At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

Earn-Outs in Mergers and Acquisitions: Key Factors

M&A negotiations usually revolve around the valuation of the target company. However, when buyers and sellers cannot agree on the current value, a pricing mechanism known as an earn-out comes into play. Earn-outs in mergers and acquisitions serve as contingent purchase prices, where the buyer agrees to pay additional quantities if the company achieves pre-determined milestones within a specified timeframe after the closing of the transaction.

In this article we look at the ins and outs of earn-outs, their mechanisms, advantages, challenges and implications for both buyer and seller.

Concept and functionality

Earn-outs in mergers and acquisitions are multifaceted instruments in M&A transactions, which serve several purposes beyond mere valuation alignment. In addition to bridging valuation disparities, earn-outs also serve the following purposes mitigating buyer risk by linking a portion of the purchase price to the future performance of the target company.

For example, an acquirer may accept an earn-out agreement conditional on the target company obtaining regulatory approvals, obtaining patents or achieving certain post-acquisition profitability metrics. In essence, earn-outs in M&A offer sellers the prospect of higher profits if their optimistic forecasts materialise, thereby encouraging a alignment of incentives between both parties involved in the transaction.

Advantages and Disadvantages

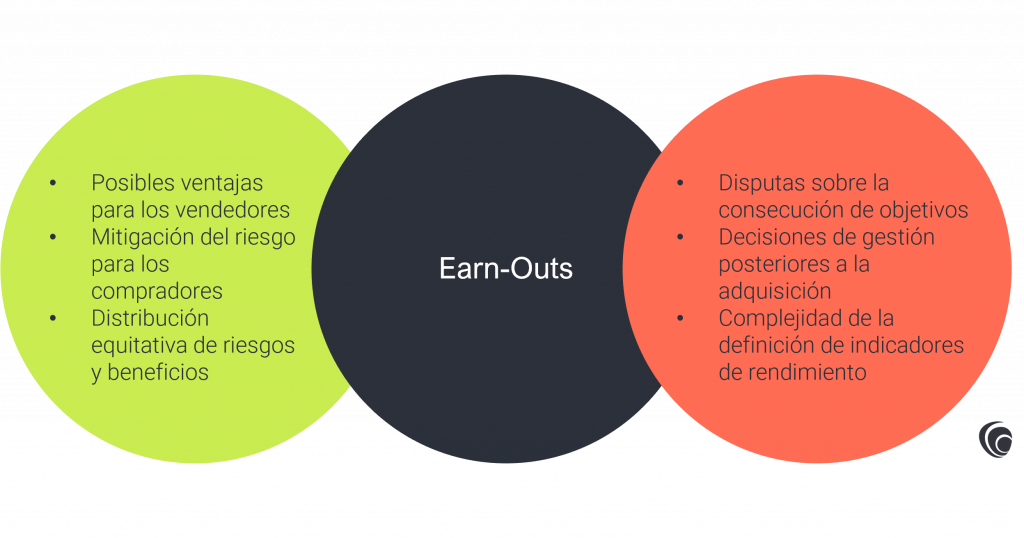

Los «earn-outs» ofrecen tanto oportunidades como desafíos, ya que sirven como mecanismo para la realización de valor adicional y la mitigación de riesgos, aunque introducen complejidades y posibles disputas:

Advantages:

- Potential benefits for vendors: Repurchase agreements offer sellers the opportunity to realise additional value beyond the initial purchase price if the target company exceeds post-acquisition performance expectations.

- Risk mitigation for buyers: By linking payments to the target company's performance, buyers can effectively mitigate risk and align their financial outlay with the actual value generated by the target company over time.

- Equitable distribution of risks and rewards: Earn-outs encourage a more balanced distribution of risk and reward between buyers and sellers, ensuring that both parties share in the success of the acquired business.

Disadvantages:

- Disputes over the achievement of objectives: Disagreements may arise between buyers and sellers over the achievement of objectives, which can lead to disputes and sour the post-acquisition relationship.

- Post-acquisition management decisions: Differences in strategic direction or post-acquisition operational decisions may affect the target company's ability to meet earn-out objectives, leading to friction between the parties.

- Complexity in defining performance parameters: Define and accurately measure the performance parameters can be complicated, especially when targets are based on subjective criteria or when operational changes affect the target's performance trajectory.

Factors influencing the structuring of earn-outs

The structuring of earn-outs in mergers and acquisitions is subject to the influence of several factors, each of which exerts a significant impact on the negotiation process and the ultimate outcome of the deal. Key considerations include the initial valuation of the target company, expected performance indicators, risk assessment, strategic imperatives and relevant legal and regulatory considerations. Both buyers and sellers must plan and negotiate meticulously to defining profit targetsThe company's management has a strong commitment to the development of a comprehensive and transparent strategy, establishing precise timelines and devising payment mechanisms that promote alignment and mitigate potential conflicts or misunderstandings.

Set expectations

A effective communication and comprehensive documentation of the deal are imperative to managing expectations around earn-outs in mergers and acquisitions. The parties must anticipate and address potential changes in the target company's operating landscape post-acquisition, ensuring that earn-outs remain relevant and achievable in changing circumstances.

Conflicts often arise when parties fail to anticipate or adequately address operational changes or when there is ambiguity surrounding the definition and measurement of performance parameters. Clarity, transparency and mutual understanding are therefore essential to build trust and minimize the likelihood of conflict after the transaction.

Definition of objectives

Earn-out targets can take two main forms: event-based or outcome-based, each of which presents unique challenges and complexities. Event-based earn-outs, such as obtaining regulatory approvals or patents, typically offer straightforward criteria for target achievement.

In contrast, performance-based earn-outs, which are based on metrics such as revenue or profitability, require meticulous definition and measurement due to their inherent subjectivity and susceptibility to interpretation. Both sellers and buyers often request audit rights to verify the accuracy and fairness of earn-out calculations in mergers and acquisitions, safeguarding their interests and ensuring compliance with mutually agreed terms.

Earn-Outs vs. reinvestment of capital

Although earn-outs are valuable instruments for bridging valuation disparities and aligning the interests of buyers and sellers, equity reinvestments represent a alternative mechanism with distinct advantages and challenges. Equity reinvestments allow sellers to retain stakes in the target company, thereby encouraging continued participation in its long-term growth and success. While this arrangement aligns buyer and seller interests and facilitates post-acquisition integration, it also introduces complexities related to governance, decision making and output.

Ultimately, the choice between earn-outs and equity rollovers depends on the parties' long-term objectives, risk tolerance and strategic vision of the target company.

Cliffs, levels and buffers

Los acuerdos de «earn-out» pueden estructurarse con diversas características, como pagos «cliff», pagos escalonados y topes, diseñados para gestionar el riesgo e incentivar eficazmente el rendimiento. Los pagos escalonados ofrecen binary resultsThe right to receive benefits is only triggered if a specific objective is achieved, otherwise no payment is made.

In contrast, tiered payments offer gradual rewards for the achievement of incremental goals, allowing salespeople to receive partial payments even if the full earn-out is not realized. Caps impose a ceiling on the total consideration payable, thus limiting the buyer's potential liability while offering sellers the opportunity to earn rewards commensurate with the target's performance.

The role of earn-outs in the success of mergers and acquisitions

In conclusion, earn-outs in mergers and acquisitions represent a versatile and valuable tool in the M&A toolbox, as they offer a means to bridge valuation disparities, manage risk, and align effectively the interests of the buyer and the seller.

However, the success of earn-out agreements depends on clear communication, meticulous planning and mutual understanding between the parties. Carefully defining objectives by setting realistic expectations and structuring deals with transparency and fairness, buyers can effectively manage the complexities of M&A transactions, ensuring optimal outcomes for all parties involved.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: