At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

Value your company by discounted cash flow: 2 ways to calculate terminal value

The discounted cash flow, or intrinsic valuation methodis the method used to measure the realisable value of an investment. It is a valuation method based on projecting all future cash flows generated by the company's operations and discounting them by the return demanded by investors.

In order to calculate the company's future cash flows, the company's future cash flows are calculated on the basis of financial data (Balance Sheet, P&L and Cash Flow) for the last few years, and realistic assumptions are made based on the expected growth of the company and the performance of the industry.

It is therefore essential to have expert valuers who know the sector in order to be as realistic as possible. Otherwise this "objective" valuation would become a mere mathematical fiction with no real value. The key to this method of valuation is the analyst's ability and experience in similar operations..

In the case of discounted cash flows, the longer the cash flows are projected, the more difficult it will be to approximate what will actually happen, as the assumptions will no longer be as accurate. This is why normally, depending on the sector and the life cycle of the company, cash flow generation will be projected for 5 to 10 years.

Once the first 5 or 10 years have been projected, we will proceed to simulate the rest of the cash flows, and we will group them under the name of "Terminal Value.

How to calculate the shareholder's required return (Ke)

The rate at which the projected flows have to be discounted is the shareholder's required returnwhich is neither the expected return nor the historical return. This rate will therefore be different for each investor depending on his risk aversion.

It is important to note that the flows to be discounted by the return demanded by shareholders should be the free cash flows to the shareholder (after investments and financing).

A practical way to calculate is as follows: Re=Rf+Rp, where

- RfTake as a reference a risk-free return, for example the long-term bond (10 years) of the same country as the company we are valuing.

- RpWe add a risk premium. This premium will depend on the company's perception of operational risk. Aspects such as whether the sector is cyclical, the maturity of the company, cost structure (fixed vs. variable), product diversification, product differentiation, customer concentration, degree of regulation of the sector, etc. are taken into account.

How to calculate the terminal value

To calculate the terminal value in discounted cash flow valuation, there are two different ways which have to be applied in different cases:

1) Perpetual growth method

This method assumes that the company will grow reasonably for an infinite time and that the return on investment will be higher than the required return.

To do this, the first step is to look at the economic cycle of the sector in which the company operates, the company and its products, and then analyse what sustainable growth can be achieved in the future.

2) Output Multiples

This method assumes that sector multiples are good indicators of the real value of the company, so first a universe of comparable companies is sought. Then the variables that really influence the value of the company are searched for by multivariate analysis. The value of the selected companies is then divided by these variables and the median is calculated. Finally, we usually multiply the median we have calculated by the value of this variable of our company.

For example: Let us imagine that we are analysing an industrial company, we have already analysed the companies in the sector or complementary sectors and we have chosen the companies that are best comparable. We have checked that EBITDA is the variable that has the strongest relationship with the value of the companies. We have also calculated the median and it gives us that the companies have a median of 8 times their EBITDA, so we would multiply the EBITDA of our company by 8, thus obtaining the terminal value of the company.

In order to calculate the terminal value using exit multiples, it is essential to have knowledge of the sector in which the company operates, market development and the ability to find the variables that are really related to the final valuation, since in many sectors, such as the technology sector, EBITDA multiples can distort the final valuation and wrongly undervalue or overvalue the real valuation of the company. In other words, it is necessary to use multiples that really influence the valuation of the company, which differs in each sector or economic cycle that the company is experiencing.

The sum of the discounted cash flows and the terminal value would be the intrinsic value of the company.

Example of discounted cash flow valuation

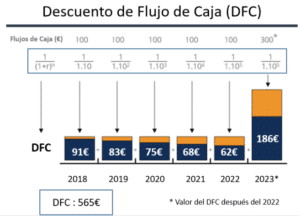

In the following example we can see in a very simplified way how the discounted cash flow valuation works, in this case we would apply a required rate of return of 10%.

Limitations of the DCF method

The limitations that this methodology may have is the difficulty in finding realistic assumptions, which implies the need for expert advice to avoid meaningless valuation, which would only lead to meaningless investment or disinvestment decisions.

It is also a method that does not take into account the economic cycle and the possible revaluation or boom in certain sectors, which is why this method must be supported by the multiples method in order to achieve a realistic and objective range.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: