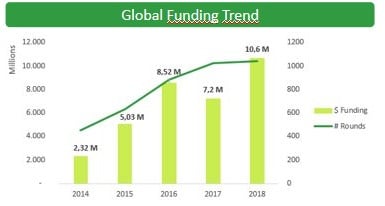

The trend in the mergers and acquisitions The market for food and beverage companies has been clearly bullish, with more than 5,500 rounds of financing worldwide and raising, in total, more than $58.6 billion.

Although the number of funding rounds in each of the last years analysed (2017 and 2018) has been similar, in terms of funding raised, 2018 saw a record high in the sector, with $10.6 billion invested in just one year.

This is because the rounds launched in 2018 were much more significant in value than those conducted in the previous year. For example, the company Magnit attracted USD 2.45 billion in equity investment in the same year, and Starbucks received $900 million.

In terms of mergers and acquisitionsIn the sector, 1,820 companies in the sector have been acquired, compared to 527 companies in the sector that have been acquired.

Most active acquirers in the Food & Beverage sector

The most active companies in mergers and acquisitions have been large multinationals such as Coca Cola, Unilever and the food delivery companies Bite Squad and Just Eat.

The Coca Cola Company has acquired a total of 13 companies in recent years, including some of international significance, such as the coffee shop chain Costa Coffee, the juice and soya drinks brand AdeS and the soft drinks manufacturer Tropico.

With the same number of acquisitions is the firm Bite Squad, which has acquired in the last five years the companies FoodNow and DoorStep, among others.

Unilever adds 10 mergers and acquisitionsincluding the health food brands Horlicks and Graze.

Most relevant acquisitions in the sector

One of the most talked-about deals in the food and beverage sector was the acquisition of Whole Foods by Amazon in June 2017, for a total value of $13.7 billion.

Another major acquisition was that of the US bakery and coffee shop chain Panera Breads by the German conglomerate JAB Holding Company for USD 7.2 billion.

Finally, it is worth mentioning that Patron Spirits was acquired by Bacardi 5.1 billion in January 2018.