At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

3 Critical Factors in International Mergers & Acquisitions

Cross-border transactions, also referred to as international transactions or international mergers and acquisitions, are a significant component of global business activities. These transactions involve buyers from one country investing in or acquiring companies located in another country. While the overall objective of these transactions remains similar to that of domestic transactions - to create value, expand market presence or gain strategic advantage - the process is often characterized by a myriad of complejidades y matices propios de las operaciones internacionales.

In this guide, we will discuss the ins and outs of international M&A transactions.

Understanding cross-border dynamics

At the heart of international mergers and acquisitions is the interplay between different legal, regulatory, economic and cultural frameworks. Unlike domestic transactions, where parties operate in a familiar environment, cross-border transactions require navigating unfamiliar terrain, often characterized by language barriers, divergent business practices and regulatory variations. As a result, buyers embarking on international acquisitions must possess a comprensión matizada de la dinámica del mercado de destino and be prepared to face a number of challenges throughout the life cycle of the operation.

Challenges and considerations

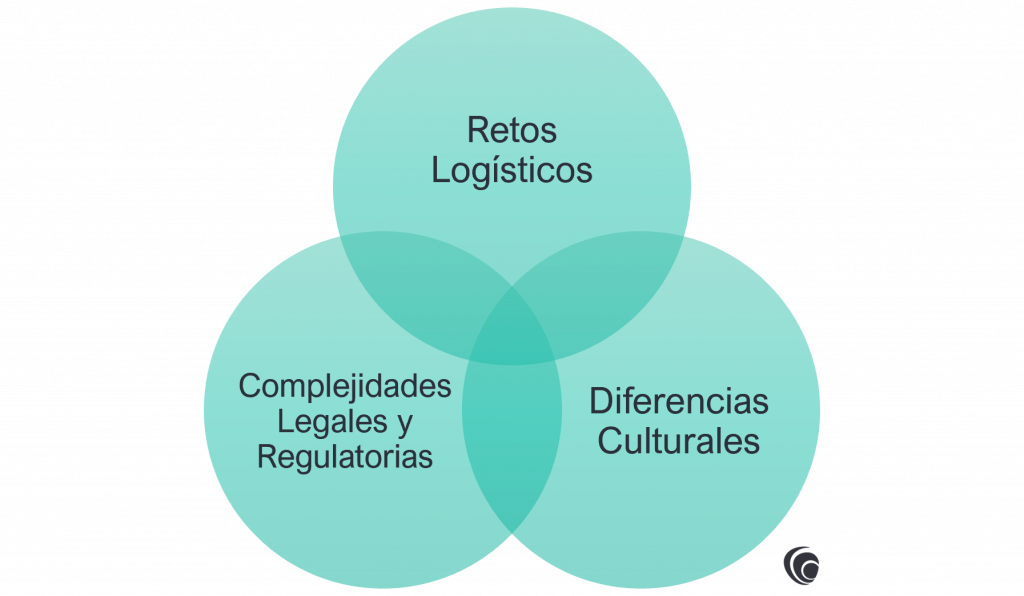

The complexities inherent in cross-border operations manifest themselves in multiple dimensions, from logistical hurdles to cultural complexities. From a logistical standpoint, coordinating teams dispersed across time zones, languages and jurisdictions poses formidable challenges, requiring meticulous planning and fluid communication channels. In addition, navigating diverse legal and regulatory frameworks, tax regimes and labor laws requires an in-depth understanding of the intricacies of each jurisdiction to ensure compliance and mitigar los riesgos normativos.

Cultural disparities further compound the complexity of cross-border transactions, influencing negotiation strategies, decision-making processes and post-acquisition integration efforts. Differences in business etiquette, communication styles and management practices can significantly influence transaction outcomes and the éxito a largo plazo of the acquired entity. Therefore, buyers should prioritize cultural due diligence and encourage cross-cultural collaboration to bridge cultural differences and foster synergy between organizations.

The role of local expertise

Competent local teams with a thorough understanding of the regulatory landscape, business environment and cultural norms of the target market are critical to the success of cross-border transactions. Local teams play a key role in facilitating due diligence, identifying market opportunities and navigating complex legal and regulatory requirements. Moreover, their presence enhances the integración posterior to acquisition, as it provides valuable insight into local business practices, consumer preferences and competitive dynamics.

In addition to in-house resources, buyers are often supported by cross-border advisors who specialize in a variety of disciplines, including legal, financial, tax and cultural advisory services. These advisors bring their expertise and experience in the complexities of international transactions, providing orientación estratégica and mitigating the risks inherent in cross-border engagements. By leveraging local expertise and using experienced advisors, buyers can effectively navigate the intricacies of international M&A transactions and take advantage of growth opportunities in foreign markets.

Selection of cross-border consultants

Selecting the right cross-border advisors is a critical step toward success in international transactions. In addition to evaluating the background and experience of potential advisors, it is important to consider other key factors that may influence the effectiveness of their contribution. Here are some additional aspects to consider when selecting cross-border advisors:

- Profundidad de conocimiento del mercadoIn addition to having experience in international transactions, it is crucial that advisors possess a thorough knowledge of the target market and its local particularities. This includes understanding market dynamics, industry-specific regulations and regional economic trends. Advisors with detailed knowledge of the local business environment can offer strategic insights that maximize transaction value.

- Red y relaciones: Advisors with an extensive local network can facilitate access to additional resources and key partners in the target market. These connections can be valuable in overcoming regulatory hurdles, identifying investment opportunities and establishing strong relationships with local partners. The ability of advisors to establish and maintain effective relationships in the foreign market can make a difference in the long-term success of the operation.

- Adaptabilidad cultural: Cultural sensitivity and adaptability are essential qualities for advisors in international transactions. In addition to understanding cultural differences, advisors must be able to adapt to different communication styles, negotiation protocols and business practices. The ability to navigate and mitigate cultural challenges can facilitate effective collaboration between all parties involved in the transaction.

- Estrategias de gestión de riesgos: Advisors must be able to identify and manage the risks inherent in international transactions. This includes assessing the legal, regulatory, financial and reputational risks associated with international M&A transactions. Proactive advisors can develop risk mitigation strategies tailored to the specific needs of the transaction and ensure that the buyer's interests are protected.

Success in international mergers and acquisitions

International mergers and acquisitions represent a vital avenue for companies seeking global expansion and strategic growth. However, navigating the complexities of these transactions requires an in-depth understanding of the diversos panoramas jurídicosThe regulatory, economic and cultural challenges of borders. From logistical challenges to cultural disparities, each aspect requires meticulous planning, expert execution and strategic partnerships.

By recognizing the importance of local expertise and having the support of experienced cross-border advisors, buyers can enhance their abilities to overcome challenges and take advantage of opportunities in foreign markets. The importance of local expertise cannot be overemphasized. equipos localesWe have a team of experts with in-depth knowledge and ideas to facilitate due diligence and ensure a seamless integration after the acquisition.

In addition, the selection of asesores transfronterizos is a key determinant of success in international transactions. Beyond track record assessment, factors such as depth of market knowledge, network and relationships, cultural adaptability and risk management strategies play a critical role in maximizing transaction value and mitigating risks.

By addressing these considerations comprehensively, companies can unleash the full potential of international expansion and achieve a crecimiento sostenible en el interconectado mercado global actual.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: