At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

The Sale and Purchase Agreement in M&A Transactions: 4 Key Elements

In mergers and acquisitions (M&A), the sale and purchase agreement is a key tool for risk allocation. Sellers play a crucial role in this process, as the guarantees they offer to buyers directly influence the level of risk assumed by the latter. Essentially, the more protections and warranties a seller is willing to offer in the purchase agreement, the lower the risk for the buyer, potentially resulting in a lower risk for the buyer.Translated with DeepL.com (free version) higher purchase price. This relationship between risk and return is fundamental; higher risk is often accompanied by lower returns, and vice versa.

In this article, we will take a closer look at the key elements of the sale and purchase agreement, providing a comprehensive understanding of the importance and implications of each component in mergers and acquisitions (M&A) transactions.

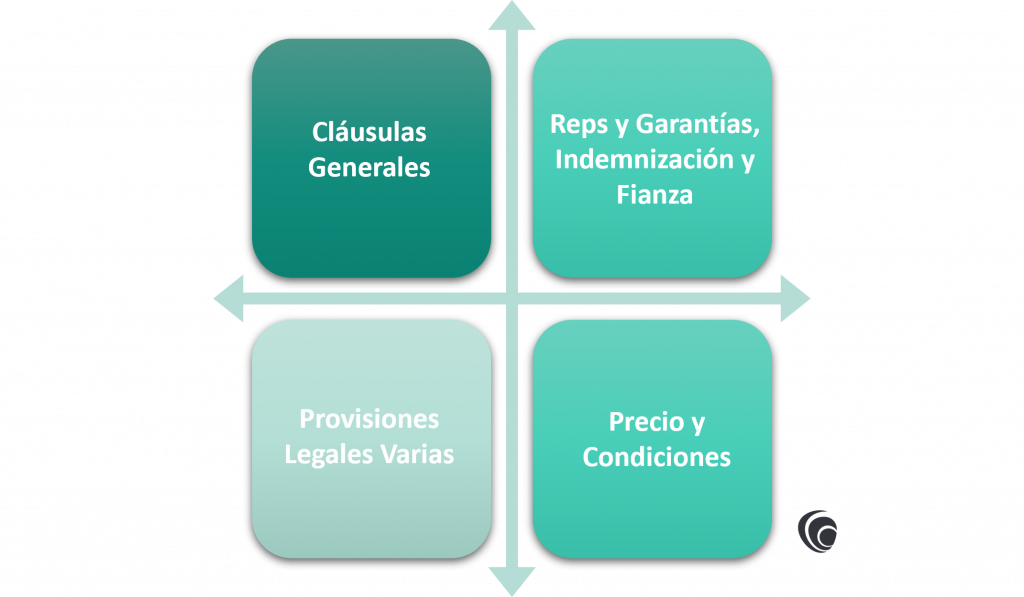

Key elements of the sales contract

In a comprehensive purchase agreement, several key elements must be meticulously addressed to ensure clarity, fairness and enforceability. These elements cover various facets of the transaction and lay the foundation for a successful transaction.

General clauses

When drafting a sound sales contract, clarity and precision are vital:

- Definitions: A well-drafted purchase agreement includes clear definitions of key terms to avoid ambiguity. This section clarifies crucial concepts such as closing, change of possession and other terms essential to understanding the agreement.

Price and conditions

When structuring the financial aspects of the transaction, particular attention should be paid to ensuring fairness and transparency for all parties involved. The price and conditions section covers the following elements:

- Purchase price: This clause defines the total consideration for the transaction and the form of payment. It specifies whether the purchase price comprises cash, shares, debt, profit or other forms of consideration.

- Allocation of the purchase price: This segment, which addresses the tax implications, describes how the purchase price will be allocated among the different assets or entities involved in the transaction.

- Working capital: This section, which defines working capital and its adjustments between signing and closing, ensures clarity on the valuation of inventory and its impact on the purchase price.

- Closing and apportionment costs: By clarifying the distribution of the closing costs between the parties, this clause ensures fairness and transparency in the transaction.

- Transition period: By detailing the terms and duration of the post-closing transition agreement, this section facilitates a smooth transition of operations between the parties.

Representations and warranties, indemnification and security deposit

To protect both buyer and seller, provisions relating to representations, warranties, indemnities and escrow are essential. This section includes:

- Declarations and assurances: Representations and warranties encompass the commitments and declarations made by each party to protect against misrepresentation. They function as a form of protecciónThe insurance policy, similar to an insurance policy, in case a statement is later found to be false. For example, a party may provide assurances that all taxes have been duly settled and that there is no ongoing litigation. These guarantees are an important part of the purchase agreement and are tailored to the particular nature of the business in question. Depending on the sector, these commitments may focus on a number of areas, such as environmental regulations in the case of manufacturing companies or intellectual property issues in the case of technology companies..

- Knowledge and materiality qualifiers: En los casos en los que no se puede garantizar una certeza total en relación con una declaración, se emplean calificativos como «según el leal saber y entender del Vendedor» o «según el leal saber y entender del Vendedor». Estos calificativos indican el grado de conocimiento o comprensión de la parte con respecto al asunto en cuestión.

- Exclusions: The representations and warranties are made in the affirmative, which means that they affirm the accuracy of certain statements. However, exceptions to these assertions are meticulously documented by legal counsel in the disclosure annexes.

- Survival periods: Normally, representations and warranties have a limited duration, expiring after a period ranging from 12 to 24 months. However, some declarations, in particular those relating to tax obligations, last indefinitely, remaining in force beyond the standard term.

- Compensation: This segment describes the dispute resolution procedure and includes a commitment to indemnify the opposing party for breaches of the agreement. The amount of the indemnification is restricted by thresholds called cestas, que fijan unos mínimos, y unos topes conocidos como topes.

- Cesta – Mínimo: Functioning like an insurance excess, a basket sets the minimum level that must be exceeded to trigger indemnity. The typical basket size is 0.75% of the purchase price and can be either tilting, starting at zero liability, or non-tilting, starting at the amount above the deductible.

- Límite Máximo: A cap denotes the maximum limit of compensation, which is usually between 10% and 20% of the purchase price.

- Partes implicadas: El comprador suele solicitar la indemnización de varias partes, como todos los accionistas y ejecutivos clave. En casos de múltiples accionistas, es aconsejable evitar acordar una «responsabilidad solidaria».

- Recursos: The contract of sale should specify whether indemnification is the sole remedy of the parties.

- Proceso de indemnización: The purchase agreement will also describe the procedure for handling compensation claims.

- Cuenta de garantía bloqueada: The amount of the escrow account typically ranges from 10% to 20% of the purchase price, depending on the perceived likelihood and potential magnitude of the risks.

- Plazo: Most of the escrows cover 12 to 24 months.

- Conditions: The purchase agreement should detail the entity controlling the release of escrow funds and the dispute resolution mechanism.

Miscellaneous legal provisions

In addition to the basic components of the sales contract, several legal provisions ensure the enforceability and completeness of the contract. These include:

- Form of the transaction: Esta cláusula especifica la estructura jurídica de la transacción, ya sea una venta de activos, una venta de acciones o una fusión, lo que repercute en las implicaciones fiscales y la continuidad operativa.

- Condiciones y pactos: This segment, which addresses pre-closing contingencies and post-signing obligations, describes responsibilities such as maintaining business operations and fulfilling purchase orders.

- Contingencies and conditions: El acuerdo de compra incluye disposiciones para los acontecimientos que deben producirse antes del cierre, como la obtención de financiación o la aprobación del propietario. Otra condición típica es asegurar que las declaraciones y garantías sigan siendo exactas en la fecha de cierre, lo que se conoce como «bringdown».

- Pactos: These are obligations of the parties between the signing of the purchase agreement and closing, such as maintaining normal business operations, retaining a certain number of employees and fulfilling outstanding purchase orders. Covenants are generally not subject to negotiation.

- Incumplimiento y recursos: This provision, which defines the conditions for termination of the sales contract and remedies in the event of non-performance, safeguards the interests of the parties in the event of unforeseen circumstances.

- Disposiciones legales varias: This section, which covers various legal aspects such as attorneys' fees, mediation, applicable law and notifications, ensures the enforceability and completeness of the agreement.

Timing y Consideraciones

The signing of the purchase agreement usually takes place on or near the closing date, marking the culmination of the negotiations and due diligence. Pre-closing contingencies and covenants, including regulatory approvals, financing agreements and employee retention agreements, are intended to safeguard operational continuity and mitigate risks. The parties should meticulously plan the timing of signing and closing to conform to regulatory requirements, financing timelines and operational integration strategies. In addition, provisions such as material adverse change clauses and termination rights can be included to address unforeseen circumstances and protect the interests of both parties.

Conclusion

Sellers play a key role in this part of the M&A process, as the guarantees they provide directly influence the risk assumed by the buyer and thus the price and terms of the transaction.

We have explored the key elements of the sale and purchase agreement, shedding light on the importance and implications of each component in M&A transactions. From the general clauses to the legal provisions and the structuring of the transaction, understanding these elements is crucial to crafting an effective M&A deal. solid purchase agreement and enforceable that fits the objectives of both parties. By effectively navigating these components, parties can increase the likelihood of a successful transaction and maximise value creation.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: