At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

Key Aspects of LOI Negotiation in a M&A Transaction

The negotiation of a letter of intent (LOI) in a merger and acquisition (M&A) transaction is a critical step that can largely determine the final outcome of the transaction. In this step, sellers need to take into account a number of key considerations in order to protect your interests and maximise your company's value. In this article, we will explore the fundamental role of LOI, its negotiation nuances and strategies for exerting influence and achieving optimal outcomes in M&A transactions.

Overview of the LOI negotiation

In LOI negotiation, while strategies may vary, understanding your strategic leverage points is essential to steer negotiations in your favour. Let's start by exploring the typical strategies employed by buyers during LOI negotiation.

Buyer strategies

Buyers strategically draft letters of intent after assessing the suitability of a target, including critical elements such as purchase price, inclusion of assets and liabilities, exclusivity clauses and closing conditions. Conversely, sellers often overlook the seriousness of the LOI negotiation, falling prey to buyer tactics aimed at exploiting impatience and lack of foresight:

- Rushing to sign an LOI: Experienced buyers take advantage of sellers' urgency, pressuring them to quickly sign the LOI and trigger exclusive negotiations. These exclusivity clauses make sellers vulnerable, eroding their LOI bargaining power and allowing buyers to dictate favourable terms.

- Gradually lower the priceBuyers can take advantage by making sellers invest a lot of time and money in a deal before they start negotiating prices and terms. This leaves sellers exhausted and in a weak bargaining position, especially where negotiate exclusively with one buyer, while buyers may be negotiating with several sellers simultaneously. This dynamic can lead sellers to compromise in negotiations, benefiting the buyer until the last moment before closing.

- Potential damage from withdrawal: Buyers exploit the reputational risks faced by sellers in withdrawing from the deal, coercing compliance for fear of tarnishing the company's credibility. This asymmetry in leverage reinforces buyers' boldness to employ renegotiation threats, further weakening sellers' positions.

Undefined terms in the LOI

The potency of buyers' strategies emanates from poorly defined or ambiguous LOIs, underlining the imperative to clearly define key terms in them. Otherwise, there is a risk of granting bargaining advantages to buyers, which amplifies vulnerabilities during subsequent contract purchase negotiations.

Failure to define certain terms in the letter of intent can be devastating for you. If a term is not defined in the letter of intent, the contract of sale will be will draft in favour of the buyer in the first draft and it may take many rounds of negotiation to undo a term that was not defined in the letter of intent. Here are some terms that could, but should not, be left undefined in the LOI:

- Working capital: It is essential to define working capital precisely, as it directly influences the final value of the transaction and the amount of money you will receive. Including how it will be calculated and which elements make it up will avoid misunderstandings and financial losses.

- Transition period: It is crucial to establish the length and terms of the transition period to ensure a smooth transition after the buyout. This can range from the transfer of knowledge and operations to the retention of key employees.

- Period of exclusivity: Exclusivity can be advantageous for both parties, but it is essential to set clear limits as to its duration and conditions. Without a clear definition, you could be tied to a single buyer for an indefinite period, limiting your options and putting pressure on your LOI negotiating terms.

- Retention: Withholding a certain amount from the purchase price is common in order to protect the buyer against possible problems after the purchase. It is crucial to define precisely the amount and criteria for the release of these funds to avoid unpleasant surprises and future disputes.

- Purchase price: Detailing the purchase price specifically and comprehensively, including possible adjustments, is essential to avoid misunderstandings and disputes during the closing process. This may also include conditions related to financing and payment structure.

- Conditions: Detailing the terms of the transaction, including any additional financing or special clauses, helps to avoid unpleasant surprises and ensures that both parties are fully informed and in agreement before proceeding.

Reasons why a LOI is needed

As noted, the letter of intent is a comprehensive document for any M&A transaction, even if it is not binding. Here is a list of the value that a well-drafted letter of intent adds to the transaction:

- Moral obligation: The LOI morally binds each party to the transaction, demonstrating good faith and candour before incurring significant costs for the Due Diligence and the negotiation of the purchase agreement.

- Commitment: The LOI assesses the seriousness and commitment of each party to the transaction. It serves to gauge the buyer's willingness to invest time and energy in the process, thus establishing a solid basis for the future negotiation of the purchase agreement.

- Express intentions: Although non-binding, the LOI expresses the intentions and priorities of each party, clarifying aspects such as the form of payment and other important terms.

- Clarify key terms: The LOI documents key terms, avoiding confusion or disputes later in the negotiation of the purchase agreement.

- Grant exclusivity: Few buyers will devote time and resources to due diligence without the guarantee of exclusivity, preventing the seller from seeking other offers.

- Reducing uncertainty: Defining the main terms of the sale in an LOI, even if non-binding, significantly reduces the likelihood of disagreements at later stages of the negotiation.

- Clearly define contingencies: The LOI clearly sets out the conditions that must be met before the transaction can take place.

- Allows for pre-approval of funding: Most lenders require an LOI before they will commit to spend on the loan appraisal.

- Granting permits: The LOI allows the parties to conduct mutual due diligence before committing to negotiate the purchase agreement.

- Agree on the price: Although the price is likely to change during Due Diligence, the LOI provides a common starting point for LOI negotiations.

Key considerations in negotiating a letter of intent

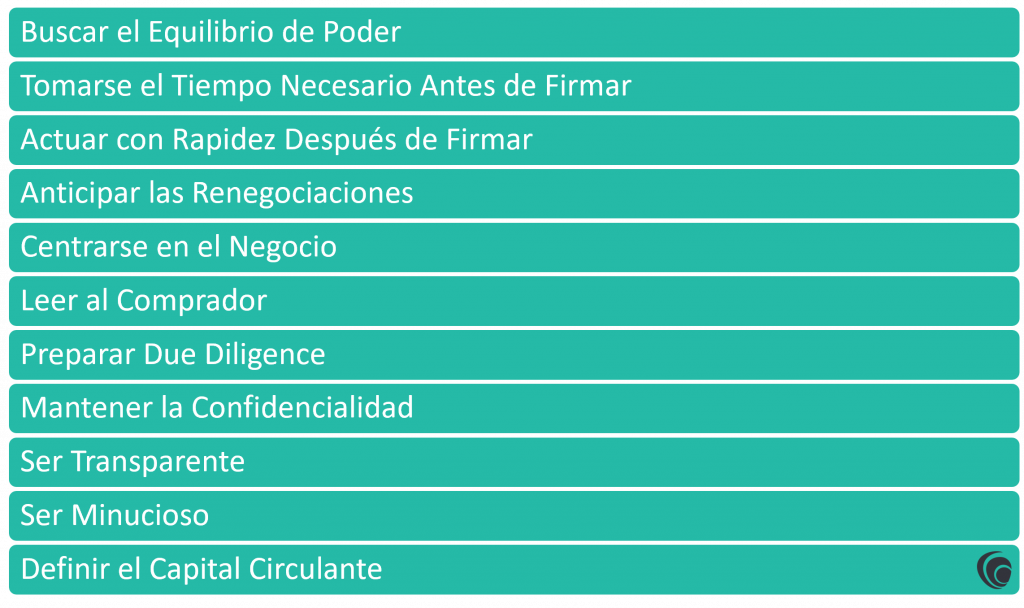

Having understood the importance of the LOI, let's delve into some of the most important considerations in negotiating the LOI, from establishing the balance of power to comprehensively defining the KEY TERMS. These guidelines are essential to protect the seller's interests and facilitate a smooth and efficient negotiation process.

The search for a balance of power

The signing of an LOI marks the beginning of formal negotiations between the seller and the buyer. However, it is important to recognise that this stage can also tip the balance of power in favour of the buyer. Exclusivity clauses in the LOI may limit the seller's options by committing the seller to negotiate exclusively with a single buyer for a certain period of time. Sellers therefore need to be aware of this change in the balance of power and try to spell out the critical terms in the LOI to avoid exploitation of ambiguities by the buyer.

Take the necessary time before signing

Although the tempting offers of an LOI may seem attractive, sellers should resist the temptation to rush into signing. It is crucial to take the time to carefully review and negotiate the proposed terms. Rushing to sign an LOI can expose sellers to unfair strategies by the buyer, who may back out or propose less favourable terms once the seller has committed.

Acting swiftly after signature

Once the letter of intent is signed, sellers must maintain a steady pace to close the deal. Delays can expose the company to additional risk and diminish the perceived value to the buyer. Maintaining momentum during this period is crucial to maximise the sale price and minimise opportunities for renegotiation by the buyer.

Anticipating renegotiations

One of the main concerns for sellers after accepting an LOI is the possibility that the buyer will attempt to renegotiating key conditions during Due Diligence. To avoid this, vendors need to take proactive steps, such as thorough preparation of the Due Diligence and early disclosure of potential problems. This helps set clear expectations from the outset and minimises unpleasant surprises during the sales process.

Focus on the business

While negotiating the LOI is crucial, sellers should not neglect the day-to-day management of their business. Maintaining the profitability and sales flow during this period is essential to avoid renegotiations based on changes in business performance. It is important to strike a balance between negotiating the LOI and the effective operation of the business.

Interpreting the buyer

Letters of intent are not standard and can vary significantly depending on the buyer and the nature of the transaction. Sellers should anticipating concerns The buyer's specific concerns in negotiating terms and proactively addressing them. Experience and proper guidance can help sellers identify and effectively address buyer concerns.

Preparing for Due Diligence

The Due Diligence is an integral part of the sales process and can influence the buyer's perception of the value and viability of the company. Sellers need to prepare in advance for the Due Diligence having the key documents available and organised in advance. This not only speeds up the sale process, but also reduces the chances that due diligence will negatively affect the company's performance.

Maintaining confidentiality

Confidentiality is paramount throughout the sales process to protect the seller's interests and prevent misuse of information by the buyer. Sellers should exercise caution in sharing sensitive information and seek controlled disclosure of confidential information to minimise the risks associated with disclosure.

Being transparent

Disclosing potential problems with the company upfront allows sellers to control the narrative and avoid unpleasant surprises during the sales process. Being transparent from the outset can help build trust with the buyer and avoid renegotiations based on later discoveries during due diligence.

Being thorough

Negotiating the LOI requires meticulous attention to detail. It is critical that the LOI cover all critical terms of the transaction from the outset. Avoiding leaving important provisions for later negotiations ensures a smoother process and protects the seller's interests. Clarity and thoroughness in drafting the LOI are essential to avoid misunderstandings and unfavourable renegotiations. Each term should be precisely defined and any ambiguity must be removed that may arise during the execution of the agreement.

Definition of working capital

Working capital can be a source of dispute if it is not clearly defined in the LOI. It is crucial to establish specific criteria for its calculation, including which assets and liabilities are included in the formula. Detailing how each component of working capital, such as inventories and accounts receivable, is determined helps to avoid disputes during the final audit of the balance sheet. A precise definition of working capital in the LOI provides safety and reduces risk of disagreements at later stages of the sales process.

Conclusion

It is clear that both sellers and buyers must be aware of the importance of the LOI as the starting point of the transaction, morally binding and laying the groundwork for future negotiations of the purchase agreement. Clarity in the definition of the terms, the pursuit of the balance of powerThe preparation for due diligence and transparency are key aspects that can influence the final outcome of the LOI negotiation. Ultimately, a well-negotiated and drafted LOI provides certainty, clarity and protection to both parties, reducing the uncertainty and risks associated with the transaction.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: