. In short, it is an indispensable guide to achieving strategic objectives through mergers and acquisitions, regardless of the size of the organisation or its previous experience.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: