Curious about the financial underpinnings of the IT industry? What are the current industry multiples? The 2023 Information Technology Valuation Report by Baker Tilly provides an overview of the IT and digital services sector. It encompasses a comprehensive analysis of 242 listed companies and offers a detailed exploration of financial statements, characteristics, and sector multiples.

In a rapidly evolving digital landscape, understanding the market valuation and financial health of IT companies is pivotal for stakeholders across the board. Baker Tilly’s 2023 Information Technology Valuation Report serves as a guiding light for investors, corporate leaders, and industry experts, offering a comprehensive analysis of the financial and valuation factors influencing the IT industry.

Market Dynamics and Strategic Vision in Information Technology

The continuous technological evolution and the growing demand for innovative solutions are driving competition in the information technology (IT) and digital services sector. IT companies are adopting agile, customer-centric approaches to develop products and services that address the changing market needs. This includes close collaboration with customers to understand their business challenges and design customized solutions that drive operational efficiency and generate added value.

Agility and adaptability are paramount in a business environment characterized by rapid technological evolution and shifting consumer expectations. Leading IT firms are investing in human talent, research, and development to stay at the forefront of innovation and deliver differentiated solutions that enable them to stand out in an increasingly competitive market. Furthermore, collaboration with strategic partners and the establishment of business alliances are key to expanding global reach and accessing new markets and customer segments.

In this context, the strategic vision of IT companies must align with market trends and emerging opportunities, enabling rapid adaptation and sustainable long-term growth. The ability to anticipate and agilely respond to market changes will be crucial for success in the information technology landscape.

Financial Statement Analysis of the Industry

The report conducts a detailed exploration of companies' financial statements, including revenues, cash flows, and leverage. This analysis provides valuable insights into the financial stability, profitability, and operational efficiency of IT companies.

Debt Evolution

An in-depth analysis of debt levels within IT companies offers a clear view of the sector's leverage and financial stability. By examining companies with varied debt strategies, such as BigBear.ai, the report underscores the implications of financial leverage on company valuations and investor confidence.

Valuation by Market Multiples

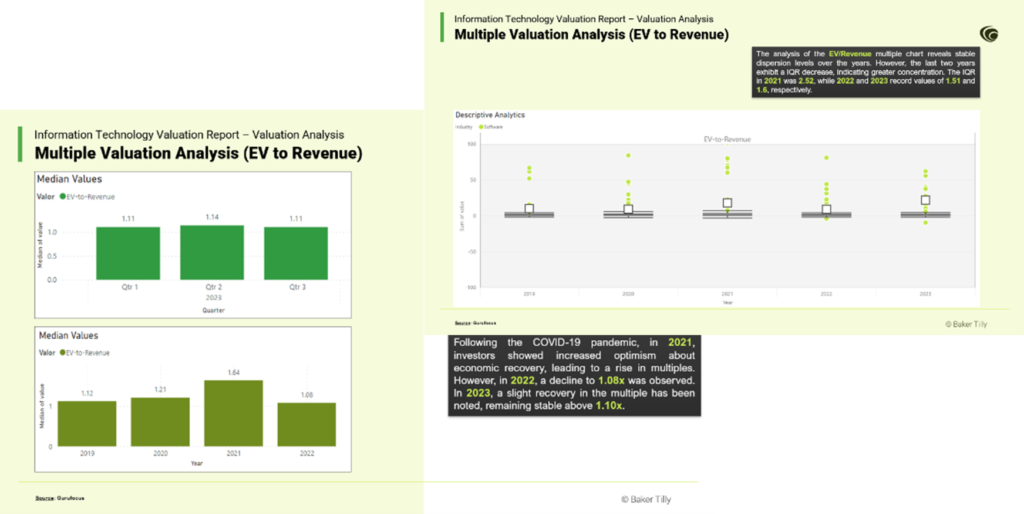

The 2023 Information Technology Valuation Report presents a comprehensive market valuation, illustrating the strong growth of the IT sector. It includes an analysis of the size and value of the enterprise. The report offers a detailed and comprehensive evaluation of market multiples for publicly traded companies in the information technology (IT) sector. This analysis provides a comprehensive view of the relative value of these companies in the current market.

Key Multiples Analyzed:

- Enterprise Value/Revenue (EV/Revenue): This multiple compares the total value of the enterprise (including debt and market value) to its total revenues. It is a fundamental measure for evaluating a company's valuation in relation to its ability to generate revenue.

- Enterprise Value/EBITDA (EV/EBITDA): EV/EBITDA compares the total value of the enterprise with its EBITDA (earnings before interest, taxes, depreciation, and amortization). It is a widely used measure to evaluate a company's operational profitability.

- Enterprise Value/EBIT (EV/EBIT): EV/EBIT compares the total value of the enterprise with its EBIT (earnings before interest and taxes). This multiple provides a measure similar to EV/EBITDA but takes into account depreciation and amortization.

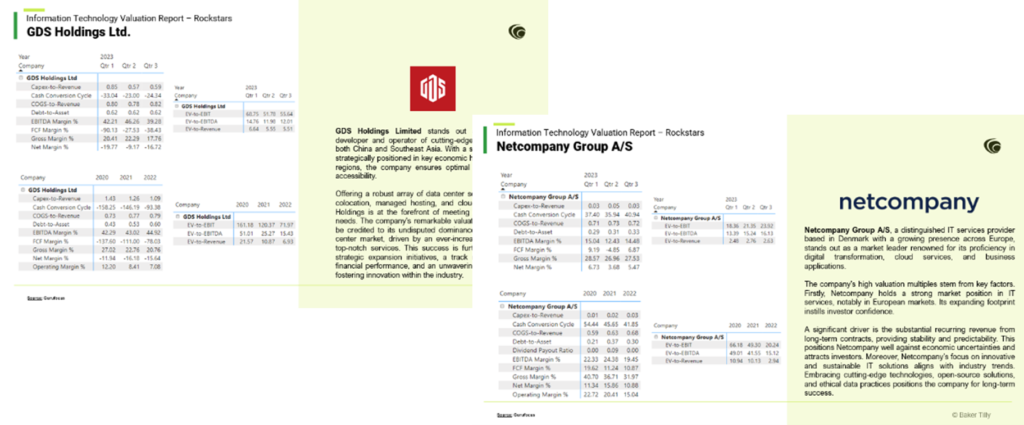

Industry Rockstars

The Information Technology Valuation Report 2023 not only analyses general industry trends, but also highlights some of the industry's "stars", companies that stand out for their high valuation in terms of financial multiples. These companies are leaders in innovation, have a strong track record of growth and have demonstrated an outstanding ability to create shareholder value. This list includes GDS Holdings Limited and Netcompany Group A/S..

The analysis of these companies highlights their ability to achieve superior financial multiples, such as EV/Revenue, EV/EBITDA and EV/EBIT, compared to the industry average.

Latest Initial Public Offerings (IPOs)

The last part of the 2023 Information Technology Valuation Report includes some of the latest initial public offerings (IPOs). In the context of the information technology industry, it is important to consider the latest IPOs that have taken place in the market. IPOs offer a unique insight into the current valuations and growth prospects of emerging companies in this sector.

Some of the notable IPOs include companies that have experienced rapid growth and generated significant market interest.

Obtén valiosas ideas sobre los múltiplos de la industria, estados financieros, evolución de la deuda y valoraciones de mercado, todos los cuales son cruciales para navegar por las complejidades del sector de TI y más allá. Para acceder al informe completo y obtener ideas detalladas sobre el panorama de valoración de la industria de TI, puede rellenar el formulario más abajo.

Valuation report

Informe de valoración de la Tecnología de la información 2023

Download the full report here and stay informed about the financial status and latest news of the most important companies in the market.