At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

What is direct lending or debt funds? Definition, typology and examples

What is Direct Lending?

Direct Lending or Debt Funds are a direct form of financing to the company, without the intermediation of financial institutions. Its actors are investment funds, which grant loans to companies with the aim of obtaining a return on their investors' capital.

This funding alternative to bankingThe Spanish fund of funds, consolidated in countries such as the US and the UK, is gaining strength in Spain. At first, these funds were international or had foreign participation, although little by little funds of Spanish origin have been emerging.

The P2P lending and the platforms of crowdlending are sometimes considered as part of the DL sector.

How does Direct Lending work?

On the one hand, the borrowers are usually small or medium-sized enterprises (SMEs) rather than large listed companies or large corporations that already, for example, have access to corporate bond issuance.

On the other hand, the lenders However, they will only consider loans above €5M, so direct lending is mainly focused on mid-market borrowers.

Why is DL more flexible and agile than Bank Finance?

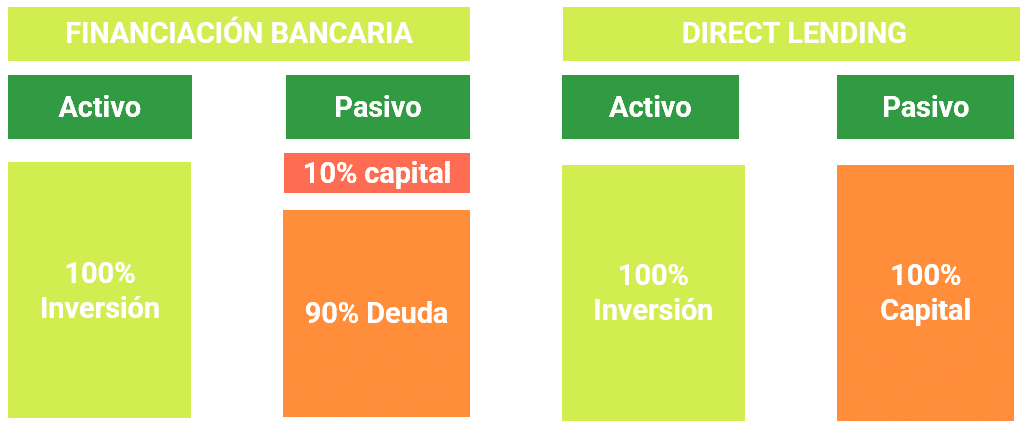

Bank Finance requires more regulation compared to Direct Lending, which results in greater rigidity and limitations for the former, making it in many cases less attractive.

Main advantages of Direct Lending

The advantages of Direct Lending include:

- Flexibility to adapt to the needs

- The borrower's flow generation

- LGuarantees are clearly less demanding for companies than syndicated loans or securities.

- The amortisation period is longer and generally in bullet form (100% at the end of the period).

- They are not subject to banking regulations, which allows them to obtain the necessary financing more quickly.

It should be borne in mind that the cost of direct lending is usually higher than bank lending. In addition, it is sometimes necessary to carry out an audit in order to receive the capital and, on occasions, the funds tend to condition the financing to hold a seat on the Board of Directors in the borrowing company.

Differences with Venture Capital

- No dilution of shareholding

- Does not affect the management of the company

- Does not oblige you to a joint exit after the investment process

- Simpler and streamlined negotiation process

- Lower cost. Equity is always the most expensive financing

Uses of Direct Lending

- To develop an acquisition-based growth plan

- To finance investments in high fixed assets (new plants, etc.)

- For the financed buy-back of minority shareholders

- Extraordinary dividend payment

- Refinancing of a short and highly atomised banking pool

Direct Lending Funds in Spain

In 2014 several funds such as Bravo capital, Iberian Private Debt or Aria Capital started operating under the direct lending modality in our country.

Bravo Capital was founded in November 2013 by U.S. funds Avenue Capital and JZ Capital, and in January 2014 it began operating in our country.

Its objective is to complement banking by granting direct lending loans. Bravo closed 2014 with more than 300 million euros in financed operations.

One of the first funds created in our country, it has as its protagonists the American Muzinicha manager specialised in alternative financing and Arcanum, 300 million to provide loans of up to seven years to 15 to 25 companies in all sectors.

The fund called Iberian Private Debt invests in loans and private credit issues of healthy Spanish and Portuguese companies and is aimed at institutional investors, Family Office and Private Banking.

"The vehicle is designed to support companies in their growth, internationalisation and export activity," says Diego Gutierrez.

Renta 4 Bank and AFI, created in June 2014 a direct lending fund managed by Aria Capital, the joint venture created by Renta 4 Banco and Afi, whose participants are national and international institutional investors. The volume of the fund is €200M. They lend to companies with between €50m and €500m in annual turnover in any sector, excluding only finance, real estate and emerging technologies.

Bankinter did not want to be left behind and in 2014 decided to promote direct lending to companies by joining forces with the fund manager Magnetar Capital. Subsequently, in view of its success, it signed another agreement with Mutua Madrileña.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: