At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

Private Equity vs Venture Capital – 5 differences

Intro

When you set yourself the goal of selling your company in the optimal way, one of the challenges you will have to address is to identify those investors who may have more interest in your company and therefore can put a higher price on the table. To help you in this task, in a previous article we explained the differences between a strategic partner and a financial partner and under what circumstances one or the other is suitable.

The most relevant and active financial investors are private equity and venture capital , which we have explained individually in detail above. Here we will summarise the main differences between the two. Private equity vs Venture Capital.

The 5 differences between Private Equity and Venture Capital

Before talking about their differences, we can highlight their similarities. Both Private Equity and Venture Capital work in a very similar way:

- They raise capital from so-called limited partners to invest in private companies.

- Their main objective is the same for both: to increase the value of the companies they invest in during the time they are invested in and then sell them at a higher price.

- They are temporary investors, so sooner or later they have to divest from the company.

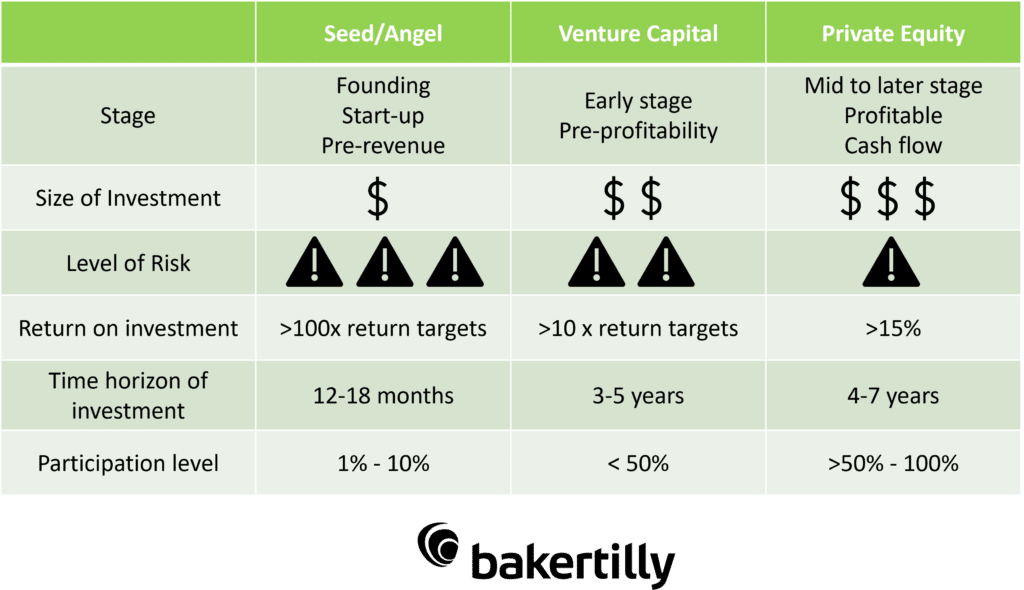

In terms of the differences they have, we divide them into several aspects:

- The stage of development of the companies in which it invests

- The level of participation they acquire

- The time horizon of your investment

- The volume of investment

- Investment risk and return

Investment stage

Here we find one of the first important differences, the stage at which the companies in which these two forms of financing a business are invested are at:

- The Venture Capital Method usually enters into the capital of a company at an earlier stage, when it is usually not yet profitable, but is considered to have great growth potential. This also means that Venture Capital, in addition to providing capital, usually provides a lot of know-how to the start-up company that is still in the early stages (Pre-seed, Seed, Early Stage).

- In contrast, Private Equity enters into the capital of more nature, established companies. They may be in growth stages or already consolidated, but Private Equity expects to add more value during the time it invests in the business.

Investment volume

The stage at which a company is invested in will determine the amount of investment required:

- At an early stage of a business, large amounts of money are usually not necessary.Therefore, when investing in the phases, Venture Capital Method usually invests between €100k and €10M in each startup in which it participates. The volume usually increases with each new round. If the startup reaches milestones in its business plan, the investor perceives less risk and consequently increases its investment. Therefore, earlier stages, more risk and smaller round size, and vice versa.

- The Private Equity on the other hand, invests from 10M€ to 100M€ in a single company. The effort is concentrated in fewer, larger companies. The level of diversification is typically between 10-15 companies per fund. Private equity needs to find a balance between diversifying risk and not losing focus on its management capacity and support to investees.

Investment risk and return

The risk taken and the return expected or required from an investment are closely related. The more risk any fund takes in a single company, the more return it expects to get from taking that risk. Risk obviously has to do with how confident one can be that the business model will work:

- A start-up that is still in its infancy and is trying to bring an innovative product to market is an unsafe investment: the market volume, level of competitiveness, profitability, etc. are not known. Therefore, the risk that Venture Capital Method tends to assume when investing in a company in its early stages is greater than that of Private Equity. As a result, the return demanded when selling its stake is also higher. It is common for only 15% of startups to survive over time.

- On the other hand, the risk assumed by Private Equity when investing in an established company with many years of experience is much lower than that assumed by Venture Capital when investing in a start-up. The average annual return that is usually achieved is around 15% of what is invested.

Level of participation

The level of participation normally implies a capacity to control during the management period and for divestment:

- A Private Equity fund typically acquires a majority, often 100%, stake in mature companies or traditional industries that present an opportunity for growth. This growth plan can be generated in a variety of ways: management improvement, acquisition of competitors or complementary companies, internationalisation, ..... Venture capital in its value creation form requires a greater capacity for corporate control. In divestment, it also requires the ability to sell 100%.

- In contrast, Venture Capital Method usually acquires minority stakes in early-stage companies that primarily need the capital injection to start production or marketing of their products or to accelerate the growth of a well-defined business project. Venture Capital at the time of exit does not need to drag the management team into a sale because the new investor will want its shareholding in the next growth phase.

In particular, in the case of private equity, the level of participation is changing when it comes to buying, and there is an opening to invest through minorities. Often this happens at the moment when they buy a VC's stake.

Time horizon of the investment

This aspect refers to the time between the input and output of the inverter:

- Venture Capital tends to have somewhat shorter investment durations than Private Equity, usually between 3 and 5 years.

- For Private Equity the durations are slightly longer, between 4 and 7 years.

As with everything else, this is not a written rule, but the experience of what we have observed in the market. Thus, it is also possible that in some cases it may deviate from what has been described above.

Examples of Venture Capital and Venture Capital:

We indicate some examples of each type so that you can have some references:

Examples of venture capital:

Providence equity partners based in Boston (USA) is one of the pioneers of private equity firms specialising in specific sectors with international coverage, in its case in software and education in North America and Europe. Some of its current investees are Imaweb, Masmovil, Blackboard,...

Nazca capital, based in Madrid, is one of the deans of private equity en España con enfoque sectorial abierto y enfocado en empresas españolas. Algunas de sus participadas actuales son Seprotec, Filmin o IDP…

Examples of Venture Capital:

Sequoia Capital is a company of VC fund which invests in startups in the energy, financial, enterprise, healthcare, internet and mobile sectors. The company has offices in the US, China, India and Israel. Sequoia has founded companies by lending capital to those who started them. Some of the companies that grew thanks to this capital are: Cisco Systems, Oracle, Oracle, Apple, YouTube, Yahoo and Google.

Global Founders Capital (GFC), based in Munich, Germany, is a globally oriented, stage-agnostic VC fund that empowers talented entrepreneurs. The firm seeks to invest in companies operating in the internet, retail, financial software, media and IT sectors.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: