Want to hit the nail on the head to drive value for your business?

Maximize the value of your company is your most profitable investment

At Baker Tilly we have extensive experience in maximising sustainable growth by increasing the value and attractiveness of your business.

We increase the attractiveness of your business for a successful sale.

At Baker Tilly Tech M&A Advisors we create strategies aimed at increasing the value of technology SMEs, our years of experience in M&A guarantee the effectiveness of our methodology and growth tools.

Investment analysis methodology

We use an analysis method used by real investors to calculate the value of your company.

Complete and updated information

Our Intelfin platform provides us with information on what buying companies really value.

Strategic

and structured approach

We provide advice and tools that will increase the value and attractiveness of your technology company in the market.

Our method to achieve the maximum

attractive to investor profiles

At Baker Tilly Tech M&A Advisors, we offer a growth consulting service for the sale of companies with a methodology based on our extensive knowledge of M&A. Our approach consists of analysing areas such as the quality of the client base and the level of competitiveness of the sector.

1. Diagnostics

We identify the key areas of improvement to increase the value of your company.

2. Action plan

We develop a plan with precise and detailed actions prioritising their impact.

3. Implementation and execution

We accompany you and help you to implement the plan systematically.

Do you want to increase the value of your business?

At Baker Tilly we carry out a complete analysis of your case to offer you the best advice when it comes to implementing strategies to increase value.

Why choose Baker Tilly? We are

specialists in M&A in companies of the Tech sector

Boost the growth and attractiveness of your technology SME with Baker Tilly. Our team of experts offers customised strategies, resource optimisation and risk reduction to ensure sustainable growth.

Our team understands the quantitative and qualitative variables that have a major impact on the valuation of a company, which is crucial for developing and implementing a growth plan.

We have years of experience advising companies in the technology sector.

We know what investors value most.

We design effective strategies

We create an action plan that allows the company to develop a strong brand in the market to attract future buyers.

We are the area specialising in technology sector

belonging to Baker Tilly's global network.

M&A transactions

advised by BT globally

operations

for technology companies

people

dedicated to M&A in EMEA

13

in the world ranking

of M&A companies in 2023

Own M&A Data Analytics: Intelfin

Our proprietary Intelfin platform provides us with comprehensive and up-to-date information on technology companies and the sector.

Tailor-made

Market Research

Our consultantsthrough our technology and sectoral analysis, examines data to understand opportunities and the competitive environment.

The experience and expertise of the whole team is the result of advising on hundreds of transactions, leading sales with high quality standards.

Success cases

Successful business sale transactions completed by Baker Tilly.

Opinions about our work

Frequently Asked Questions of our clients about Value Growth advisory

How to design an effective growth plan for a company?

Designing an effective growth plan involves analysing the company's current situation, defining clear and achievable objectives, researching the market, developing specific strategies, planning the necessary resources, implementing the plan and monitoring progress to make adjustments as necessary.

How can an advisor help my business grow?

A consultant can help you identify the aspects that a prospective buyer values most and analyse whether they can be improved. These aspects are both quantitative and qualitative in nature. From there we seek to develop customised strategies, reduce risks, implement the latest trends and technologies, and optimise your financial resources to improve profitability and ensure sustainable growth.

When does a Value Growth consultancy take place?

It is highly recommended to prepare a business sale in advance and therefore to start 3 to 5 years prior to the sale to analyse the situation with a valuation of the company. The result of this valuation may lead to a desire to increase this value and therefore to carry out a consultancy of this type.

What are the key financial variables and metrics for valuing my company?

Key financial metrics include revenue and revenue growth, EBITDA, profit margin, free cash flow, debt to equity ratio, asset value and return on investment (ROI). In addition to these and other financial metrics, non-financial variables are also important.

What non-financial metrics are key to the value of my company?

In addition to financial metrics, aspects such as the quality of the customer base, the differentiation of your product or service, intellectual property, talent management and leadership are analysed. All of these aspects influence the value to an investor of the company, and therefore improvements can be implemented if they currently negatively affect the value of the company.

Does the type of investor influence the valuation of my company?

Yes, the type of investor can influence the valuation of your company. Strategic investors may value your company more on the basis of potential synergies and strategic benefits. On the other hand, financial investors may focus solely on financial returns and short-term viability, which may result in a different valuation. In addition, investors with experience in your industry may have specific criteria that affect valuation.

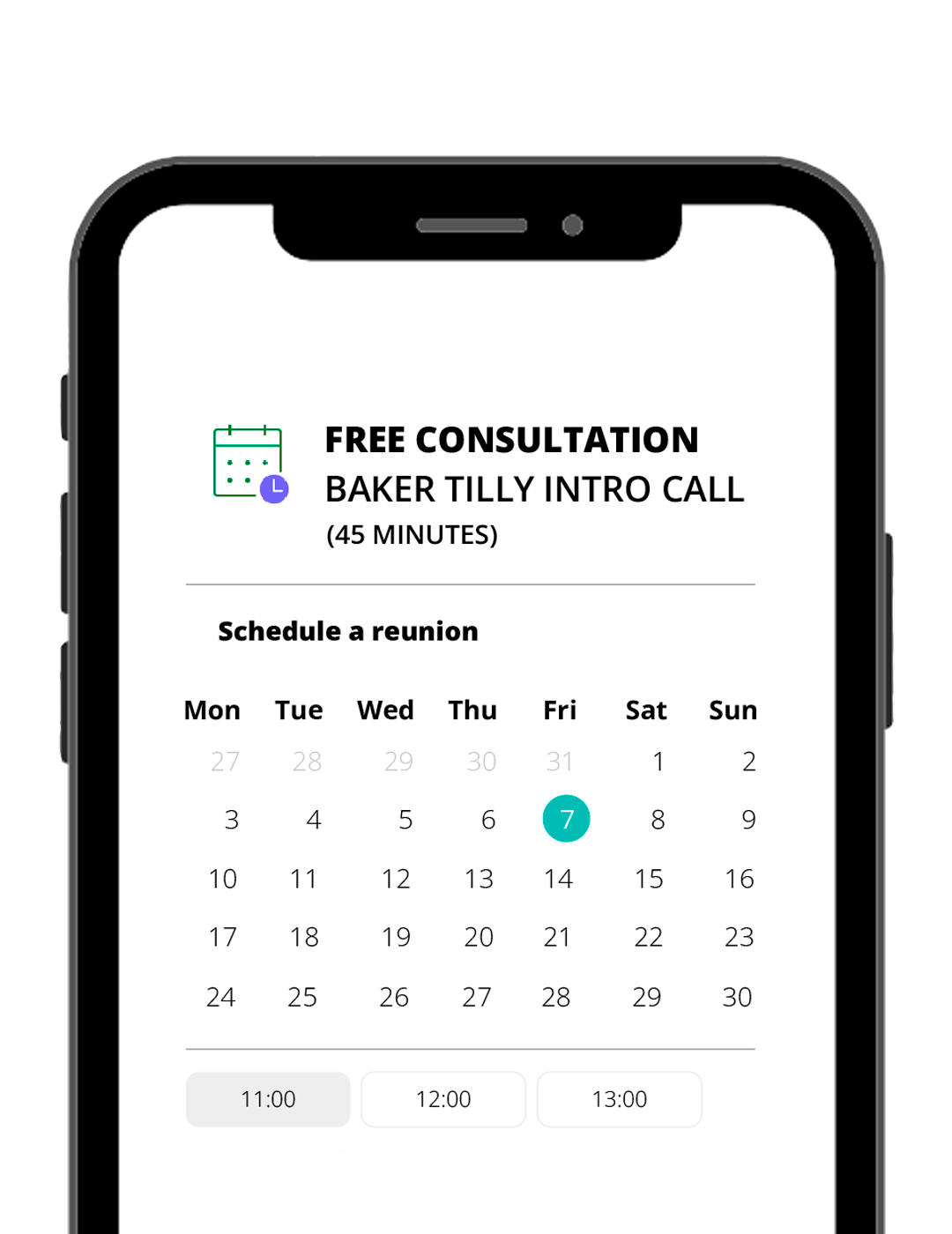

Talk to our specialist M&A advisors

Do you want to accelerate your company's expansion with customized growth and merger strategies? Our team of M&A specialists advises you every step of the way. Request a free consultation and prepare your company for future investment opportunities.

Ready to boost the attractiveness of your business and make a successful sale?

Contact our team of advisors today to develop a strategic plan for your business in the marketplace.