At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

Objective Valuation in M&A: How to Identify and Mitigate Biases

In the world of mergers and acquisitions, one issue stands out above all others: agreeing on a price through an objective valuation. Without this crucial step, a deal cannot materialise. However, reaching a consensus on the value of a company is not always easy.

The valuation is a subjective process, especially when it comes to private companies. Although there are several methods for valuing a company, each with its own limitations and dependent on certain assumptions, none offers an absolute solution. Ultimately, it is the methodologies employed and the assumptions made by individuals that determine the perceived value of a company. This subjectivity underscores the absence of an exact science in company valuation, making it a estimation rather than a precise calculation.

In this practical guide, we will address the role of human judgement in the objective valuation process and advocate a disciplined approach among buyers.

How to avoid biased and emotional decision-making

As mentioned above, the valuation of a company is an inherently subjective and complex process, where the determination of value is not governed by objective standards, but depends to a large extent on the individual perceptions and interpretations of those involved in the process. This subjectivity, while unavoidable, opens the door to a range of emotional biases and influences that can significantly affect the integrity of the decision-making process.

Among the most troubling of these is confirmation bias, a psychological phenomenon in which decision-makers actively seek information that confirms their pre-existing beliefs, while ignoring or dismissing any evidence that contradicts their views. This bias, although often unconscious, distorts the objectivity of the valuation process and can lead to erroneous conclusions about the true value of the company in question.

In addition to cognitive biases, emotions also play a crucial role in the valuation process. Pressure to close a deal, anxiety about missing an opportunity or overconfidence in one's own abilities can influence individual perceptions of company value and ultimately the decisions made. These emotions can lead decision-makers to overlook critical aspects of an objective valuation process or to underestimate the associated risks to the transaction, compromising the integrity of the process and leading to suboptimal decisions.

To counter these risks and ensure a more objective and informed valuation, it is crucial that buyers adopt a disciplined and rigorous approach to the valuation process. This involves cultivating an analytical and objective mindset, as well as applying structured and transparent processes to guide informed decision-making. Acknowledging the subjectivity inherent in the valuation process and actively addressing cognitive biases and emotional influences enables buyers to improve accuracy and reliability of their valuations, thus promoting more informed and accurate decisions in the transactional context.

The importance of a disciplined approach to objective assessment

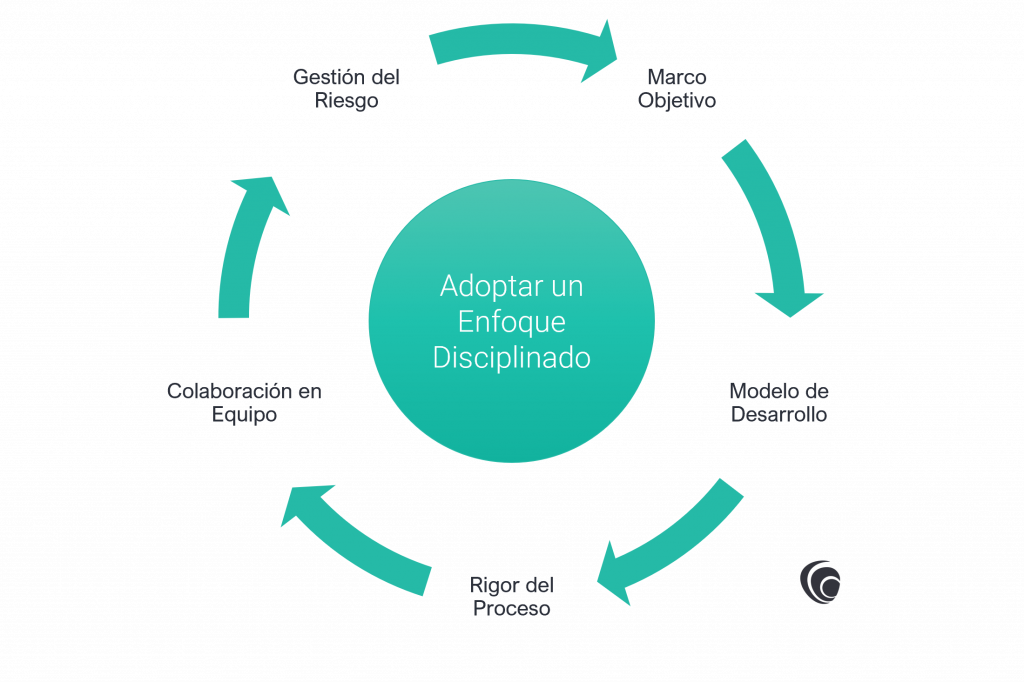

A disciplined approach to valuation is essential to ensure sound investment decisions and mitigate inherent biases and emotional influences. By following a structured framework and rigorous process, buyers are able to minimising the risk of overvaluation and make prudent investment decisions. This disciplined approach encompasses several key principles:

- Objective framework: Buyers should develop a comprehensive valuation framework that incorporates various methods and inputs from a variety of perspectives. By employing a systematic approach to objective valuation, buyers can mitigate the influence of bias and emotion, promoting objectivity and consistency in decision-making.

- Model development: Buyers should establish robust valuation models that take into account the unique characteristics and dynamics of each transaction. These models should integrate financial projections, risk assessments and market data to facilitate informed decision-making and mitigate valuation uncertainties.

- Rigour of processes: Rigour in due diligence processes and procedures is essential to ensure the integrity and reliability of valuations. By conducting thorough analyses and reviewing all relevant information, buyers can identify potential risks and uncertainties, enabling them to make prudent investment decisions.

- Team collaboration: Collaboration between various functional teams within the organisation is critical to developing comprehensive valuation models and assessing the strategic implications of a transaction. By leveraging the expertise of different stakeholders, buyers can gain valuable insights and perspectives, improving the robustness of their valuation assessments.

- Risk management: Effective risk management strategies are essential to mitigate the uncertainties inherent in M&A transactions. Buyers should conduct thorough risk assessments and develop contingency plans to address potential challenges and mitigate adverse outcomes.

Adopting a disciplined approach

In short, adopting a disciplined approach to the valuation process is crucial to ensure sound investment decisions and mitigate inherent biases and emotional influences. Through the development of an objective framework, the establishment of robust valuation modelsBy maintaining rigorous due diligence processes, fostering team collaboration and effectively managing risk, buyers can improve the accuracy and reliability of their valuation assessments. This disciplined approach not only promotes informed decision-making, but also helps to mitigate the risks associated with M&A transactions, thereby ensuring the long-term success of corporate investments.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: