Athos Capital's investment in Agroptima is analysed from a Corporate Finance point of view. Athos Capital is a startup that has designed a tool for the mobile management of harvests and crops.

Agroptima, the technological solution to improve the efficiency of the agricultural sector

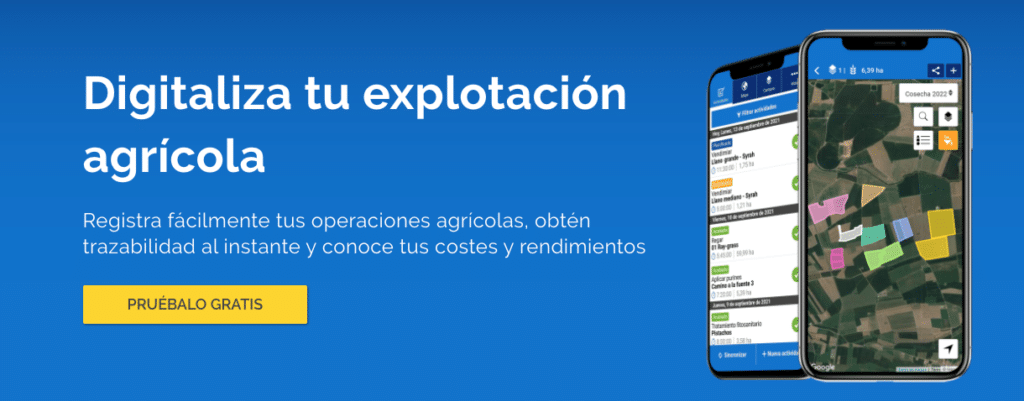

Agroptimathe startup created in 2015 by Emilia Vila and Ferran Gascón, was created with the aim of streamlining the work and saving time for agricultural professionals: farmers, agricultural and agri-food companies. Agroptima's proposal allows, through a mobile app, the registration of harvests, as well as yield and traceability reports.

For the achievement of this project Agroptima has a team of farmers and engineers who have focused their efforts on creating an application that allows the farmer to carry out in a simple way a real-time analysis of the entire process of exploitation of their crops, recording the daily work in the field through the mobile application and then consult all the information on a web platform, where you can download all the data of the crops, yield reports, as well as the mandatory traceability reports required by the Ministry of Agriculture.

▷ You may be interested in: Why and when to look for investors or shareholders?

Agroptima 1.2M€ investment to internationalise its service

The startup Agroptima has raised €1.2M in a round led by Athos Capital, accompanied by Esade Ban and its current partners. For Esade Ban this has been the largest investment round in its history, after the Signaturit mobile app, closed in 2017.

Athos Capital is a venture capital whose objective is to make selective investments in unlisted companies with high growth potential. It was founded by Fernando Castiñeras, who began his career at Arthur Andersen in 1990 and twelve years later founded, together with other partners, the consultancy firm Management Solutions. At the end of 2013, he left Management Solutions as a partner, and in 2016 he created Athos Capital with the help of a team of experts in venture capital and strategic consulting. The firm is currently managing its first fund: Athos Capital Fund I.

With the closing of this transaction, Agroptima expects to exceed one million euros in turnover in the next twelve months, allocating the capital raised in the investment round - the second investment round in which Esade Ban has participated - to its internationalisation and the continued development of the platform.

Analysis of the figuresThe sector AgTech

Reflecting global venture capital markets, there was a considerable decline in deal flow (-17%) in this sector mainly due to a large contraction in early stage financing. While agri-food technology is maturing, loss of activity at the planting stage or weather instability is still a relevant factor undermining investor confidence.