At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

Spin-Off Operations: Methods and Key Considerations

Spin-off operations represent a strategic approach used by companies to restructure their businesses and unlock shareholder value.

In this guide, we explore the ins and outs of demerger transactions, from structural considerations to the complexities of transitioning and establishing the spun-off entity in its new environment.

Introduction to demerger operations

A spin-off transaction involves the separation and sale of a specific part of a business by the parent company. This part, known as the carved-out business, can be a division, an operating segment or even a set of products and services within the parent company. broader business portfolio of the parent company. The reasons behind a spin-off may vary from focusing on core business areas to raising capital for growth or debt reduction.

A notable example of a demerger operation is the separation of PayPal from eBay in 2015. eBay, a leading e-commerce platform, decided to spin off PayPal, its online payments unit, to allow both companies to focus on their respective growth strategies. The deal was well received by shareholders and allowed PayPal to become an independent leader in its industry.

Structuring a spin-off

A hive-off transaction can be structured in a number of ways, the most common being asset sales and share sale agreements. This decision depends on a number of factors, such as the existing legal framework of the hived-off company and the preferences of both the buyer and the seller. An asset deal may be preferable if the demerger operates within a larger corporate entity, allowing for the selective procurement of specific assets and liabilities while leaving the entity's other businesses behind.

Conversely, an equity transaction may be more appropriate if the unbundling already exists within its own legal entity. Regardless of the structure chosen, purchasers should respect the key transaction mechanismsincluding working capital adjustments, net debt considerations and compensation, tailored to the specific circumstances of the demerger.

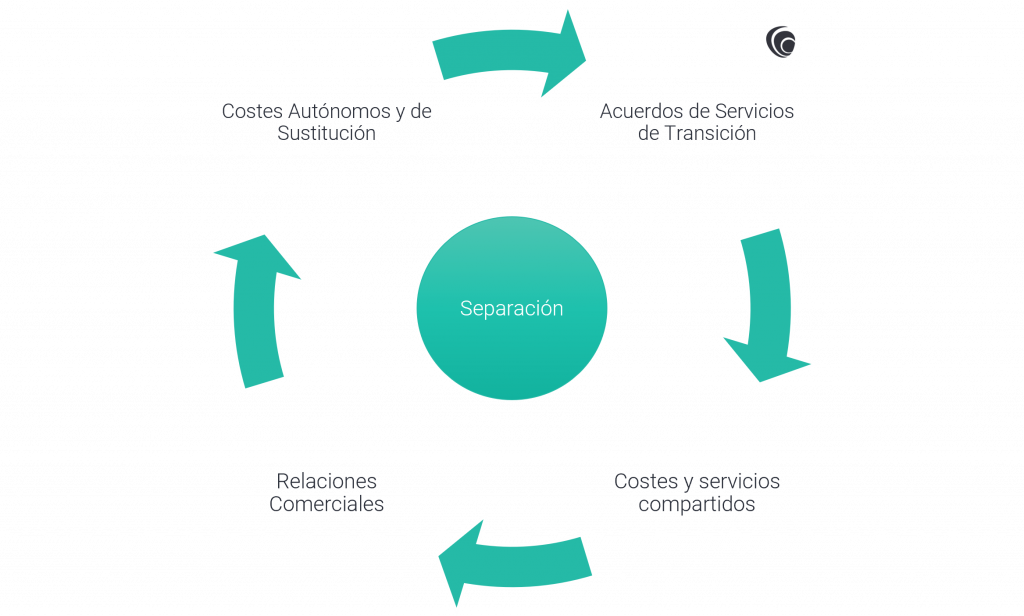

Transitional Service Agreements

The transfer of a spun-off company from its former parent to a new owner usually requires a period of transition and support. To ensure a smooth transition from the spun-off company to the new owner, it is common for the parties involved to establish Transition Services Agreements (TSAs). These agreements cover a range of functions, from IT and accounting to operational support, ensuring the continuity and stability of the spun-off company as it adapts to its new owner. new operating environment. However, the duration and scope of TSAs should be carefully negotiated, balancing the buyer's need for support with the seller's desire to waive the obligations and costs associated with the spin-off.

Challenges of demerger operations

Separation transactions can pose unique challenges for both parties. For the seller, effectively separating the spun-off business from the rest of the parent company can be complex, especially if there are operational or financial interdependencies between the entities. For the acquirer, integrating the spun-off business into its existing operations may require a careful planning and execution to ensure a smooth transition and the realisation of expected value.

Business relations

One of the most important challenges in spin-off transactions is the management of the business relationships between the spun-off company and the parent company. These relationships may include supply agreements, licensing contracts, strategic alliances and others. When the spun-off company ceases to be part of the parent company, these relationships may be affected, requiring a careful review and, in some cases, renegotiation of contractual terms.

Shared costs and services

Shared costs and services represent another level of complexity in spin-off transactions, as they encompass a broad spectrum of expenses and resources shared between the spinoff and its parent or subsidiaries. From insurance premiums and professional services to centralised functions such as IT and HR, these shared arrangements require careful scrutiny to determine their implications for the future operations and finances of the exit.

Purchasers should meticulously assess the scope of shared costs and services, identifying those that will require replacement or restructuring after the transaction. Whether creating independent capabilities or leveraging existing resources within the purchaser's organisation, the strategic planning is essential to ensure a smooth transition and a sustainable cost structure for the spin-off.

Stand-alone costs vs. replacement costs

Post-transaction planning involves a critical decision: whether to pursue stand-alone operations or to integrate them into the buyer's portfolio. The choice of a stand-alone operation requires a thorough cost assessment, covering the administrative and operational functions necessary for autonomy. By contrast, integration into existing operations requires a careful scrutiny of costs and shared services to ensure a smooth takeover within the buyer's framework, striking a balance between efficiency and financial sustainability. This decision largely determines the allocation of resources and cost structures after the acquisition, which has an impact on the trajectory and success of the company.

A stand-alone approach requires meticulous scrutiny of all independence-related expenditures, with an emphasis on a thorough understanding of operational needs. Integration, on the other hand, requires a delicate balance between using existing resources and adapting to the specificities of separation. The transition to autonomy may entail investments in infrastructure, technology and human resources, with priority given to long-term viability. Integration requires the seamless incorporation of spin-off operations into existing structures, exploiting synergies and minimising disruption.

Strategies for success

In short, thorough planning is crucial in demergers. Spin-offs offer opportunities, but also pose unique challenges. From the structuring of the deal to the integration of the acquired business, buyers must addressing complexities such as relationship management and cost management shared. Understanding the operational needs of the spin-off and potential synergies is crucial. In addition, transition service agreements play a key role in ensuring a smooth transition. In general, the cases requires meticulous due diligence and clear planning to seize opportunities and drive growth.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: