At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

Cost of Capital: errors in valuation

Among the different existing methods for valuing companies related to the cost of capital, the discounted cash flow method is undoubtedly one of the most widely used. However, its greatest difficulty lies in calculating the appropriate discount rate, a task that is not exempt from numerous errors that are frequently made and which we will explain in the following lines.

What is the Discounted Cash Flow (DCF) method?

The discounted cash flow method is based on the idea that the value of a company's shares, assuming its continuity and operation, reflects its capacity to generate cash for shareholders. Thus, the method requires the estimation of future cash flows and their discounting at a rate appropriate to the cash flow rate used.

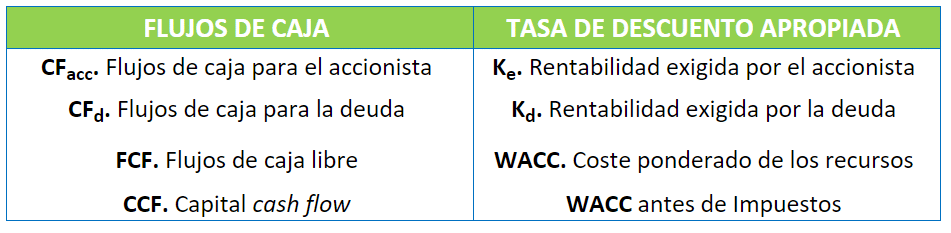

The calculation of cash flows is based on the different financial items linked to the generation of cash flows (e.g. sales collections, labor payments, repayment of receivables...) and their detailed and careful forecasting. Once the projections have been obtained, the cash flow to be used must be selected, as the discount rate to be used will depend on this choice. Thus, the different cash flows correspond to the following discount rates:

WRONG DEFINITION OF WACC

Given the multitude of existing concepts and formulas, it is common to confuse the definition of WACC with that of Ke o la del Ku among others. To avoid this mistake, the correct WACC formula should be remembered:

where:

Ku=cost of unleveraged company equity

Kd=cost of debt

D=value of debt

E=value of shares

T=tax rate

CALCULATING WACC USING DEBT AND EQUITY BOOK VALUES

Observing the WACC formula above, the values of debt and equity should be used. These values should not be obtained from their book value but from their market value in order to be consistent with the definition and interpretation of the WACC.

ASSUME A CONSTANT CAPITAL STRUCTURE

Since companies tend to vary their capital structure over the years, the WACC to be used should change for each period, adjusting to the expected debt for each year. A change in the amount of debt will affect the value of the shares and therefore the WACC.

USE A WACC LOWER THAN THE RISK-FREE RATE

El Ke y Ku must always be higher than the risk-free rate. However, the WACC can be lower than the risk-free rate only in the case of companies or investments with a very small risk.

VALUING ALL THE BUSINESSES OF A DIVERSIFIED COMPANY USING THE SAME WACC

When valuing a company that has lines of business in different countries or industries, it is important to perform the valuation adjusting it to the specific circumstances of each business. Thus, the risk presented by a company's operations in Spain cannot be assimilated to those it might face in Venezuela, for example.

ASSUME THAT THERE IS A SINGLE WACC

It is clear that investors have different expectations about a company's cash flows and different assessments of their risk, which leads to different WACCs. Therefore, there is no single WACC that exists and can be obtained for all investors, but rather, depending on each investor's assessments and estimates, it will vary.

Source: 201 Common errors in company valuation. Pablo Fernández. 2008.

You know our section of HowTo with a lot of explanations and tips around M&A?

Download the complete guide to company valuations here:

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: