At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

Evaluation Phase: 3 Factors to Sell your Company

Embarking on the journey of selling your business is an important decision, and the valuation phase serves as a compass to guide you through this complex process. Am I looking to sell my business with in a way that is lucrativea buyer who identifies with my values or simply an exit from the company uncomplicated? These questions are the key to finding the best way forward.

Below, we take a closer look at the factors for selling your business that entrepreneurs need to consider when considering the sale of their business, providing insights that can shape the fate of your business legacy.

The first step towards a profitable exit: 3 Factors for selling your business

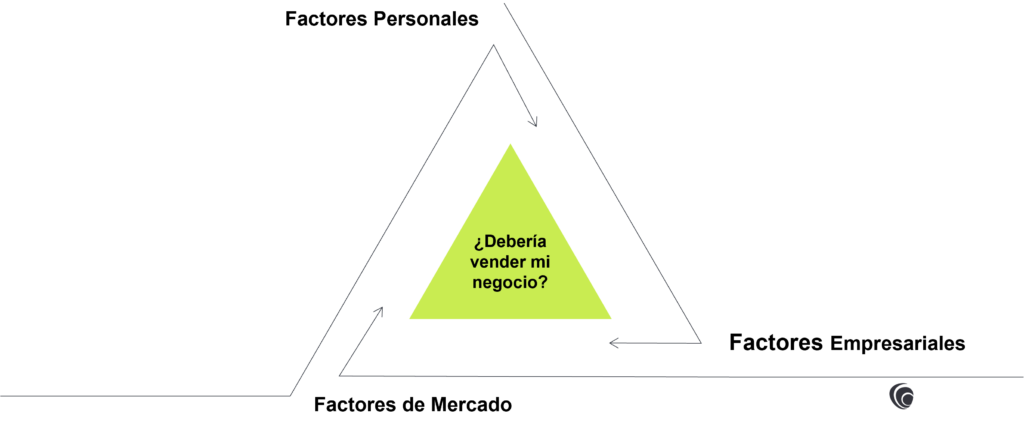

The decision to sell your company marks a significant milestone and emotionally charged, encapsulating the culmination of years, and often decades, spent meticulously cultivating and growing your business. This juncture is not a mere transaction, but a profound change that prompts introspection and evaluation. It is a crucial decision that requires a deliberate and strategic approach, guided by three essential elements that serve as a driving force in a complex terrain:

- Personal Factors Explore long-term objectives, motivations and post-sale considerations to inform decision-making.

- Market factors: Navigate external forces by deciphering sweet spots, understanding the competition and aligning with industry dynamics.

- Business factors: Uncover value through valuations, market multiples, value enhancement strategies and strategic exit possibilities.

Each of these factors will be examined in detail below, providing information on the considerations that accompany the decision to sell a company.

Personal factors

Your company's sales process requires a in-depth exploration and introspective consideration of personal factors that go far beyond mere financial considerations. This intricate journey requires a thorough examination of your long-term aspirations, motivations and inner strengths, which serves as the cornerstone upon which strategic decisions are meticulously crafted.

1.1 Long-term aspirations

Start with a deep dive into your long-term goals. Articulating aspirations lays the foundation for understanding how the sale aligns with these goals, ensuring purposeful decision making. Aligning the business journey with personal aspirations ensures purposeful decision making and mitigates post-sale regrets.

1.2 Motivations

Merging financial and non-financial objectives requires nuanced consideration. Peel back the layers with questions such as What long-term plans do my financial goals match with? Understanding the money as a means reveals a complete picture of aspirations.

1.3 Opportunity costs and industry dynamics

«El precio de cualquier cosa es la cantidad de vida que cambias por ella», subraya Thoreau. Más allá de las consideraciones financieras, la venta de su empresa profundiza en los opportunity costs and the dynamics of the sector. Exploring a sale from both quantitative and qualitative angles provides a holistic perspective.

1.4 Assessing burnout and satisfaction

Beyond goals and commitments, the factors for selling your business play a critical role in determining the feasibility of selling your business. The amalgam of personal satisfaction, commitment and burnout influences the overall decision-making landscape. It is crucial to distinguish routine challenges from deep dissatisfaction.

1.5 Post-sale horizon

Reflect on the values that underpin decisions and consider how you will spend your time after the sale. Selling your business is not a transaction, but a life-changing decision.

2. Market factors: Routing the horizon for business sales

When embarking on the journey of selling your company, the factors for selling your company externally determine the course of strategic decisions. Deciphering the optimal timeIn the face of competition, navigating the waters of competition, capital and cash flow become your tools.

2.1 Planning the sale of the company

Timing coincides with the peak of your company's and industry's performance. It aligns the sale of your business with the pace of your objectives, industry nuances and market dynamics.

2.2 Exploring competition, capital and cash flow

Critical questions integral to specific investments include: Is the competitive landscape intensifying? Is your capital sufficient for sector competition? If competition is increasing, contemplates a quick exit. The value of your business is linked to the trajectory of revenues and cash flow..

3. Business factors: Unlocking value in business sales

Understanding the factors that influence value in selling your business is vital. To optimise performance, it is essential to delve deeper into key aspects such as the comprehensive appraisalsThe report also includes a review of market multiples, value enhancement strategies and strategic exit possibilities.

3.1 Valuation and multiples

A recent valuation and an understanding of market multiples within your industry provide insight into the valuation of your business. Seeking a professional valuation ensures preparation for unexpected buyers and risk diversification.

3.2 Strategic exit options

Understand your exit options and contracting a third party for an unbiased assessment is critical. The alignment of your business with strategic objectives determines the next steps, whether the sale is to a strategic buyer, a competitor or a financial buyer.

3.3 Enterprise value management

Understanding the value trajectory of your company is crucial. Selling while the business retains its value is imperative. Evaluate the possibility of turning around a declining business and compare it to the opportunity to sell.

3.4 Preparing for sale

Preparing your business for sale involves eliminating deal breakers and optimise value drivers. If full preparation is not feasible, continuous changes while the company is in the market remain an option.

The road to a cost-effective transition

Selling a business is a multi-faceted journey that requires careful consideration of personal, market and business factors. The valuation phase serves as a compass, guiding entrepreneurs through this complex process towards a cost-effective way out. Understanding long-term aspirations, motivations and post-sale considerations at a personal level ensures decisive decision-making.

On the other hand, navigating external market factors such as timing, competition and financial dynamics is crucial to maximising value.

Finally, unveiling the true value of the company through valuations, strategic exit options and readiness assessments is essential to the success of the sale. By considering these factors in selling your business, business owners can set themselves on the path to a lucrative and successful transition, forging the destiny of their business legacy.

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: