At Baker Tilly, we believe that knowledge should be shared. Well-informed decision-making is a practice we live and share, which is why we invite you to discover the exciting world of M&A.

Deciding to Sell Your Business or Doubling Down on It

In the world of entrepreneurship, pivotal decisions often serve as crossroads, determining the trajectory of one's professional journey. One such juncture that entrepreneurs frequently encounter is deciding to sell your business, capitalizing on its current value, or to double down, reinvesting and steering it towards further growth. This decision, akin to navigating uncharted waters, holds profound implications for the future. This article aims to provide a comprehensive framework to guide entrepreneurs through this crucial decision-making process, emphasizing introspection and industry analysis.

Explora tus opciones: ¿Vender o redoblar la apuesta?

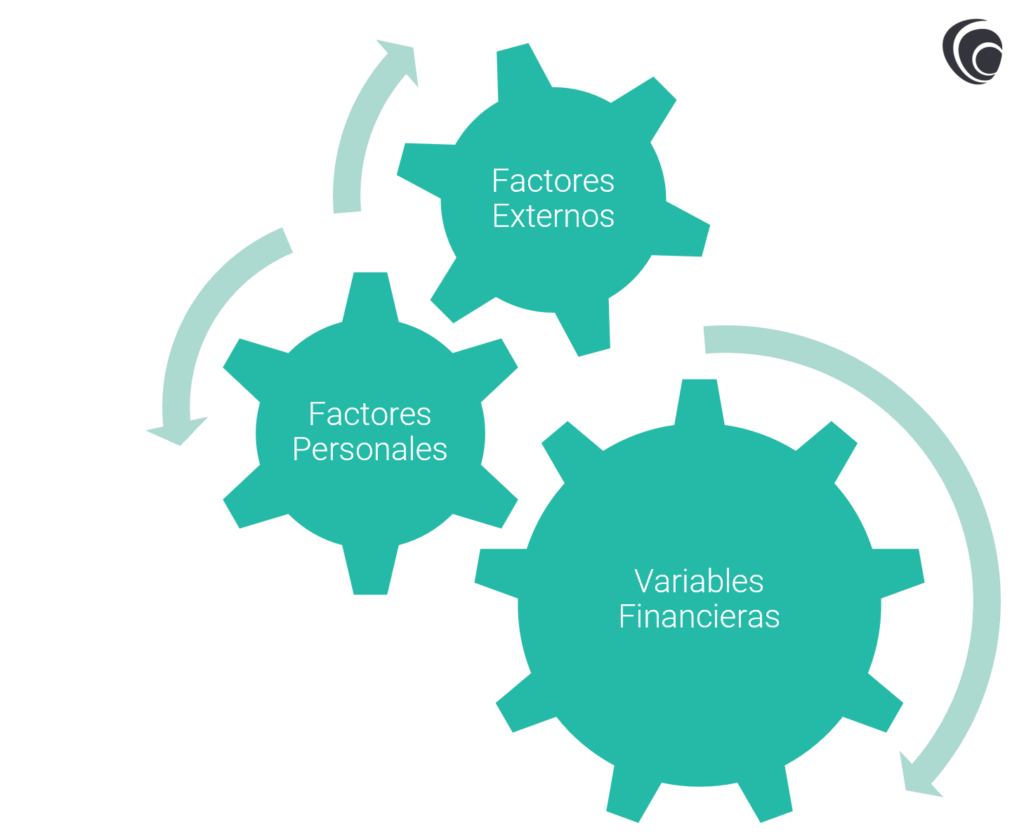

When facing the pivotal decision of whether to sell or double down on your business, adopting a strategic approach becomes paramount. This critical juncture necessitates a thorough analysis of internal and external factors, establishing the groundwork for a well-informed decision-making process.

Assessing the External Landscape

Commence this strategic journey with a systematic approach to gather external information, emphasizing the importance of objective data collection.This initial step acts as the cornerstone for the decision-making process. Pose essential questions regarding the stability of your business, delve into prevailing industry trends, and meticulously examine the dynamics of your competitive landscape.

Probe the stability of key financial indicators such as revenues, gross margins, and net profit. Conduct a rigorous evaluation of the continued relevance of your value proposition, critically assessing whether you are gaining or losing ground in the fiercely competitive arena. This external scrutiny offers a comprehensive perspective on your business's current standing within the broader market.

Once information is gathered, the next step is to simplify and synthesize it, providing a panoramic view of industry dynamics.Investigate industry growth patterns, identify consolidation trends, and dissect competitive threats to unveil the trajectory of your business within the broader market context. This synthesis is pivotal as it transforms raw knowledge into actionable wisdom, fostering a clearer understanding of your business's position in the competitive landscape.

Reflexionar sobre uno mismo – Autoanálisis

Acknowledging the impact of personal attributes on decision-making, it is imperative to shift the focus inward. This introspective phase delves into an assessment of your skills, motivation, and alignment with personal dreams.

Evaluate the relevance of your skills considering the industry's demands. Are your capabilities aligned with the evolving requirements of your business landscape? Delve into motivational factors, particularly in the crucible of competitive environments. Explore the depth of your personal dreams and scrutinize their alignment with overarching business goals, introducing an emotional intelligence dimension to the decision-making process.

This dual-pronged exploration, both outward and inward, forms an intricate dance between objective industry analysis and subjective self-reflection. The convergence of external and internal factors provides a holistic understanding, empowering you to make an informed decision that resonates with both market dynamics and personal aspirations.

Clear Signals for Doubling Down

Now that you've delved into both your industry and personal considerations, it's the pivotal moment to make a decision. Indications favoring the doubling-down option include a pragmatic evaluation revealing your business's sustained competitiveness and growth. Your optimism about the industry's prospects, coupled with a relatively weak competitive landscape and the absence of imminent threats from new entrants or highly attractive value propositions, further supports this choice.

These insights serve as essential markers to guide your decision-making process, help you deciding to commit to further investment in it or deciding to sell your business

Apart from your business, industry, and competitive landscape, there are various other indicators that suggest you should increase your commitment:

Financial Variables

- Net Worth: Net Worth: Your net worth isn't overly concentrated in your business, providing a buffer against potential downturns.

- Reinvestment: Puedes permitirte reinvertir efectivo en tu negocio si es necesario para seguir siendo competitivo.

Personal Factors

- Skills: You possess the skills and ability to remain competitive in your industry.

- Motivation: Your love for your business fuels the drive, motivation, and energy needed to continue.

- Dreams: Doblar la apuesta se alinea con tus sueños y aspiraciones a largo plazo.

Clear Signals for Selling

On the contrary, indicators suggesting selling as a strategic choiceare examined next. The identification of certain elements, namely the decline in revenues, the confronting of industry challenges, and the prevalence of robust competition, distinctly signals the imperative to carefully craft and implement an exit strategy deciding to sell your business. As revenue streams diminish, industry-specific hurdles emerge, and formidable competition becomes a prevailing factor, the call for strategic planning to navigate a successful exit becomes increasingly evident.

Financial constraints, along with a lack of motivation and the misalignment of personal and business objectives, also underscore the need to adopt selling as a prudent and necessary measure

Financial Variables

- Net Worth: Your net worth is heavily concentrated in your business, making you uncomfortable with the associated risks.

- Reinvestment: The inability to reinvest cash back into your business jeopardizes your competitiveness.

Personal Factors

- Reason for Sale You have other hobbies, passions, or businesses to pursue, and your business isn't your life.

- Skills: You lack the skills or ability to compete effectively in your industry.

- Motivation: Burnout has set in, and you lack the drive, motivation, or energy to stay competitive.

- Dreams: Your business doesn't align with your long-term dreams and aspirations.

Be Flexible if the Industry or Economy Changes

Given the dynamic nature of business environments, it is advisable to embrace flexibility. Market cycles and industry shifts may require adjustments to the strategy.An adaptable mindset allows business owners to pivot plans based on emerging information or changing economic conditions.

Deciding Between Selling and Doubling Down

Deciding to sell your business or doubling down on its growth represents a critical juncture for entrepreneurs, one that demands a strategic and introspective approach. By carefully assessing both external market conditions and internal personal factors, entrepreneurs can gain a holistic understanding of their business's position and potential trajectory. Clear signals indicating whether to double down or deciding to sell your business emerge from factors such as financial stability, industry prospects, competitive landscape, personal skills, motivation, and alignment with long-term aspirations.

However, it's crucial to remain flexible and open to adjusting strategies based on changing industry dynamics or economic conditions.

Ultimately, by combining objective analysis with subjective reflection, entrepreneurs can make informed decisions that align with both market realities and personal goals, charting a course for success in the ever-evolving landscape of entrepreneurship.

¿Aún tienes dudas sobre si es buen momento para vender tu empresa? A continuación te dejamos un webinar donde nuestros expertos en compraventa de empresas comentaron los factores clave a tener en cuenta antes de tomar la decisión:

Request for information

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us at: